Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Embrace being in an "unfundable" market as a competitive moat:

Jason intentionally chose a market that 95% of VCs dismiss, explaining "I compete primarily against financial institution incumbents. I don't have to compete with other venture backed businesses." While this meant less access to capital and higher bars for fundraising, it eliminated the "race to the bottom" competition common in hot VC markets. B2B founders should consider that being in an overlooked market can provide sustainable competitive advantages if the TAM is large enough to support venture outcomes.

Build for profitability from early stages when capital access is limited:

Octane maintained profitability plans from Series B onward, with Jason noting "we always had a plan that would work since our Series B, that if we never raise a dime again, we'd be fine." This wasn't about never raising again, but ensuring they could "control their own destiny." B2B founders in less popular markets should prioritize unit economics and profitability early to reduce dependency on external funding cycles.

Expand value proposition beyond core product to create switching costs:

Octane evolved from just offering faster credit decisions to providing "lead management tools, content strategy, workflow tools, to the financing and lifecycle marketing." Jason emphasized that "the SaaS product is much weaker without the lending attached to it" and vice versa. B2B founders should look for adjacent problems in their customers' workflows that they can solve to create a more comprehensive, harder-to-replace solution.

Partner with distribution channels that have aligned incentives:

Rather than building direct-to-consumer, Octane focused on B2B2C through manufacturer partnerships. Jason explained they partnered with manufacturers "who knew that they were losing sales" and saw Octane as driving "extra sales." B2B founders should identify channel partners who have clear, aligned incentives for their success rather than trying to convince neutral parties.

Use early product criticism as competitive fuel:

Jason candidly shared "originally, our product was awful and we got tons and tons of negative feedback. But guess what, that negative feedback was absolute gold because we listened to it and we just kept making our product better." The key was having distribution partners (merchants and manufacturers) who were incentivized to provide honest feedback because Octane's success drove their sales. B2B founders should structure early partnerships where customers have skin in the game and will provide brutal, actionable feedback.

Plan strategic evolution in 2-3 year waves rather than 10-year master plans:

Jason described their approach as finding "something that's really underserved or an opportunity that we think is exciting" and riding "that wave as long as we can. And as we see the wave is petering out, we try to find the next mountain to climb." Their waves included: 1) speed and superior credit (2016-2018), 2) end-to-end purchasing tools (2018-2022), and 3) Captive as a Service (2022+). B2B founders should focus on medium-term strategic planning while remaining flexible about long-term direction.

Conversation

Highlights

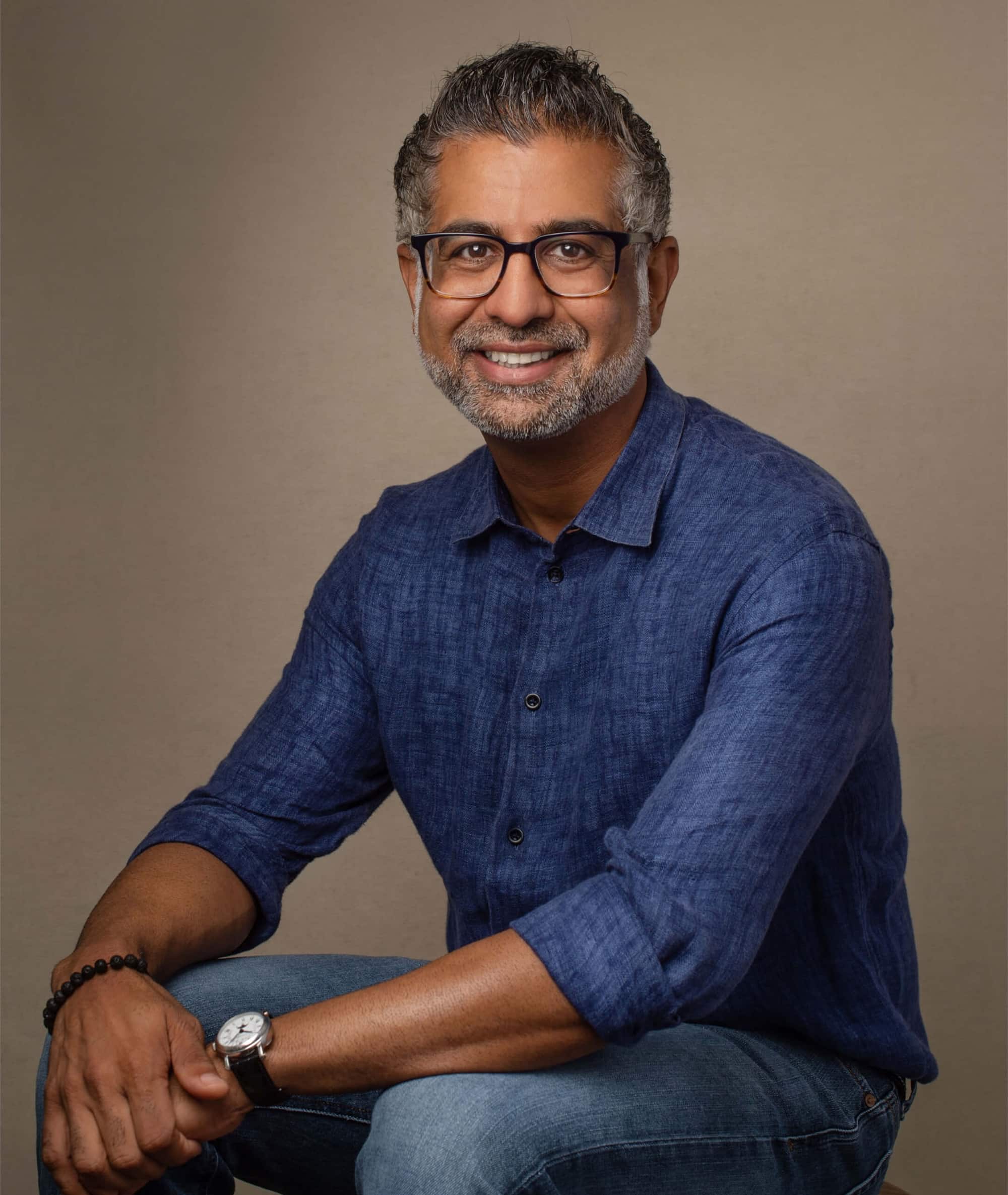

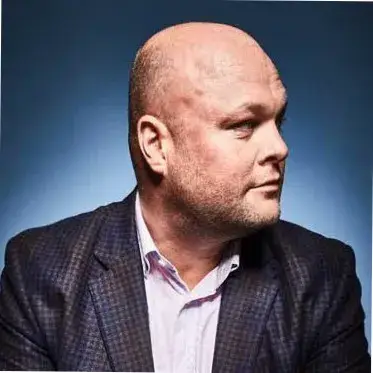

How Octane Lending Built a $400M+ Revenue Fintech by Choosing Markets VCs Hate

Most fintech founders chase hot markets flooded with venture capital. Jason Guss did the opposite. In a recent episode of Unicorn Builders, Jason, the CEO and co-founder of Octane Lending revealed how deliberately entering an “unfundable” market became their greatest competitive advantage.

Octane’s journey began with a spectacular failure that would have killed most startups before they began. But it also illuminated a path that 95% of venture capitalists wouldn’t touch – and that made all the difference.

The Six-Week Reality Check

In 2014, Jason and his co-founder launched what they thought would be a lending marketplace for powersports financing. The plan seemed logical: aggregate multiple lenders and let them compete for borrowers seeking loans for motorcycles, ATVs, and UTVs.

“We launched that business and within six weeks or so, we realized that it just wasn’t going to work,” Jason recalls. “There weren’t enough lenders in the market to be able to create that much demand on that side of the marketplace.”

Most entrepreneurs would have shut down or pivoted to a sexier market. Instead, Octane made a counterintuitive decision that would define their entire trajectory.

“We realized that we had to utilize our own technology and pivot to using that to fund our own lender as opposed to helping other people lend more efficiently,” Jason explains. “And that’s really when the business started working.”

This pivot transformed Octane from a failed marketplace into what would eventually become a profitable unicorn that has originated over $6.5 billion in loans and generates more than $400 million in annual revenue.

The Strategic Advantage of Being Dismissed

What makes Octane’s story particularly compelling isn’t just their recovery from early failure – it’s how they weaponized investor disinterest. Jason deliberately chose a market that venture capitalists actively avoid.

“We wanted to focus on a large enough market that was really overlooked,” he says. The reasoning was strategic: “I compete primarily against financial institution incumbents. I don’t have to compete with other venture backed businesses.”

This created what Jason calls “track A versus track B” competition dynamics. Track A businesses operate in hot VC markets where “funding flows like water” but face dozens of venture-backed copycats. Track B businesses like Octane face a different challenge: “95% of people just dismiss you out of hand because they have no time or interest in what you are doing.”

The trade-offs were significant. Octane had to achieve multiples of the KPIs typically required for funding rounds. But they avoided the venture-subsidized “race to the bottom” that destroys many hot market startups.

“I didn’t have to face off with 35 copycats trying to do the exact same thing in the exact same way,” Jason notes. “I was able to be the solo tech challenger in my vertical.”

Building Profitability from Necessity

Operating in an investor-unfriendly market forced Octane to develop financial discipline early. Jason implemented what he calls a dual-track strategy: plan for growth with capital, but ensure survival without it.

“We always had a plan that would work since our Series B, that if we never raise a dime again, we’d be fine,” he explains. “And if we raise capital and were lucky enough to raise capital, we would accelerate our plans.”

This wasn’t about rejecting growth or venture funding entirely. Octane has raised multiple rounds since their Series B. But they never became dependent on external capital for survival.

The results speak for themselves. Octane achieved $29 million in GAAP net income last year and expects $40-50 million this year, with EBITDA around $90 million. This profitability gave them “control of their own destiny” – a luxury most venture-backed companies never achieve.

Finding the Underserved Segments

Octane’s initial go-to-market strategy exemplified how overlooked markets often contain substantial opportunities. They started in the near-prime consumer segment – creditworthy borrowers who couldn’t access financing simply because few lenders served the powersports market.

“In power sports, very limited lenders in the non prime consumer space,” Jason explains. “And so lots of really credit worthy people who deserved access but they just didn’t have a chance because there just weren’t many lenders in the market.”

This created natural distribution partnerships with manufacturers who were losing sales due to financing gaps. “We partnered with different manufacturers who knew that they were losing sales,” Jason recalls. “And we partnered with them for distribution because it was a win. They knew that if we’re there they were going to get extra sales.”

Starting with the most underserved segment allowed Octane to prove value before expanding to serve the full credit spectrum – a strategy that took about 18 months to execute fully.

Evolution Through Strategic Waves

Rather than following a rigid long-term plan, Octane evolved through what Jason calls strategic “waves” – 2-3 year periods focused on specific value propositions.

Their first wave (2016-2018) centered on speed, ease, and superior credit offerings. “It wasn’t enough just to be faster and easier,” Jason explains. “We had to be faster and easier and have a better credit product.”

The second wave (2018-2022) expanded beyond lending into comprehensive ecosystem solutions. “We started creating all sorts of research tools, all sorts of lead management tools, all sorts of workflow tools where if we can provide a tremendous amount of leads to our merchant partners, they’re going to appreciate our lending will win the lending business as well.”

The current wave focuses on “Captive as a Service” – white-labeling Octane’s entire lending infrastructure so manufacturers and merchants can offer financing under their own brands. “We white label all of our systems to enable a merchant or manufacturer to have the benefit of owning their own lender without the blood, sweat and tears of building it themselves,” Jason describes.

The Power of Brutal Feedback

Octane’s willingness to embrace criticism became a competitive advantage. Early partnerships provided aligned incentives for honest feedback since merchants and manufacturers benefited when Octane succeeded.

“Originally, our product was awful and we got tons and tons of negative feedback,” Jason admits candidly. “But guess what, that negative feedback was absolute gold because we listened to it and we just kept making our product better and better.”

This feedback loop was only possible because Octane had distribution partners with skin in the game. Unlike typical SaaS feedback, these partners needed Octane to work because it directly impacted their sales.

“The NPS is night and day between the first six to 12 months of our product and where we are today,” Jason reflects.

Looking Toward $10 Billion

Octane’s ambitious goal reflects both their confidence and the opportunity they see ahead. They’re targeting 40% annual growth from their current $2.2 billion in annual originations to reach $10 billion by 2030.

“When I take a look at that business, it’s going to be majority captive as a service,” Jason predicts. “It’s going to be diversified. Not only is continue our number one streak in power sports, but also number one lender across all the recreational verticals that we’re targeting and also a major player in the auto market.”

This expansion strategy builds on the same principles that drove their initial success: finding underserved markets, building comprehensive solutions, and maintaining the discipline that comes from operating without guaranteed access to venture capital.

Jason’s contrarian insight cuts to the heart of modern startup strategy: “Whether or not you choose to monetize through SaaS income or lending income is actually more dependent on the underlying economics of your market as opposed to whether or not you’re a lender or a SaaS business.”

For B2B founders, Octane’s journey demonstrates that the most sustainable competitive advantages often come not from chasing the hottest markets, but from finding large, overlooked opportunities where patient capital and strategic discipline can compound over time.