Ready to build your own Founder-Led Growth engine? Book a Strategy Call

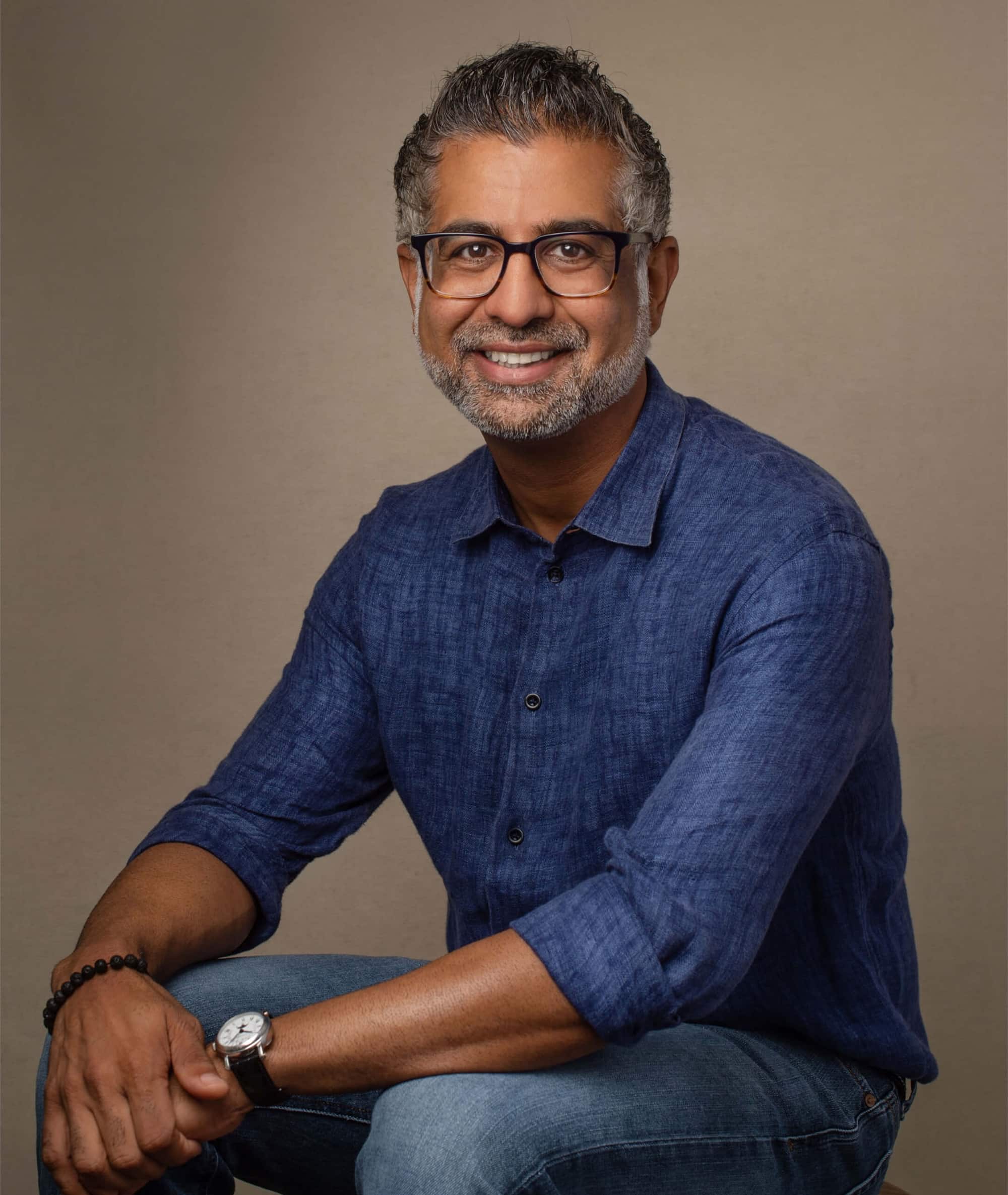

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Build the opposite of industry conventions:

David developed ScienceLogic's strategy by identifying how incumbents were failing customers and deliberately doing the opposite. "We started looking at the industry before we started the company and realizing if were to start with a clean slate, what would we do? Totally the opposite way. Like so differentiated, so obviously different," he explained. This approach led to 220 differentiating features that set them apart from industry giants. B2B founders should examine their industry's standard practices and question which ones might be reinvented to deliver superior customer value.

Create force multipliers through partner selling:

ScienceLogic achieved remarkable capital efficiency by turning partners into their primary sales channel. "Our go to market wasn't going to be us selling. It was being a reference architecture that these partners who already had a customer ecosystem would then show," David shared. This sell-through model now drives 75-80% of their revenue. B2B founders should consider how their solution could become an essential component of their partners' offerings, creating a force multiplier effect where "that sales team becomes an extension of our sales team."

Bootstrap until product-market fit is proven:

ScienceLogic operated as a break-even business for seven years before taking institutional funding, growing organically through sales rather than capital infusion. "I put a $400,000 mortgage on my house... We had five credit cards. That was good for another 70,000," David recalled. This bootstrap approach allowed the founders to maintain significant ownership while proving their model. B2B founders should consider whether bootstrapping longer might lead to better outcomes and valuations when they eventually raise capital.

Reinvent your company every 3-5 years:

To sustain growth over decades, ScienceLogic has completely replatformed its architecture three times to adapt to major technology shifts. "I think every three to five years I have to say, what is the next science logic? In three to five years from now, what are we going to be?" David explained. This forward-thinking approach has kept them relevant through mainframe, client-server, cloud, and now generative AI eras. B2B founders should build continuous reinvention into their company DNA rather than waiting until disruption forces change.

Take capital efficiently on your terms:

Despite having major investors like NEA, Goldman Sachs, and Silver Lake, ScienceLogic has maintained a disciplined approach to funding. "We Always took less capital than we could have used. We took what we thought was the right amount of capital for that moment in time, then prove out the next growth spurt and then have the next round of capital at a lower dilution," David explained. This approach preserved significant founder and employee ownership while still enabling growth. B2B founders should resist the temptation to raise maximum amounts and instead focus on capital efficiency.

Authenticity creates customer longevity:

ScienceLogic has maintained many customers for 15+ years through a genuine commitment to their success. "Being authentic with your customers, being real with them, having their backside when things aren't perfect and giving them more than maybe you should," David advised. This approach stands in stark contrast to the industry trend of aggressive price increases. B2B founders should focus on building authentic, long-term customer relationships even when it sometimes means short-term profit sacrifices.

Conversation

Highlights

The Opposite Day Strategy: How ScienceLogic Bootstrapped to $300M+ by Defying Industry Norms

One sleepless night on an outage bridge call changed everything.

Engineers from different teams pointing fingers. Everyone insisting their systems looked fine. No one taking responsibility. Hours wasted while customers suffered.

“I had been on enough bridges operationally in the middle of the night, realizing that it was just terribly broken,” recalls David Link, CEO and co-founder of ScienceLogic. “The tools that were available when we started the company were onerous, difficult and expensive and provided poor outcomes for the users.”

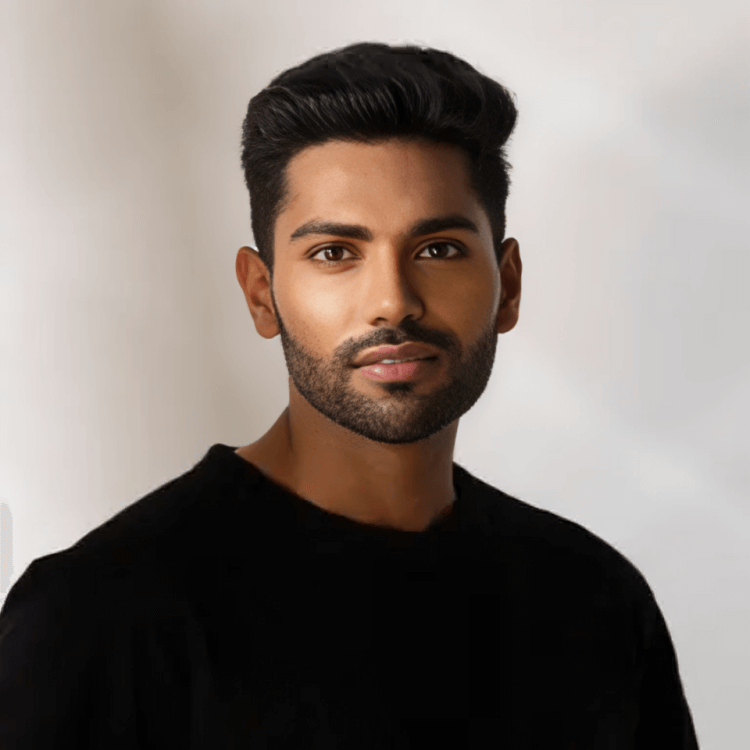

In a recent episode of Unicorn Builders, David shared how this pain point led him to build ScienceLogic, an AI ops and observability platform that’s raised over $140 million and grown to a $300M+ valuation over 22 years. But what makes this journey truly remarkable isn’t just the outcome—it’s the contrarian approach that got them there.

The Seinfeld Strategy

When David and his co-founders set out to transform IT operations monitoring in 2003, they didn’t study best practices or industry playbooks. Instead, they found inspiration in an unlikely place: a Seinfeld episode.

“I saw this Seinfeld episode and it was one where George was opposite day. And everything that George did was the opposite of what you would believe he should do in the circumstance. And every time he did the opposite of what you think should be done, everything turned out like so golden,” David explains.

This “opposite day” philosophy became their strategic framework. The team methodically identified 220 features where they could differentiate from industry incumbents like IBM, HP, and Computer Associates (now Broadcom) by doing the exact opposite of conventional wisdom.

While competitors sold fragmented tools requiring complex integration, ScienceLogic created an all-in-one appliance where you could “plug in an ethernet cord, a power connection and go discover your network, model it, monitor it.”

This approach wasn’t just different—it solved a fundamental pain point that David had experienced firsthand. The resulting product could discover, model, and monitor networks through a single system, eliminating the data silos that plagued the industry.

The Bootstrap Blueprint

Rather than following the standard Silicon Valley playbook of raising venture capital first, ScienceLogic bootstrapped for seven years. David put a $400,000 mortgage on his house, maxed out five credit cards for another $70,000, and secured a $50,000 bank loan.

The team worked out of their basements until a friend offered them seven seats and two data center racks for $150 a month. As they grew to 15 people, the cost increased to $400 monthly—still remarkably frugal compared to typical startup spending.

After 15 months of development, they started testing the product with prospective customers, who immediately recognized its value: “We love the concept. It’s obvious.”

Six months after launching sales, they reached profitability—an almost unheard-of timeline for a B2B product company. This allowed them to grow organically, “hiring another person when we got that next sale and getting the next sales.”

The Partnership Force Multiplier

Perhaps ScienceLogic’s most brilliant move wasn’t the product but how they sold it. Instead of building a direct sales force, they leveraged partners who already had established customer relationships.

“Our go to market wasn’t going to be us selling. It was being a reference architecture that these partners who already had a customer ecosystem would then show something different, something new, something they could get a meeting set for,” David explains.

By becoming the engine that powered managed service providers’ offerings, they created a self-reinforcing growth loop: “Once we become the product used to stand up the service, then as they’re selling more devices under management, that brings on more revenues to Science Logic. And they’re kind of our force multiple where that sales team becomes an extension of our sales team.”

This approach now drives 75-80% of their revenue—a remarkably capital-efficient growth engine that took about six to seven years to fully optimize.

The Capital-Efficient Mindset

When ScienceLogic finally took institutional funding after seven years—a $15 million round from NEA—they maintained their capital-efficient mindset. Six months after the investment, their investors were shocked to discover they had more money in the bank than when they’d received the funding.

“Harry says to me, ‘Dave, what in the world is going on here? I can’t remember in my lifetime any investment I’ve made where the balance of your bank account is higher six months later than it was when we put the money in,'” David recalls.

Throughout their growth, ScienceLogic has maintained this disciplined approach: “We Always took less capital than we could have used. We took what we thought was the right amount of capital for that moment in time, then prove out the next growth spurt and then have the next round of capital at a lower dilution.”

This strategy has allowed the founders and employees to maintain significant ownership despite raising over $140 million from investors including NEA, Intel Capital, Goldman Sachs, and Silver Lake.

The Continuous Reinvention Engine

How has ScienceLogic survived for 22 years in the rapidly evolving technology landscape? By systematically reinventing themselves every few years.

“I think every three to five years I have to say, what is the next science logic? In three to five years from now, what are we going to be? How is it going to be different? Because technology does not stand still,” David shares.

This philosophy has driven them to completely replatform their architecture three times and adapt to major technology shifts like cloud computing and generative AI. Each transition requires significant investment while continuing to support existing products—”a high wire act,” as David describes it.

One replatforming effort nearly sank the company when they underestimated the resources required. “We almost burned the company to nothing. We flubbed that up so badly in getting it right with customers, transitioning them to this new version of the product.”

This experience taught them to be more realistic about transformation timelines and resource requirements—a lesson that’s helped them navigate subsequent reinventions successfully.

The Customer Authenticity Advantage

Throughout ScienceLogic’s evolution, one constant has remained: an unwavering commitment to customer success. This isn’t just a value statement—it’s baked into how they operate.

“Being authentic with your customers, being real with them, having their backside when things aren’t perfect and giving them more than maybe you should… you also need to help them succeed in their careers as well. And they’re taking a risk on you to use your technology,” David explains.

This approach has built exceptional customer loyalty, with many staying with ScienceLogic for 15+ years despite industry changes and competitive pressures.

David contrasts this with the current trend of aggressive price increases by major software vendors: “The software industry right now is behaving very badly. The biggest software companies are raising prices, sometimes more so than it budgets are raising year over year, which are causing tremendous hardship.”

The GTM Principles That Endure

ScienceLogic’s journey offers several enduring principles for B2B founders building their go-to-market strategy:

Solve problems you’ve personally experienced. David’s firsthand knowledge of IT operations pain points gave ScienceLogic authentic insight into customer needs.

Challenge industry conventions deliberately. The “opposite day” approach wasn’t random contrarianism—it was a systematic method to differentiate where it mattered most.

Build force multipliers, not just direct channels. By becoming essential to partners’ offerings, ScienceLogic created a self-reinforcing growth engine.

Maintain capital efficiency even when well-funded. Their disciplined approach to spending preserved equity and extended runway through multiple growth phases.

Plan for systematic reinvention. By anticipating technology shifts and proactively rebuilding, they’ve remained relevant through multiple technology generations.

Prioritize authentic customer relationships. Their willingness to “lose money on a customer before you give up on them” has built exceptional loyalty and word-of-mouth.

These principles aren’t just tactics—they’re the strategic foundation that has allowed ScienceLogic to outlast countless competitors and build a $300M+ company over two decades of industry transformation.