Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Target the structural "in-between" role that bridges technical and business worlds:

Dataiku's buyers aren't CTOs managing infrastructure or business leaders focused purely on outcomes—they're "people sitting most of the time in IT, but very much business focused" who run AI strategy, analytics, and data initiatives. These leaders face a permanent structural problem: fragmented infrastructure that changes every 2-3 years on one side, business users demanding project delivery on the other. Most vendors optimize for one side; nobody built for the translation layer as the primary product. B2B founders should identify these permanent structural gaps that exist regardless of which specific technologies are in vogue.

Platform architecture beats professional services for enterprise scale:

When business users couldn't apply AI, the obvious path was high-margin consulting. Dataiku rejected this explicitly: "We actually managed very well to avoid, I would say this consulting trap" by building training, partner ecosystems, and self-service capabilities instead. Two years later, this enabled them to sell to US Fortune 500 companies—a jump requiring platform sophistication for customer independence, not dependency. The strategic bet: self-service drives faster adoption and better retention than services. Founders should design for customer capability-building from day one, even in complex domains.

Retention through output velocity, not platform stickiness:

Most enterprise software tracks NRR or feature adoption. Dataiku measures "the acceleration and the multiplication of AI projects"—how many production deployments business teams deliver. Florian was explicit this differs fundamentally from traditional retention: "Retention is not built out of thin air or being just a virtue of being perceived as indispensable...retention is derived from the business value you generate." Each successful project creates organizational capability for the next one—teams delivering five projects become equipped to deliver ten, then twenty. The platform becomes valuable through accumulated competency, not technical lock-in. Founders should define success metrics that create compounding customer capability rather than switching costs.

Position as infrastructure that outlasts technology churn:

Rather than competing feature-for-feature with Snowflake and Databricks, Dataiku positioned as the stable layer above constantly-evolving infrastructure. Enterprise data ecosystems "very candidly change every two or three years"—Hadoop to cloud to Snowflake to Databricks, with new platforms constantly emerging. Infrastructure vendors will "always optimize for technical capabilities, not business user experience." That permanent gap between infrastructure sophistication and business accessibility is Dataiku's sustainable position. Every platform shift reinforces the need for translation infrastructure. Founders should find the layer that remains stable while underlying technologies fragment.

Build global leadership for scale while maintaining technical centers of excellence:

Dataiku kept product and engineering in France but recruited experienced executives globally from proven US public companies. "A lot of the people with the experience of scale and the experience of speed have got this experience in the largest U.S. companies," Florian explained, noting their team includes leaders from Zoom, ServiceNow, and Twitter—companies that successfully navigated public markets at scale. This hybrid model maintained technical excellence in their original base while accessing operational expertise required to sell enterprise software where Fortune 500 buying decisions happen. European founders shouldn't choose between staying local or relocating entirely—build hybrid structures that capture both advantages.

Choose customer personas for decade-long relationships, not quick wins:

Before starting Dataiku, Florian received advice that if he succeeded, he'd "be there for 10 years or 15 years or 20 years," meaning "you really need to love this persona because it's a very long relationship." Twelve years later, he still serves the same buyers: "I love the person I'm serving, meaning the AI, data, science, data people, the people that are in between in the business." This wasn't sentimentality—building enterprise infrastructure means decade-long customer relationships that become exhausting if you don't genuinely connect with your persona. Founders should select buyers they can authentically engage with long-term, as the relationship will define their career trajectory.

Let category positioning evolve through customer feedback rather than forcing premature definition:

Dataiku's positioning evolved organically from "data science platform" to "enterprise AI reasoning layer" as customer needs clarified over years. They didn't force category creation upfront—it emerged from solving actual problems at scale. The key was staying close enough to customers that positioning refined naturally rather than remaining locked into initial positioning that missed the market. Founders should prioritize solving real customer problems and allow category language to develop through operational insights rather than predetermined marketing frameworks.

Conversation

Highlights

How Dataiku Reached $350M ARR by Positioning Between Infrastructure and Business Users

When Florian Douetteau started Dataiku in 2013, talking about AI in enterprise contexts meant academic research and futuristic robots. Meanwhile, a new practice called “data science” was emerging in the Bay Area—companies like LinkedIn and Yahoo were building teams to optimize recommendation engines and advertising algorithms.

Florian saw the pattern forming and made a contrarian bet: this centralized approach would fail for most enterprises.

“My thought was that it was not the way to think about it, that for most enterprise, a lot of the context is actually in the business,” Florian explained in a recent episode of Unicorn Builders. His thesis: business operators with domain expertise should build AI solutions themselves, not wait for centralized data science teams.

The reasoning was specific. A junior data scientist lacks the context to optimize a bank’s customer onboarding process that touches 20 people and costs millions to run. They don’t understand railway safety protocols or pharmaceutical clinical data management workflows. “They don’t have the context of this real life matters,” Florian said.

This wasn’t philosophy—it became Dataiku’s entire go-to-market positioning.

The Platform-Not-Services Decision That Enabled Scale

When business users don’t understand how to apply complex technology, the default path is professional services. High margins, direct customer contact, proven revenue model.

Dataiku explicitly rejected this.

“We actually managed very well to avoid, I would say this consulting trap, even if it’s not necessarily a trap, but I think for us it would have been,” Florian explained. “And build the tool so that you can have people in the business that own it and start using it and find their way.”

Instead of implementation services, they built training programs, partner ecosystems, and self-service capabilities. The strategic bet: customer independence would drive faster adoption and better retention than dependency on Dataiku consultants.

Two years after launch, this decision paid off when they successfully sold to Fortune 500 companies in the US—a jump from their comfort zone that required a platform sophisticated enough for enterprises to deploy without hand-holding.

Targeting the “In-Between” Buyer Nobody Else Served

Dataiku’s buyers aren’t CTOs managing infrastructure budgets. They’re not business unit leaders focused purely on outcomes.

“Our buyers are typically people sitting most of the time in IT, but very much business focused,” Florian explained. “People in charge of AI analytics, data strategy, AI transformation strategy. They are kind of like the person in between.”

This persona faces a specific structural problem. On one side: enterprise IT infrastructure that “very candidly change every two or three years”—Hadoop to cloud platforms to Snowflake to Databricks, with new layers constantly emerging.

On the other side: business users who need to deliver projects that generate measurable ROI.

The in-between buyer must translate between these worlds—making infrastructure accessible without sacrificing governance, enabling business teams without creating shadow IT.

Most vendors optimize for one side or the other. Infrastructure vendors build for technical sophistication. Application vendors abstract away complexity. Nobody was building translation infrastructure as the primary product.

Competing as Infrastructure by Becoming “The Glue”

By the time Dataiku reached scale, competition intensified from both directions. Snowflake and Databricks added AI features. Cloud vendors launched AI platforms. The question became: how do you compete when infrastructure vendors move up the stack into your territory?

Florian’s answer: double down on the translation layer positioning.

“The role we have in the enterprise is from the perspective of business users, you want them to be able to use those tools in an easy way, but easy also to master and govern from the perspective of the enterprise,” he explained.

When asked about positioning as “the glue,” Florian didn’t hedge: “Being the glue is perfectly fine for me.”

The strategic insight: infrastructure vendors will always optimize for technical capabilities, not business user experience. The enterprise data stack will continue fragmenting and evolving. “You’ve got a multiplicity of vendors and also this ecosystem very candidly change every two or three years,” Florian noted.

That permanent gap is Dataiku’s sustainable competitive position. Every infrastructure shift reinforces the need for a stable translation layer.

Measuring Retention Through Project Velocity, Not Platform Stickiness

Most enterprise software companies track net revenue retention, usage metrics, or feature adoption. Dataiku measures something fundamentally different: how many AI projects business teams can deliver to production.

“The way we think about it is the acceleration and the multiplication of AI projects,” Florian explained. “How many can I have running in production? So many projects can my business teams delivered and so forth. Can I measure and track their value and so forth. And that’s actually how you build the retention.”

This isn’t semantic—it’s a different retention model entirely. Traditional enterprise software creates stickiness through data lock-in, workflow integration, or switching costs. Dataiku’s retention comes from enabling customers to generate compounding business value.

“Retention is not built out of thin air or being just a virtue of being perceived as indispensable,” Florian said. “At the end of the day, retention is a value is just derived from the business value you generate.”

The model works because each successful AI project creates organizational momentum for the next one. Teams that deliver five projects in production become equipped to deliver ten, then twenty. The platform becomes valuable through accumulated capability, not technical lock-in.

Building Global Leadership While Keeping Engineering in France

Dataiku made an unconventional structural decision: keep product and engineering in France, but recruit experienced executives globally from proven US public companies.

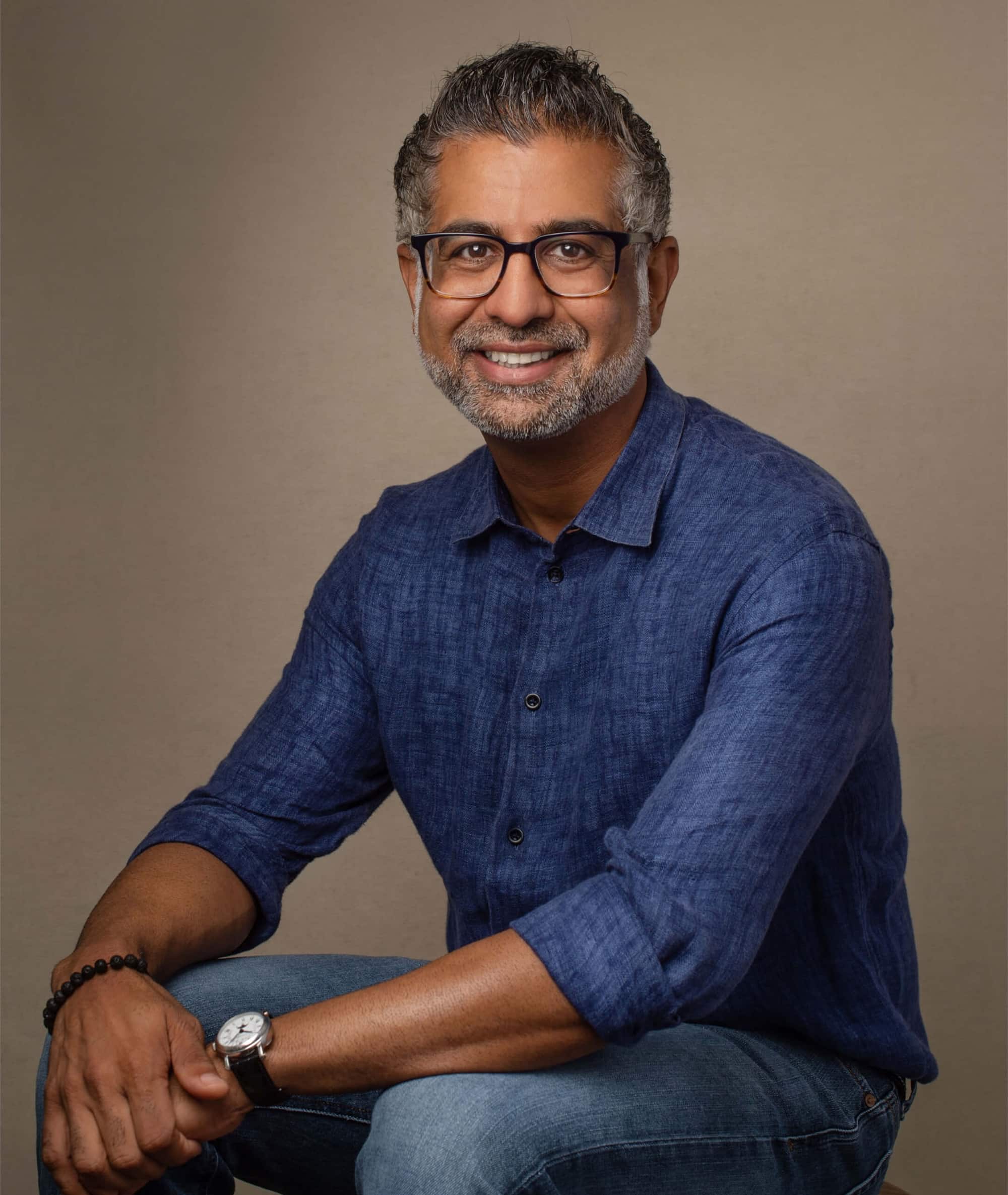

“A lot of the people with the experience of scale and the experience of speed have got this experience in the largest U.S. companies,” Florian explained. “So you have to find this talent and build that mix.”

The leadership team includes executives from Zoom, Twitter, and ServiceNow—companies that successfully scaled to billions in revenue and navigated public company requirements.

“We are building our leadership team globally,” Florian said, noting they deliberately brought in “people in finance that have run public companies for years” to prepare for eventual public company readiness.

This hybrid model let them maintain technical excellence in their original base while accessing operational expertise required to sell and scale enterprise software in the US market—where most of the Fortune 500 buying decisions happen.

The 12-Year Relationship: Choosing Customers You’ll Serve for Decades

Before starting Dataiku, Florian received advice that shaped his customer selection: “If you fail as an entrepreneur, it will be for two years. You don’t really care. But if you succeed, you’ll be there for 10 years or 15 years or 20 years.”

The implication: “Whatever the domain, and in particular, whatever the customer, the type of customer, the persona you’re serving, you really need to love this persona because it’s a very long relationship.”

Twelve years later, Florian still serves the same buyer: “I love the person I’m serving, meaning the AI, data, science, data people, the people that are in between in the business. I love those guys, I relate to them. I’m like, I can sit with them for hours.”

This wasn’t about passion—it was recognition that building enterprise infrastructure means decade-long customer relationships. If you don’t genuinely connect with your buyer persona, those relationships become exhausting rather than energizing.

The Path to $350M ARR and 700+ Enterprise Customers

In October 2024, Dataiku announced $350 million in annual recurring revenue. The company has raised over $850 million and serves more than 700 enterprise customers, including 25% of the Fortune 500.

“It’s not a straight line,” Florian acknowledged. “Ideally, when you do entrepreneurship, it’s never a straight line because you’re looking for exponentials.”

But the trajectory validates their core thesis: enterprises need translation infrastructure to operationalize AI at scale. As foundation models improve and infrastructure vendors compete more aggressively, business users still can’t directly access the technology without a translation layer.

Florian’s view on the next five to ten years is that enterprises “will have to redesign and automate significantly those processes in order to stay competitive.” The economic logic is straightforward: “It makes no sense to invest a trillion in data centers if you can’t make those very much information driven processes automated.”

Every trillion dollars invested in AI infrastructure increases demand for the translation layer that makes that infrastructure accessible to the business operators who actually understand enterprise processes.

That’s the fundamental insight Dataiku executed on: in enterprise software, being the glue isn’t a compromise position—it’s often the most defensible one.