Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Cold calling still works in traditional industries:

Starboard generates significant top-of-funnel activity through direct cold calling, with freight forwarders actually appreciating the personal touch. Sumeet's team achieves a 10% pickup rate and converts 15-20% of answered calls to discovery meetings by being upfront about the cold call nature and immediately focusing on business outcomes. The approach works because their target market—freight forwarders—are accustomed to making and receiving cold calls as part of their daily business operations.

Door-to-door prospecting remains viable for relationship-driven markets:

In industries where personal relationships dominate, physical presence can be a differentiator. Starboard literally brings donuts to prospects' offices, which works because their target market values face-to-face interactions. This approach only makes sense when your industry culture supports it and when the lifetime value of customers justifies the time investment.

Founders should personally execute early sales to understand the playbook:

Rather than immediately hiring sales staff after raising funding, Sumeet chose to personally close the first 20-30 deals. This allowed him to deeply understand customer pain points, refine the sales process, and develop a replicable methodology before bringing on sales team members. Only after proving out the top-of-funnel motion did he hire his first SDR, and only after closing 15-20 deals did he hire a sales leader.

Physical implementation presence drives early-stage product adoption:

For complex B2B products still achieving product-market fit, being physically present during implementation creates stronger relationships and better feedback loops. Starboard's team travels to be on-site when clients first use the product, which helps with both adoption rates and product development insights. They maintain ongoing communication through WhatsApp and Teams channels rather than Slack, adapting to their customers' preferred communication methods.

Category creation requires education over product promotion:

Starboard's marketing strategy focuses entirely on educating the market about AI's potential impact on logistics rather than promoting their specific product. By speaking at events, writing blogs, and participating in podcasts about industry transformation rather than Starboard features, they position themselves as thought leaders. This approach builds trust and creates demand for the category before potential customers are ready to evaluate specific solutions.

Sequencing product development based on customer feedback:

The company's current quoting product serves as a wedge, with plans to expand into marketplace functionality and then full operations automation. Each expansion builds on customer relationships and data from the previous phase. This measured approach to product development ensures each step creates value while building toward the larger vision of comprehensive trade infrastructure.

Conversation

Highlights

How Starboard Built 95% Product Adoption by Breaking Every Modern SaaS Rule

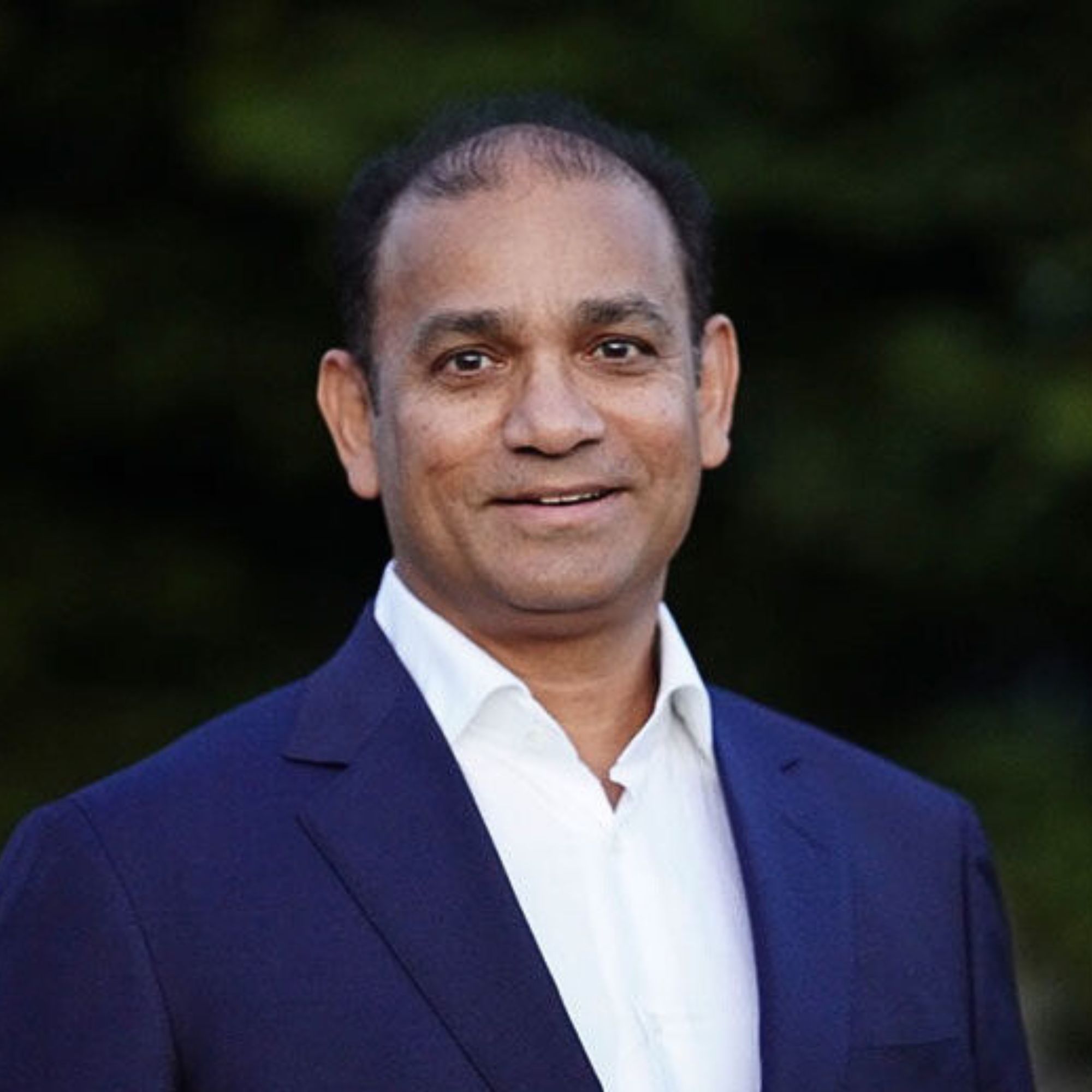

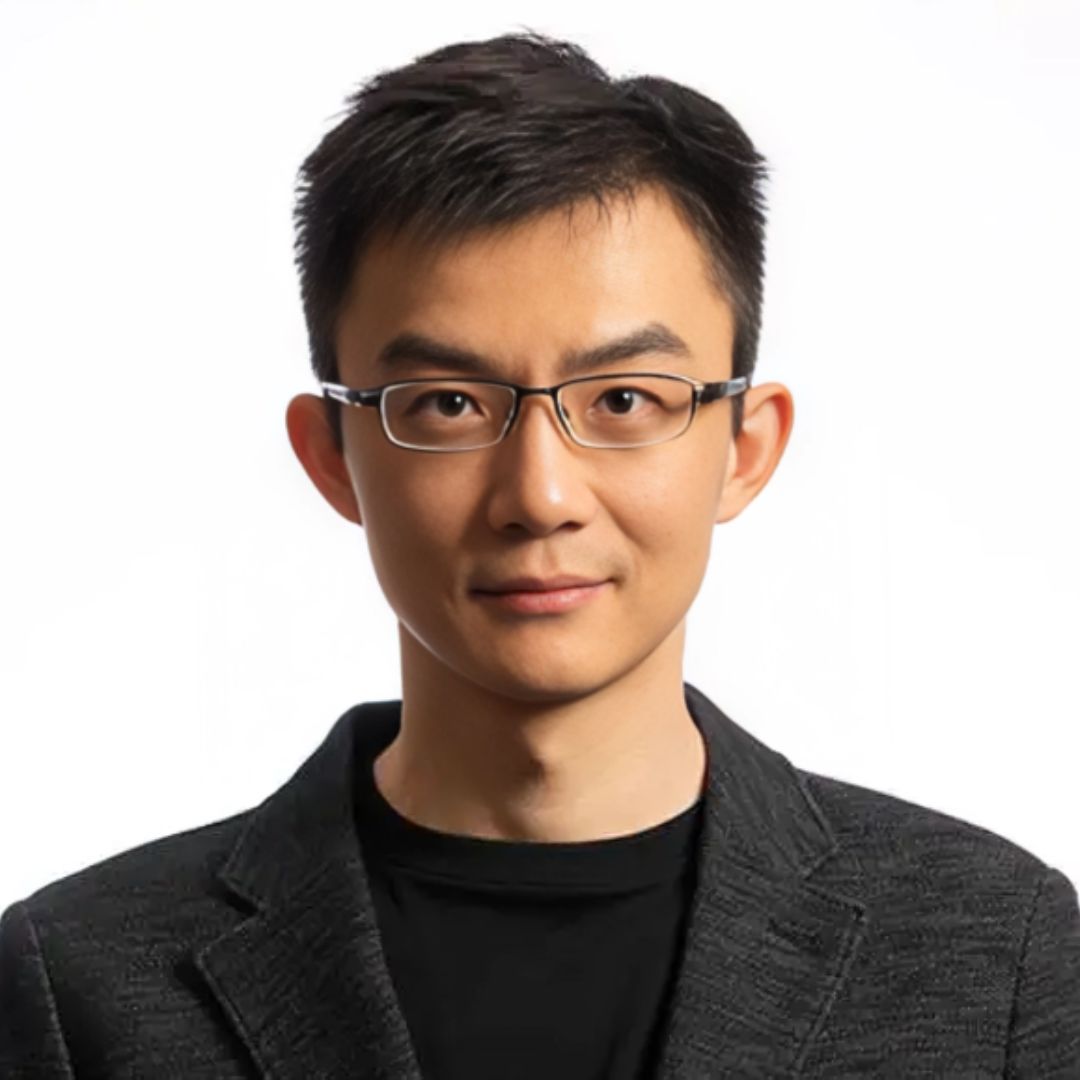

Most B2B founders avoid cold calling like the plague. Door-to-door sales? That’s practically archaic. But Sumeet Trehan, co-founder and CEO of Starboard, has built his AI infrastructure company to nearly $1 million ARR by doing exactly what conventional wisdom says not to do.

In a recent episode of Category Visionaries, Sumeet shared how Starboard is transforming global trade by building what he calls “virtual infrastructure” for an industry that has spent 70 years investing only in physical assets. The company has raised $5.5 million in funding, but their go-to-market strategy reads like an anti-playbook for modern SaaS companies.

The Freight Forwarding Problem Most People Don’t Know Exists

Global trade appears simple from the outside—goods move from one country to another via ships and planes. But Sumeet explains the hidden complexity: “Every global trade transaction requires 15 to 20 different parties to execute. And there’s this entity called Freight Forwarder, which we call a human API call, which is connecting this 15, 20 different parties together and making that transaction successful.”

These freight forwarders are the invisible orchestrators of international commerce, yet they operate with outdated tools and manual processes. Sumeet saw this firsthand during his 15-year career in logistics, working at Maersk, Boston Consulting Group, and most recently Flexport, where he built their Canadian business from zero.

“It was during my time at Flexport that I realized that maybe there’s a different way to solve the global trade problem. And maybe the approaches which have been taken so far have been like kind of wrong product being built for the wrong set of people,” Sumeet recalls.

Cold Calling in an Anti-Cold-Calling Era

While most SaaS companies have abandoned cold calling as ineffective, Starboard has made it their primary lead generation engine. But their approach breaks the traditional cold calling playbook from the first ten seconds.

“We make it very clear this is a cold call. So we’ll have the client make a choice that, hey, if you want to step out of the call, that’s totally okay because we are cold calling you,” Sumeet explains. “Surprisingly, we don’t get a high drop rate after saying that. So most clients actually love the fact that you’re saying this is a cold call for us.”

The results speak for themselves. With a 10% pickup rate, Starboard converts 15-20% of answered calls into discovery meetings. Their success stems from understanding their market: freight forwarders are accustomed to making and receiving cold calls as part of their daily operations.

“Forwarders just love somebody calling them because they are almost calling every day somebody else if they get a call. They love it and love to talk,” Sumeet notes.

Door-to-Door Sales with Donuts

Even more unconventional than their cold calling approach is Starboard’s willingness to literally knock on doors. “Door to door, we have literally gone carrying a box of donuts and saying, hey, we brought donuts for you. And many people just talk to you when you bring cookies or donuts for them,” Sumeet shares.

This strategy works because freight forwarding remains what Sumeet calls an “old boys club”—an industry built on personal relationships where face-to-face interactions still carry significant weight. The approach seems almost quaint until you consider the results: clients who adopt Starboard’s AI agents use them for 95-100% of their quoting within three months.

The Founder-Led Sales Philosophy

Despite raising $5.5 million, Sumeet made a crucial decision that contradicts typical venture-backed startup advice: he personally handled sales for the first 20-30 deals before hiring any salespeople.

“I took the early decision that I’ll probably sell in the first 20, 30 deals before we hire any salesperson. So I think that was very crucial for one me to get the insights and for me to understand what actually the playbook is going to be,” he explains.

This hands-on approach allowed Sumeet to develop deep customer insights and create replicable processes before scaling the team. Only after proving the top-of-funnel motion did he hire the first SDR, and only after closing 15-20 deals did he bring on a sales leader.

The strategy reflects a broader philosophy Sumeet learned at Flexport: “Leaders in early stage startups need to lead from the front. So like you can’t be sitting behind the desk and shooting orders or like enabling people. You just need to lead from the front in early stage startup.”

Physical Presence in a Digital World

While most SaaS companies emphasize remote onboarding and digital customer success, Starboard takes the opposite approach. “Most of our successful implementations have come through actually physically being there with the client. Like the day when you launch the product, you are there with the client, you’re showing them how to do it and then you kind of build a relationship,” Sumeet explains.

This physical presence during implementation contributes to their remarkable adoption rates. Customers who work with Starboard see quote volumes increase 50-60% month-over-month as they become more efficient at generating proposals for potential clients.

The company also adapts to industry-specific communication preferences. While most tech companies default to Slack, Starboard maintains “WhatsApp or Teams channel” with clients because “our industry actually uses the teams a lot. Nobody uses slack in our industry.”

Category Creation Through Education, Not Promotion

Perhaps most counterintuitive is Starboard’s marketing approach. “Every marketing dollar we spend is never spent on promoting a starboard product,” Sumeet states. “We never talk about like, hey, this is the starboard product.”

Instead, their entire content strategy focuses on educating the market about AI’s transformative potential for logistics. “Our whole marketing strategy, our whole content strategy is around saying AI is here. This is how it’s going to change the industry. This is going to be the impact,” he explains.

This educational approach builds market demand for the category before selling specific solutions. “We hope at some point people realize that this is inevitable. Like if you want to be in the race for the long run, you need to partner with one of these technologies and you need to adopt this technology. And hopefully at that point we are an obvious choice they make.”

The Vision: AI-First Forwarders

Starboard isn’t just building software—they’re creating an entirely new category they call “AI-first forwarders.” Sumeet envisions the market segmenting into three categories over the next five years: large traditional forwarders who move slowly, mid-sized traditional forwarders who resist AI adoption, and a new breed of AI-first forwarders who grow using Starboard’s technology and procurement power.

“You’ll get a new set of forwarders who will see, hey, this is great industry, great opportunity. There’s a large set of market which probably is slowing in adapting tech. We can adapt tech and capture markets here,” he predicts.

The ultimate vision extends beyond freight forwarding to become “the default platform where global trade takes place” for small-to-mid-sized importers—a significant market since “85 to 90% of global trade is controlled by small mid sized importers.”

Lessons for B2B Founders

Starboard’s success challenges several assumptions about modern B2B go-to-market strategies. Their approach works because they deeply understand their market’s culture and preferences, adapting their tactics accordingly rather than forcing their industry to adopt typical SaaS buyer behaviors.

Key principles emerge from their journey: transparency in cold outreach builds trust rather than resistance; physical presence can differentiate in an increasingly digital world; founders should execute early sales personally to develop market insights; and category creation requires patience and education over immediate product promotion.

Most importantly, Sumeet advocates for trusting founder intuition while using data for validation: “There’s something about just listening to your gut feel and being right… you should rather use data to validate or invalidate your gut feel rather than the other way around.”

As Starboard approaches $1 million ARR and continues scaling their AI-first infrastructure for global trade, their unconventional approach offers valuable lessons for B2B founders willing to break the rules when their market demands it.