We only take on 4 clients per month. Join our October cohort. 1 spot left.

Conversation

Highlights

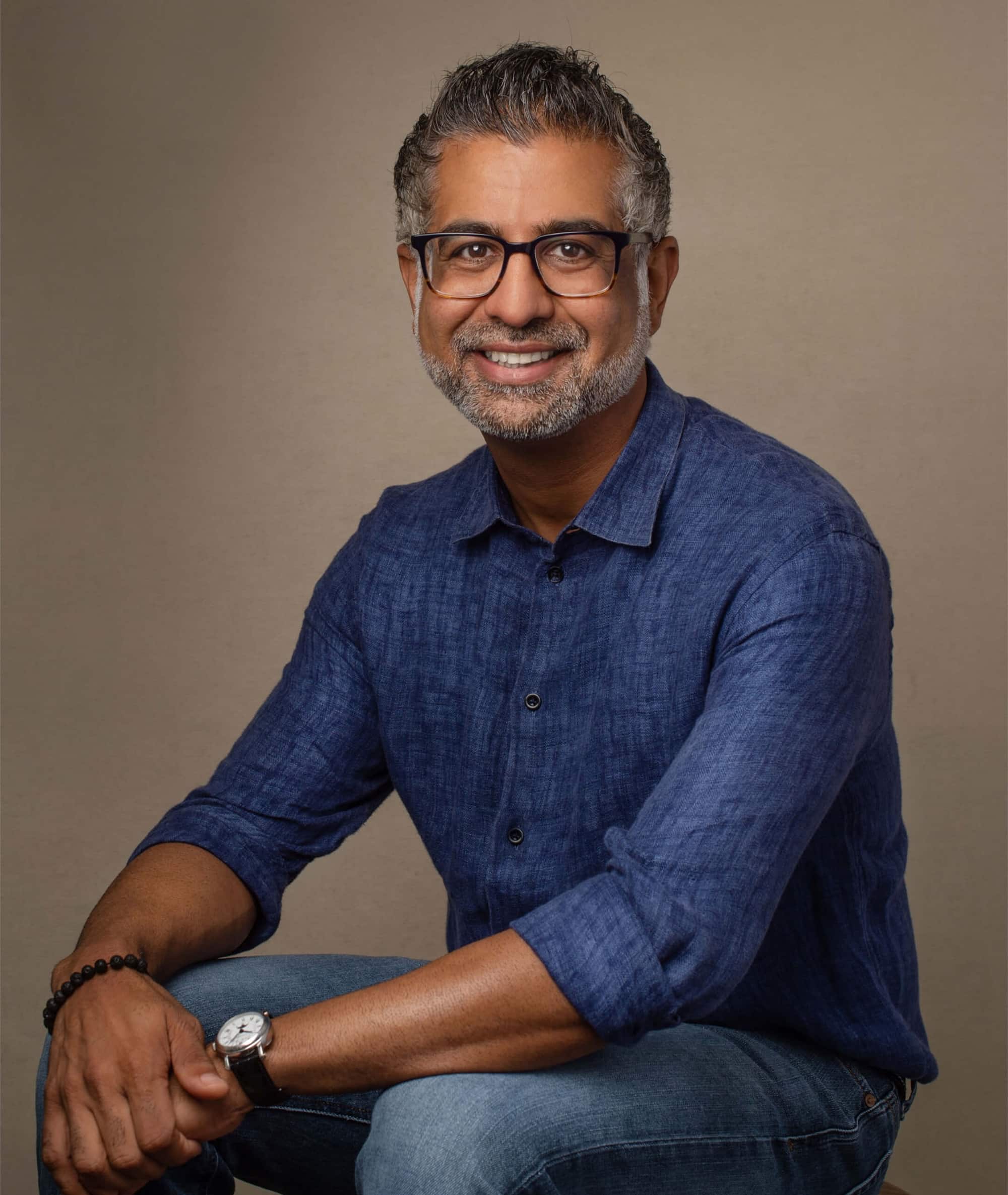

In our eighth edition of Unicorn Builders, we explore our conversation with Kevin Busque, CEO and co-founder of Guideline. Guideline is on a mission to help more SMBs offer their employees retirement planning. SMBs and their employees have been largely forgotten about by the big established players in the space and that’s where Kevin and his co-founders uncovered this massive opportunity. Here are the top lessons learned from my conversation with Kevin.

#1: Do hard things first.

“I think for us and our mantra, and it’s kind of held between myself and the co founders, is to do the hard thing first. And that was so smart to build record keeping as the very first thing we did. It wasn’t flashy. You couldn’t see it. This is all back end, right? This is all stuff that nobody really knows that you’re doing. You couldn’t show an investor. Like, how do you put a back end record keeping system on a pitch deck? It’s pretty interesting to think about. But really doing that set us apart for a very long time. And even today, if you look back, there’s threads on Hacker News and all this stuff, like, why are you reinventing the wheel? You can just use a census or matrix or whatever as a record keeper. It’s a commodity type business.

But what people really didn’t understand was the value in the data and how that translated to an experience on the web or on your phone. Having sort of a commodity record keeper didn’t allow you to differentiate on that experience because you were stuck with only looking at certain events that the record keeper would publish. So that was a big thing that we really got right and really set us apart.

💡Actionable takeaway: In the early days, take the time to invest in the “unsexy” parts of the product. This will become your moat down the line.

#2: Don’t waste time in stealth mode.

“Don’t do this stealth thing. Just stop with that because first mover advantage will work for a month. Honestly, you can generate code these days. That’s just not a thing. If that’s your differentiation, it’s not a differentiation. So tell everybody about it, get all the feedback. You can build a better product that’s going to differentiate you anyway.”

💡Actionable takeaway: Get your product in the hands of potential customers and users as quickly as possible, iterate on their feedback, then build a differentiated product from there.

#3: Celebrate major wins then keep moving.

“When I set out, I wanted to build a billion dollar company. So for me, that little box on my shoulder, I checked it and I was really proud about that. And I remember talking to the co founders and like, man, guys, we kind of did it here. This is a huge milestone for us. In the end, it becomes a valuation, right? Nobody thinks about that anymore. It was kind of one of those things where you have that goal and you want to build a billion dollar company. And being able to say that my kids don’t understand that now, but eventually they will, that’ll be a cool experience for me. But other than that, it doesn’t determine our success in any way. We still have to pay the bills. We still have to do right by our customers and all that sort of stuff, but huge achievement overall. We’re really proud about it.

One of the things that makes Guideline great is we have incredibly low egos across the board from the executive team all the way through which is really important. But I think you have to celebrate the moment, right? Like, you celebrate the funding round, you celebrate all of that stuff and then you talk about what’s next.”

💡Actionable takeaway: Take time to celebrate major milestones then get back to your mission.

#4: Keep funding rounds simple.

“I’m a big advocate for not over engineering funding rounds. Find that partner, find that amazing partner. Company or venture capital or private equity. Find that partner and really invest all you can into getting to know them. It was really difficult in COVID because we’re doing everything remote and that’s when we did our biggest round with General Atlantic. It’s really difficult to try to get to know some people that way and then align on values and mission if they’re on board with that, making sure that’s really important, and then structure the round as simply as possible. Try not to get into preferences stack and doing all this debt and just keep it straightforward so that you do right by your employees and your other shareholders.”

💡Actionable takeaway: Don’t over-engineer your funding rounds, keep them as simple and clean as possible.

#5: Ensure you can grow into your valuation.

“We passed on a round that valued Guideline at two and a half billion dollars. And I look back at that now and it’s one of the smartest moves I’ve ever done as an entrepreneur was to pass on that round. I literally had a term sheet for $50 million at a two and a half billion dollar valuation, and I passed. And I did that because I knew we could never grow into that valuation with the money that were raising, so it didn’t make sense. Right. And now you look at all of those companies that raised on those huge valuations and they’re out of cash. What do they do now?

I don’t know if I was being intelligent or smart or lucky, but I’m really proud that we actually didn’t take that round because I think we’d be in a much different position. And now we’re at the point where we’re looking to be cash flow positive, and we could be if we wanted to be, and we still have $130,000,000 in the bank. So we’re now in a really good position where we kind of control our own destiny. We don’t have to take capital if we don’t want to.”

💡Actionable takeaway: Be strategic when thinking about the valuation you raise at. While raising a high valuation will be tempting, make sure it’s a valuation that you can truly grow into before you need to raise another round.