Ready to build your own Founder-Led Growth engine? Book a Strategy Call

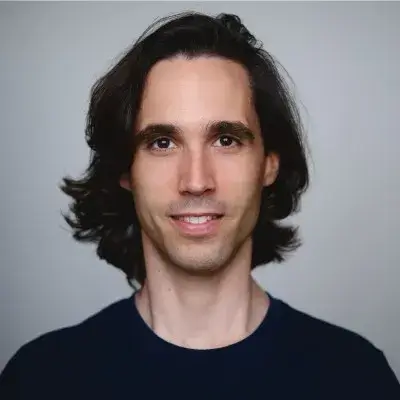

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Start with the customer's decision-making reality, not your product vision:

Cart.com initially pitched their end-to-end commerce solution to CEOs, but discovered that mid-market companies have specialized decision makers. The CMO buys marketing services, the CLO buys logistics, and the CTO buys technology platforms. Omair learned to lead with specific problems for specific decision makers, then cross-sell the broader vision. As he explained: "When we came out with this end-to-end journey, the mid-market was just confused in terms of who would make that decision." B2B founders should map their solution to existing organizational buying patterns rather than expecting customers to change their decision-making structure.

Perfect your core offering before attempting cross-sells:

Cart.com's biggest mistake was trying to cross-sell immature products to existing customers. When they sold Amazon marketplace services before the capability was fully developed, it damaged credibility for their core fulfillment offering. Omair spent months on "apology tours" to repair relationships. The lesson: "Our product and capabilities always have to catch up to our go-to-market motion... you oversell a little bit, but if you do too much of it, then you don't convince them." B2B founders should establish world-class performance in their initial offering before expanding the relationship.

Reinvent marketing when you're creating a new category:

Traditional marketing tactics didn't work for Cart.com's unprecedented value proposition. Trade show booths and paid search ads couldn't communicate their vertical integration story. Instead, they hired marketers who could "invent the playbook" rather than apply existing frameworks. Their head of marketing succeeds because "he doesn't have a playbook, he invents the playbook." B2B founders building novel solutions need marketing talent comfortable with experimentation over expertise.

Use cross-sell timing as a competitive moat:

Cart.com's current strategy involves spending 6-12 months delivering exceptional service in one area before introducing additional capabilities. This patience allows customers to organically request expanded services during strategic business reviews. Omair notes: "When you do the world's best job helping your customers, and they in the back of their mind know there's more you can do, they approach you themselves." This approach creates stronger customer relationships and higher success rates than aggressive early cross-selling.

Choose investors based on capital, terms, and understanding - not brand:

Despite access to tier-one VCs, Cart.com prioritized three factors: maximum capital, best terms, and investor comprehension of their unique model. Omair was skeptical of young associates from large funds: "Do I really want this 26-year-old Stanford grad telling me how to build my company when he or she has never done that before?" For experienced founders, investor brand recognition matters less than practical support and strategic alignment.

Conversation

Highlights

The Unconventional Path to Unicorn Status: How Cart.com Built a Billion-Dollar Company Through Strategic Acquisitions

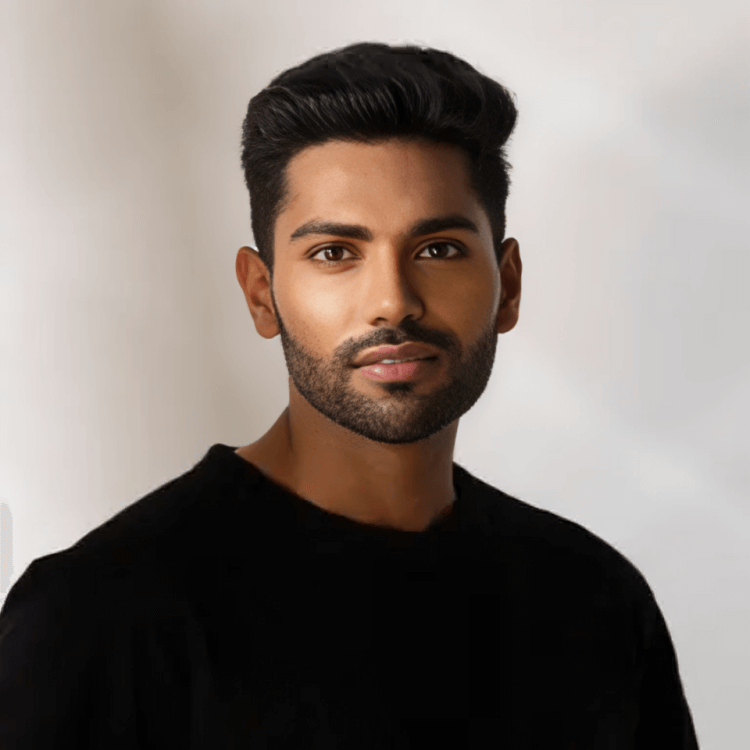

Most unicorn stories follow a familiar pattern: brilliant founder, garage startup, years of organic growth, eventual billion-dollar valuation. Cart.com rewrote that playbook entirely. In a recent episode of Unicorn Builders, Omair Tariq revealed how his company achieved unicorn status in under three years by starting with acquisitions rather than building from scratch—a strategy that defied conventional wisdom but delivered extraordinary results.

The Bold Beginning: Nine Acquisitions in Fourteen Months

When Omair started Cart.com in November 2021, he faced a daunting challenge. His vision was to help mid-market brands sell across multiple channels globally—Amazon, TikTok, international markets—with the same ease as retail giants like Home Depot. But there was a fundamental problem with the traditional startup approach.

“If we went out to the world and organically started building the technology and operational infrastructure one step at a time, by the time you would build it, the market need would have been met elsewhere,” Omair explains. “There was the complexity problem and there was a velocity problem that we were trying to solve.”

The solution was audacious: within thirty days of starting the company, Cart.com acquired its first software platform. They didn’t stop there. “I think within the first 30 days of starting, the company acquired a software company and we kept doing that eight more times in the next 14 months or so,” Omair recalls.

This acquisition spree wasn’t random. The team developed a strategic framework focusing on three critical elements: assembling the right M&A team, creating a unified strategy for what to buy and why, and securing the capital to execute their wish list of target companies.

The Reality Check: From M&A to Company Building

By their first anniversary, Cart.com had assembled an impressive portfolio: seven acquired companies, 80 employees, and approximately $100 million in revenue. But Omair discovered they had created an unexpected challenge.

“12 months in we’re like, okay, we have this much revenue. We have seven companies that we’ve acquired. We have 80 people, by the way, 40 of them are people we acquired, and 40 of them are like M&A people. Now we got to figure out how to build a company,” he explains.

The company had become exceptionally good at buying businesses but hadn’t yet mastered the art of operating as a unified entity. This realization sparked a fundamental transformation in their approach to talent and operations.

The Go-to-Market Evolution: From Confusion to Clarity

Cart.com’s initial go-to-market strategy seemed logical: pitch their comprehensive, end-to-end commerce solution to CEOs. The reality proved more complex.

“When we came out with this end-to-end journey, the mid-market was just confused in terms of like who would make that decision,” Omair admits. “Because we’re signing up for more than just logistics or more than just marketing services.”

The comprehensive pitch attracted the wrong customers—small businesses where CEOs made all decisions but lacked the budget for Cart.com’s services. Meanwhile, their target mid-market customers had specialized decision-makers: CMOs for marketing services, CLOs for logistics, CTOs for technology platforms.

The pivot was strategic: sell specific solutions to specific decision-makers, then cross-sell the broader vision. “We kind of made a pivot and we said, okay, we have to go out and really think about selling marketing services to the CMO and selling logistics to the CLO and selling our technology to the CTO.”

The Cross-Sell Conundrum: Patience as Strategy

Success with targeted messaging created a new challenge. Cart.com began winning deals, but customers only perceived them as specialists in one area. The temptation was to immediately cross-sell additional services, but early attempts backfired spectacularly.

“Customer A bought logistics from us… and we got cute and we said, hey, we can also be your transportation management platform or hey, we can actually help you sell on Amazon,” Omair recalls. When these immature capabilities failed to deliver, “you not only can’t sell them on extra things, you now actually lose credibility on the stuff you’re already doing for them.”

The breakthrough came through strategic patience. Cart.com developed what Omair calls their current approach: “We spend six months to a year with existing customers without trying to sell them on anything and we focus on doing a great job for them.”

The results speak for themselves. “When you do the world’s best job helping your customers, and they in the back of their mind know there’s more you can do, they approach you themselves,” Omair explains. Customers now organically request additional services during strategic business reviews.

Marketing Innovation: Reinventing the Playbook

Cart.com’s unique value proposition required equally unique marketing approaches. Traditional tactics—trade show booths, paid search ads—couldn’t effectively communicate their vertical integration story.

Their first marketing investment was unconventional: $5 million for the Cart.com domain name. “Our marketing strategy is the domain name because we want to show up as a credible known entity,” Omair explains. The logic was simple: “If this company spent 5 million on the domain name, they must be real.”

The marketing evolution continued with viral campaigns, including what Omair now admits were “cringy, corny” tactics like writing love letters to prospect customers and posting them throughout major cities. “A lot of those prospect brands found out about us because people were like, who are these crazy people that are writing love letters for my company?”

The key insight emerged when Cart.com realized they needed marketers who could invent rather than execute existing playbooks. “Instead of hiring seasoned chief marketing officers that had a playbook, we instead chose to invest in building up people to reinvent the playbook,” Omair explains.

Their current head of marketing succeeds because “he doesn’t have a playbook, he invents the playbook. It’s like kind of like cart.com, like, we didn’t have a playbook. We invented the playbook.”

Financial Growth: The Numbers Behind the Story

Cart.com’s financial trajectory reflects their unconventional approach. Starting with $30 million in their first year, they reached “north of 160, $170 million” in 2022. “Went from 30 million in the first year to 180 million a second year,” Omair notes, with “half of it acquired and the other half actually organic.”

Today, the company approaches half a billion in revenue just four years after founding, demonstrating how their inorganic-to-organic growth strategy has sustained momentum.

Investment Philosophy: Value Over Prestige

Cart.com’s fundraising approach defied Silicon Valley norms. Despite access to prestigious tier-one venture capital firms, they prioritized practical considerations over brand recognition.

“I really believe that the market reputation of an investor has zero correlation to them actually being good for you,” Omair states. Their criteria focused on three factors: “most amount of capital, best possible terms, and do the people investing get it?”

They walked away from several tier-one term sheets, choosing investors who understood their unique model rather than those with the most prestigious reputations.

The Future Vision: Democratizing Global Commerce

Looking ahead five years, Omair envisions a world where “any brand of any size is able to sell whatever product they have in any country, across any channel.” The ultimate goal is making commerce distribution so seamless that brands can focus entirely on product innovation while Cart.com handles everything else.

“You don’t have to be an Amazon or a Home Depot or a Best Buy to be able to tap into global geographies,” Omair explains. “You need to be just typed into cart.com and cart.com is the distribution channel for you.”

Lessons for B2B Founders

Cart.com’s journey offers several actionable insights for B2B founders. First, sometimes the fastest way to build something new is to acquire the pieces first, then figure out integration. Second, align your messaging with existing customer decision-making structures rather than expecting customers to change their processes. Third, perfect your core offering before attempting cross-sells—credibility is easily damaged and hard to rebuild. Finally, when building unprecedented solutions, hire for invention rather than execution of existing playbooks.

Cart.com’s path to unicorn status proves that unconventional approaches can yield extraordinary results. By pioneering what Omair calls the “venture-private equity blend,” they’ve created an entirely new category of vertically integrated commerce enablement that continues expanding at remarkable speed.