Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Follow customer signals even when they contradict your initial strategy:

Sal discovered NinjaOne's second major buyer persona (internal IT departments) completely by accident when large companies started calling inbound despite zero messaging targeting them. "Once we turn on paid advertising early in our journey, we started getting very large internal IT departments calling inbound when none of our messaging or branding was geared towards those departments." B2B founders should remain agile enough to pursue unexpected market signals that demonstrate genuine product-market fit.

Throttle growth to build long-term competitive advantages:

Despite having the ability to grow faster, Sal deliberately slowed growth in the early years to ensure product stability and exceptional customer support. "You know, it takes years to build trust with customers and a day to lose it... I think we took a thoughtful approach and we wanted to build a reputation for an exceptional product and unbelievable support." This contrarian approach to Silicon Valley's "growth at all costs" mentality allowed NinjaOne to build sustainable competitive moats.

Maintain technical agility through architectural discipline:

NinjaOne's competitive advantage stems from having all products built on a single, modern technology stack. "All of your engineering and product development efforts are on a single stack, a newer stack, and all coded in the same language... we could fabricate a new development team from the ether in like a week because everyone's on a homogeneous stack." B2B founders should resist the temptation to acquire companies or build disparate systems that reduce long-term engineering velocity.

Leverage market timing and secular trends:

NinjaOne's success coincided with the perfect storm of distributed workforce, device proliferation, budget constraints, and tool consolidation needs. "We live in a world where there's distributed workforce now... there's a continuous stream of devices... There's wallet consolidation and there's tool consolidation." B2B founders should identify and align their solutions with multiple simultaneous market trends that create compounding demand.

Distinguish between customer needs and wants through data:

With unlimited expansion opportunities, Sal emphasizes the critical skill of prioritization. "One of the hardest things is to separate... needs versus wants. There's probably some features requests that have come in that have been asked for eight years, but no customer ever left and no customer did not buy." B2B founders must develop the discipline to build what customers actually need rather than everything they ask for.

Conversation

Highlights

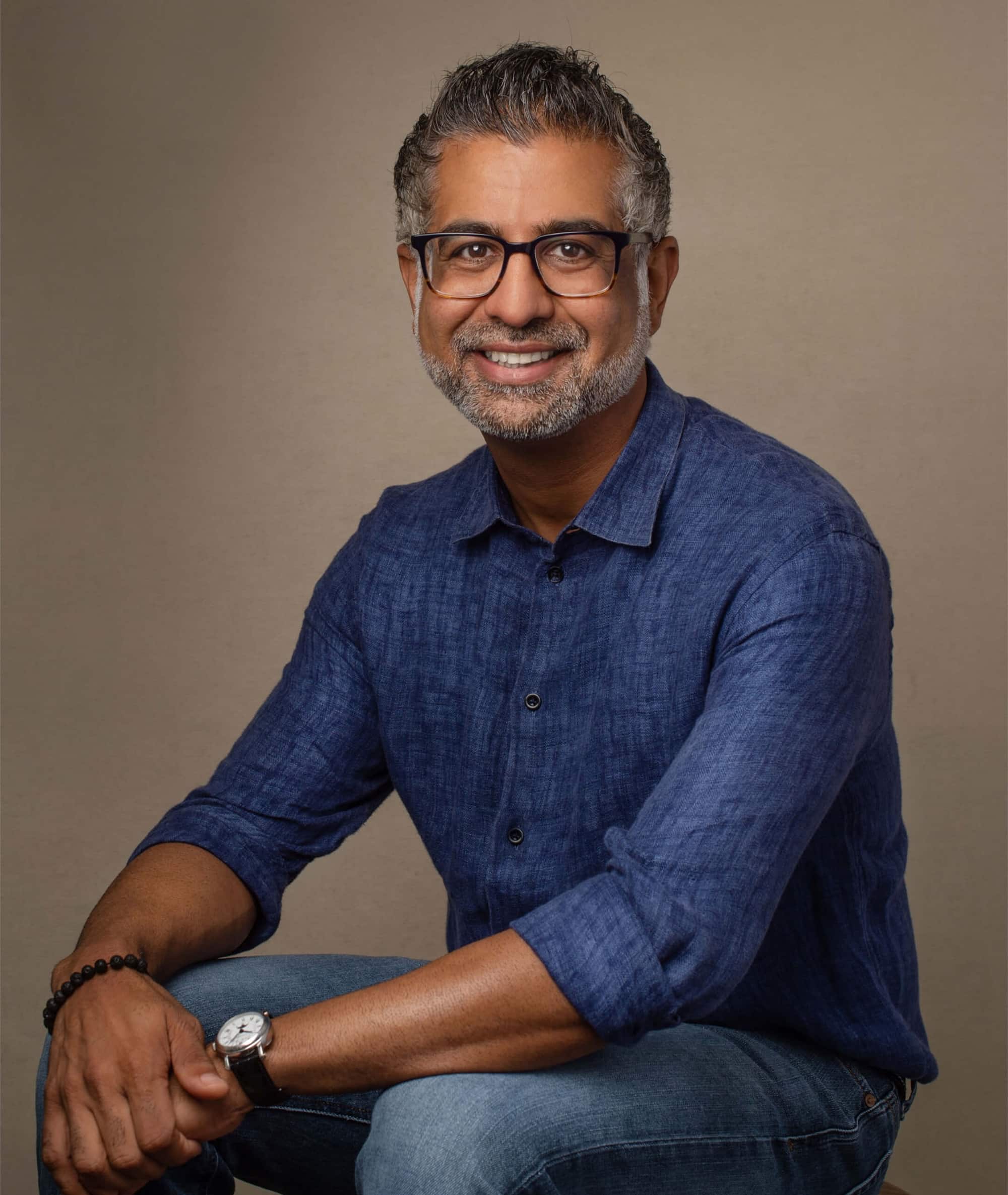

How NinjaOne Broke Into a “Super Saturated Market” and Built a $500M Business

Most entrepreneurs avoid markets with 11 or 12 entrenched competitors. Sal Sferlazza ran straight into one.

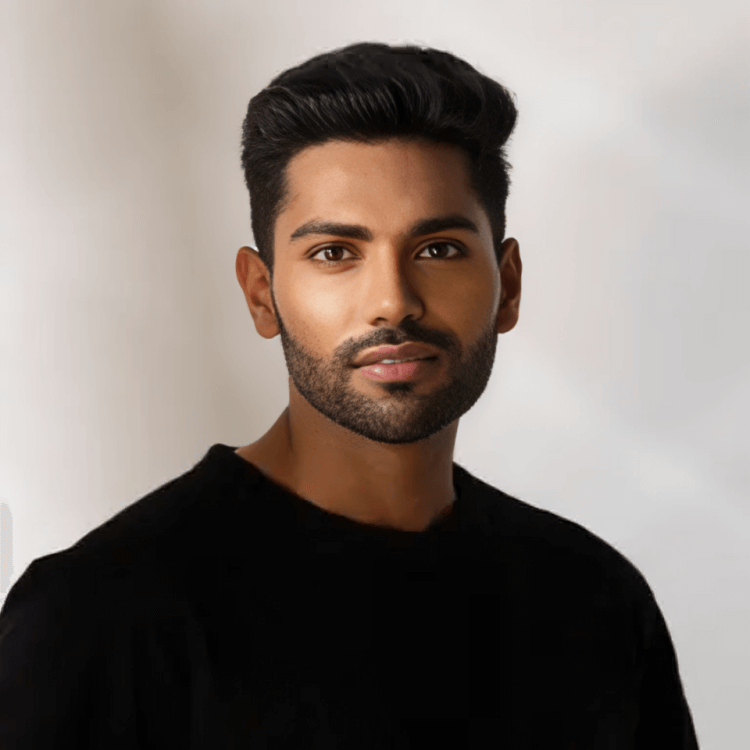

In this episode of Category Visionaries, Sal Sferlazza, the CEO and co-founder of NinjaOne shared how his company defied conventional wisdom to become what he calls “probably one of the fastest growing companies that until recently you never heard of.” Their journey from startup to a company that raised $500 million in funding offers crucial lessons for B2B founders navigating competitive landscapes.

The Unconventional Market Entry

Sal’s path to NinjaOne began with deep market knowledge. As a serial entrepreneur who had built and sold several companies to managed service providers (MSPs), he kept encountering the same problem. “Through all the other startups that I built selling to the managed service providers, everyone was having pain with the product that Ninja is,” he explains.

The logical response would have been to avoid the market entirely. “Conventional wisdom says that it shouldn’t have worked. It was a hyper, super saturated market. You know, 11 or 12 competitors are completely entrenched,” Sal notes. But instead of retreating, he saw an opening that others had missed.

The key insight was timing and technology evolution. “There was this entire consumerization of IT products that in my opinion had missed the MSP market,” Sal observes. While other industries had embraced modern, cloud-first platforms with intuitive user experiences, the MSP market remained stuck with legacy solutions.

The Unexpected Customer Discovery

NinjaOne’s go-to-market journey took an unexpected turn early on. Despite initially targeting MSPs exclusively, something interesting happened when they began paid advertising. “Once we turn on paid advertising early in our journey, we started getting very large internal IT departments calling inbound when none of our messaging or branding was geared towards those departments,” Sal recalls.

Rather than dismissing these leads as outliers, Sal and his team followed the signal. “So, you know, we’re chasing customer pain,” he explains. This customer-pain-first approach led to a crucial discovery: both MSPs and internal IT departments had fundamentally similar needs.

“What’s nice about both of these buyer personas is actually we can satisfy both buyer personas with almost an identical roadmap, which is nice. They’re not divergent roadmaps and a lost focus,” Sal notes. This realization allowed NinjaOne to serve two distinct markets without the complexity of maintaining separate product strategies.

The Counterintuitive Growth Strategy

Perhaps the most surprising aspect of NinjaOne’s approach was their decision to deliberately throttle growth in the early years. This runs counter to the typical Silicon Valley playbook of growing at all costs.

“We’ve been in hyper growth motion the entire time, but we’ve had the luxury of actually throttling growth in the first few years and not actually pushing too hard,” Sal explains. His reasoning reveals a deep understanding of trust dynamics in B2B relationships: “It takes years to build trust with customers and a day to lose it.”

This philosophy extended to their product development approach. “As a product led CEO, I just feel like when the product’s ready, people will buy, the money will follow,” Sal shares. Rather than racing to market with an unstable product, they prioritized building something customers could depend on.

The strategy required patience but paid dividends. “I’ve seen products race to market a little bit too fast. You know, that introduced instability,” Sal reflects. “We wanted to build a reputation for an exceptional product and unbelievable support that our customers could count on and build trust and relationships.”

Building Technical Competitive Advantages

One of NinjaOne’s most significant strategic decisions was maintaining architectural discipline as they scaled. Unlike many growing companies that acquire competitors or build disparate systems, NinjaOne committed to a unified technical foundation.

“All of your engineering and product development efforts are on a single stack, a newer stack, and all coded in the same language,” Sal explains. This decision created substantial operational advantages that compound over time.

The payoff is remarkable agility. “We could fabricate a new development team from the ether in like a week because everyone’s on a homogeneous stack,” Sal notes. This capability becomes a significant competitive advantage when responding to customer needs or market opportunities.

Sal acknowledges the temptation to deviate from this approach: “There’s this, I say this after purchasing a publicly traded company, but there’s a natural inclination as you’re growing to get ahead of your skis. And if you think about wallet and tool consolidation, go out and buy a bunch of companies and stitch them all together really quickly.”

The Art of Customer Feedback Prioritization

With unlimited growth opportunities comes the challenge of prioritization. NinjaOne’s approach to customer feedback offers a masterclass in separating signal from noise.

“There’s probably some feature requests that have come in that have been asked for eight years, but no customer ever left and no customer did not buy,” Sal reveals. This insight challenges the common assumption that every customer request represents a real need.

The key is distinguishing between customer needs and customer wants. “You have to really look at the data and really have a heart to heart and have a trust relationship with the customers to build the things that they really need,” Sal explains.

This disciplined approach prevents the common trap of feature bloat. “If you try to chase everything simultaneously, it’s the span of control. You know, you’re an inch deep, a mile wide. So I think you gotta be really thoughtful about that,” he notes.

Marketing Through Product Excellence

NinjaOne’s marketing strategy was unconventional by Silicon Valley standards. For years, they operated with minimal marketing infrastructure, relying instead on product quality and customer satisfaction to drive growth.

“We didn’t really have much of a marketing department in the middle. We’re pretty much an outbound sales motion,” Sal explains. This approach worked because they had built something genuinely differentiated in a market hungry for better solutions.

The company’s reputation spread through word-of-mouth and customer referrals rather than traditional marketing campaigns. “We built a great brand of reputation and, you know, we didn’t even have a comms department. Just a short while ago, less than 18 months ago, we didn’t really have a comms department,” Sal shares.

This organic growth approach required exceptional execution but created sustainable competitive advantages. When customers become advocates without paid incentives, the resulting growth tends to be more durable and cost-effective.

Timing the Market Transition

NinjaOne’s success wasn’t just about product execution—it was about recognizing and capitalizing on broader market shifts. Several trends converged to create ideal conditions for their growth.

The distributed workforce revolution created new challenges for IT management. “We live in a world where there’s distributed workforce now. So not everyone’s in the office. They’re all over the world,” Sal observes. This shift made traditional IT management approaches inadequate.

Simultaneously, the explosion of connected devices created new security risks. “If you think about 15 or 20 years ago, there was no iPhones, there was no IT devices, there’s no embedded devices. So there’s a never ending sprawl of managed devices that create security risks,” Sal explains.

These trends created demand for exactly the kind of unified, cloud-first platform that NinjaOne had built. The timing couldn’t have been better.

The Discipline of Selective Acquisition

After years of organic growth, NinjaOne recently made their first acquisition, purchasing Draws, an Australian public company. This decision required reconciling their organic growth philosophy with strategic expansion needs.

“You know, I make a joke about that because, you know, I’ve been singing the narrative I just told you for the last 10 years and here I go, I bought a company,” Sal admits. However, the acquisition met specific criteria that aligned with their values and strategy.

“There’s a ton of cultural alignment. Their CSAT scores and support mirror our own. We have some of the best CSAT scores of any company in our industry,” Sal explains. The cultural fit was as important as the product fit.

Most importantly, Sal made clear this was an exception, not a new strategy. “I made it very clear to my product engineering team that this is a one and done. We’re not going to make a habit of this,” he states.

Scaling While Maintaining Focus

As NinjaOne has grown, maintaining focus has become both more important and more challenging. With unlimited market opportunities, the temptation to expand in multiple directions simultaneously is constant.

Sal’s approach is to maintain close customer contact despite his CEO role. “I still talk to multiple customers a week of all sizes, in all cohorts and all segments, and I think that’s important,” he shares. This direct feedback helps inform strategic decisions at the highest level.

The company has also maintained its product-led culture as it scales. “As a product led CEO, so heavily involved in product, probably 20, 25 hours a week of my schedule spent on product,” Sal notes. This hands-on approach ensures product decisions remain aligned with customer needs rather than internal politics.

Looking Forward

NinjaOne’s journey from a startup challenging entrenched competitors to a company that raised $500 million in funding demonstrates that even saturated markets can be disrupted with the right approach. Their success came from combining deep market knowledge with disciplined execution, customer obsession, and strategic patience.

The lessons from their journey are particularly relevant for B2B founders: focus on customer pain over market assumptions, build technical advantages that compound over time, and remember that sustainable growth often requires short-term restraint. In Sal’s words: “We just want to make sure that we clearly deliver the message that we’re here to stay and we’re here to continue to innovate for years to come.”

For founders facing seemingly insurmountable competition, NinjaOne’s story offers hope: sometimes the most crowded markets are ripe for disruption, if you’re willing to build something genuinely better and have the patience to do it right.