Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Manual heroics prove economics before automation:

When a customer offered Amplio $25 million in surplus inventory, Trey had no warehouse, no logistics infrastructure, and no playbook. What was supposed to be four pallets became four full truckloads delivered to their WeWork. Trey and one employee physically moved inventory boxes off pallets into their office space, then figured out how to sell it while the WeWork management threatened eviction. The core insight: "the first time solving a problem, it doesn't need to be an automated, efficient process, it just needs to be okay. A customer has a problem, we need to figure out a way to solve that problem." Only after proving they could profitably solve the problem multiple times did they invest in automation and efficiency. For founders, the implication is clear—delay infrastructure investment until you've manually proven unit economics and repeatability, even if execution requires unsustainable effort.

True PMF signals come from zero-relationship wins:

Trey leveraged 15 years of supply chain relationships to secure initial customers and build product infrastructure. But he identifies the precise PMF inflection point: "middle of last year, we had both GM and SpaceX respond to a Google Ad." These companies had zero connection to Trey or his co-founder, found Amplio through SEM, and chose them over traditional liquidators they'd worked with for years. This is the distinction between "my network will buy from me" and "the market will buy from us." Founders should use their Rolodex to achieve velocity and prove the concept, but recognize that true product-market fit only exists when customers with no founder relationship choose your solution over established alternatives.

Enterprise velocity depends on payment direction and urgency profile:

Amplio deliberately focused on enterprise after being told by multiple founders to avoid "hunting whales." They discovered enterprise closed faster than SMB for three structural reasons. First, SMBs had unrealistic recovery expectations—wanting $900K back on $1M inventory when market reality is cents on the dollar, creating unresolvable expectation gaps. Second, enterprises had the problem across 100+ facilities with no dedicated owner and urgent mandates from finance or supply chain leadership. Third, because Amplio pays customers rather than charging them, legal review velocity increased dramatically. As Trey explains: "the lawyers thankfully determine, because we're not getting paid by them, that there's low risk for them in terms of signing a contract with us." Founders should map their specific deal structure and customer urgency profile rather than defaulting to SMB-first based on generic advice.

Displace entrenched relationships through dual-threading:

The surplus liquidation market is hyper-fragmented with hundreds of thousands of local liquidators, many holding 30-year plant-level relationships. Amplio's breakthrough: "partnering together with that person at the corporate level we can indicate not only can we solve the problem locally, but we can also do it across the entire enterprise." They pair the local plant manager with corporate procurement or finance leadership, demonstrating local problem-solving plus enterprise-wide scalability that local liquidators cannot match. This dual-threading strategy neutralizes the incumbent's relationship advantage while showcasing the efficiency and consistency that corporate leadership values. For founders entering relationship-driven markets, identify the corporate stakeholder whose enterprise-wide objectives trump individual facility loyalty.

Accelerate trust through predictable execution in low-NPS markets:

Industrial liquidation is a "really low NPS industry—nobody loves working with their liquidator." In markets with poor customer satisfaction and commoditized offerings, trust accelerates when you focus on "say-do ratio"—if you commit to something, execute it. Amplio often solves adjacent problems outside their core offering and frequently removes inventory from warehouses faster than economically optimal to make customers "look like an absolute hero." This over-delivery in low-satisfaction markets creates disproportionate differentiation. The tactical implementation: understand what problems the organization is trying to solve beyond your core product, find ways to solve those problems even if not monetizable, and prioritize making your champion successful over optimizing every transaction.

Conversation

Highlights

How Amplio Discovered Enterprise Deals Close Faster Than SMB by Reversing Payment Direction

Four truckloads of industrial equipment arrived at a WeWork in midtown Atlanta. The problem: Trey Closson had told building management to expect four pallets.

This wasn’t a logistics failure—it was the moment that would validate Amplio’s entire pivot. What started as supply chain risk software was about to become a marketplace built on principles that contradict most GTM advice: chase enterprise from day one, prioritize manual execution over automation, and structure deals where you pay the customer instead of charging them.

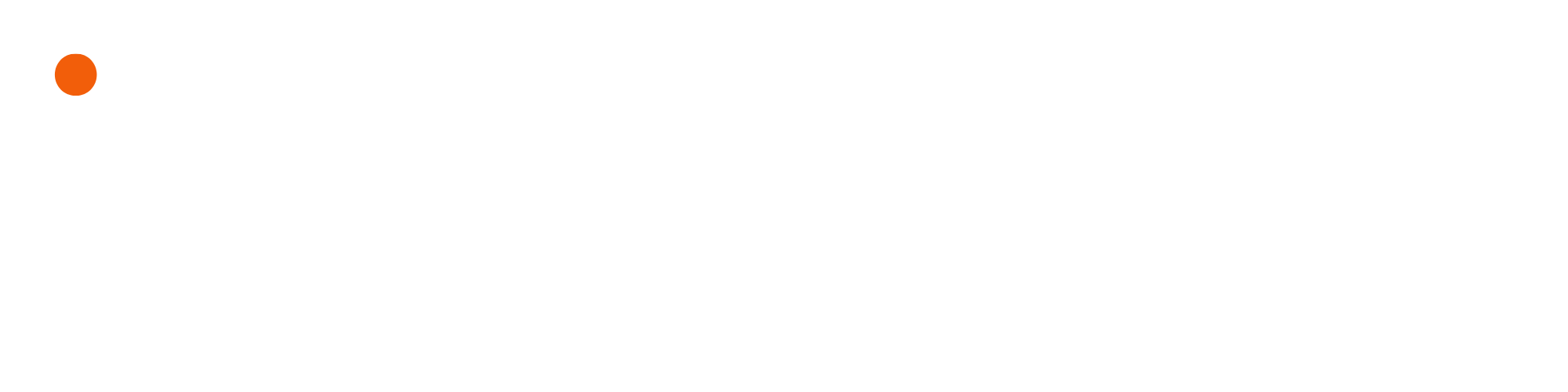

In a recent episode of BUILDERS, Trey Closson, Co-Founder and CEO at Amplio, unpacked how his company won GM and SpaceX despite competing against liquidators with 30-year plant-level relationships, and why their specific deal structure made enterprise contracts close faster than SMB—the opposite of conventional wisdom.

When Your Customer Fires You and Hands You a Better Business

Late 2023: Amplio was selling supply chain risk identification software. They’d raised a seed round and had venture backing, but momentum had stalled. “We couldn’t charge as much as we wanted to charge for the software,” Trey explains.

During a quarterly business review, one customer delivered the message every founder dreads: “Their supply chain disruptions were normalizing, and they no longer really needed the software.”

Then came the unexpected part. The same customer mentioned they were about to write off $25 million in unused inventory—brand new, sealed in the box—and their standard practice was disposal. Their question: “Do you think that you could do something better than just throwing the inventory away?”

Trey had zero infrastructure, no warehouse network, and no playbook for surplus liquidation. His answer: “Yeah, of course. We’ve done this a number of times. No problem.”

The confidence was manufactured. The capability would have to be built in real-time.

“We truly had no idea how we would do better, but we assumed that with some effort, that we could do better than just trashing the inventory,” Trey admits.

The board’s response determined Amplio’s trajectory. Rather than viewing this as a distraction from their software roadmap, they directed the team to validate whether this was a widespread problem worth pivoting toward.

Unit Economics Proven Through Manual Heroics

The first deal was supposed to be four pallets of electronic equipment. Four full truckloads showed up instead.

Trey and one employee physically moved boxes off pallets into their WeWork office while management threatened eviction. He called every friend available: “Okay, we’re in a deep problem right here. Can you please come to midtown Atlanta and help us move this inventory into our office?”

They figured out how to sell it profitably. Then they moved to a proper facility.

This experience crystallized Amplio’s product development philosophy. “The first time solving a problem, it doesn’t need to be an automated, efficient process, it just needs to be okay,” Trey emphasizes. “A customer has a problem, we need to figure out a way to solve that problem. And then if we can repeatedly do that in a way to make money, then we should make it more efficient, we should automate it.”

The implication for founders: infrastructure investment follows proven unit economics, not the other way around. Manual execution that proves profitability beats elegant systems built on unvalidated assumptions.

Trey then leveraged 15 years of supply chain relationships to validate market size. He called every manufacturer contact: “Not only was this original customer experiencing this challenge, but everybody that I reached out to had the problem, and it was actually worse than our first customer.”

The Precise Moment of Product-Market Fit

Network-driven sales created early momentum, but Trey knew relationship-based revenue could be misleading. The actual PMF signal came mid-2024.

“We had both GM and SpaceX respond to a Google Ad,” Trey recalls. Zero connection to the founders. Zero warm introductions. They found Amplio through SEM, evaluated them against traditional liquidators they’d used for years, and selected Amplio.

“That was the point in time where we realized, okay, not only can we build a business based off of the people that we know, but what we’re doing is solving a real problem and real enough that these large organizations are willing to trust us to work together.”

This is the critical distinction: your network buys from you because of accumulated trust and shared history. The market buys from you because your solution genuinely outperforms alternatives. Only the latter constitutes true product-market fit.

For founders validating through their Rolodex, the question becomes: at what point do complete strangers with zero relationship choose you over established incumbents? That’s your PMF signal.

Three Structural Reasons Enterprise Closed Faster Than SMB

Multiple founders had warned Trey explicitly: “Do not focus on the enterprise because you’re hunting whales. And it takes forever.”

After winning their first enterprise deals, Amplio initially redirected toward SMBs, following this conventional advice. The results revealed a fundamental mismatch.

SMBs had unrealistic recovery expectations. “We bought this for a million dollars. We’re only expecting $900,000 in return, which is just not how the surplus market works,” Trey explains. “It’s similar to as soon as you drive a brand new car off the lot, it depreciates in value significantly.”

Market reality—cents on the dollar—couldn’t be reconciled with SMB financial models. Every conversation hit the same expectation gap.

Enterprise deals, meanwhile, closed faster for three structural reasons:

First: Distributed problem, no dedicated owner. Enterprises had surplus across potentially 100+ facilities globally, but “nobody has the title within these organizations of surplus inventory manager. It’s always just some poor soul who gets tasked by the finance leader or the supply chain leader with solving the problem.” This created urgency without formal procurement bureaucracy.

Second: Genuine operational urgency. “Inevitably, somebody from the leadership team would visit the factory and say, we have too much inventory. We don’t have enough room in the warehouse. You need to get rid of it.” The problem had escalated to executive visibility with clear mandates.

Third: Payment direction inverted legal review. This was the breakthrough insight. “Because they’re not paying us, we pay them. The legal effort is significantly lower,” Trey explains. “The lawyers thankfully determine, because we’re not getting paid by them, that there’s low risk for them in terms of signing a contract with us.”

Standard enterprise software sales assume you’re charging the customer, creating extensive legal review of payment terms, liability, data security, and vendor risk. When the customer is effectively selling to you and receiving payment, legal friction vanishes.

The broader principle: enterprise velocity isn’t inherently slow—it’s a function of your specific deal structure, urgency profile, and whether you’re navigating formal procurement. Founders should map these variables rather than defaulting to SMB-first based on generic advice.

Displacing 30-Year Relationships Through Dual-Threading

The surplus liquidation market has hundreds of thousands of local players. Manufacturers often work with “a guy that has a warehouse or a shed in their backyard that’s local, that they’ve worked with for 30 years.”

Amplio’s displacement strategy: pair the local plant manager with corporate-level stakeholders.

“Partnering together with that person at the corporate level we can indicate not only can we solve the problem locally, but we can also do it across the entire enterprise,” Trey explains.

This dual-threading approach neutralizes the incumbent’s relationship advantage while demonstrating enterprise-wide capability that local liquidators structurally cannot provide. The local operator might have deep trust at one facility, but cannot offer consistency, data infrastructure, or scalability across a global manufacturing footprint.

The corporate stakeholder—procurement, supply chain leadership, or finance—values efficiency and standardization that trump individual facility loyalty.

Trust acceleration proved easier than expected in a “really low NPS industry. Nobody loves working with their liquidator,” according to Trey. When customer satisfaction is universally poor and offerings are commoditized, consistent execution creates disproportionate differentiation.

Amplio’s trust framework: obsessive focus on “say-do ratio”—executing what they promise. They solve adjacent customer problems even when not immediately monetizable. They frequently remove inventory faster than economically optimal to make customers “look like an absolute hero.”

In low-satisfaction markets, reliability becomes the wedge. Over-delivery on execution beats feature differentiation.

Scaling Beyond Founder-Led Sales

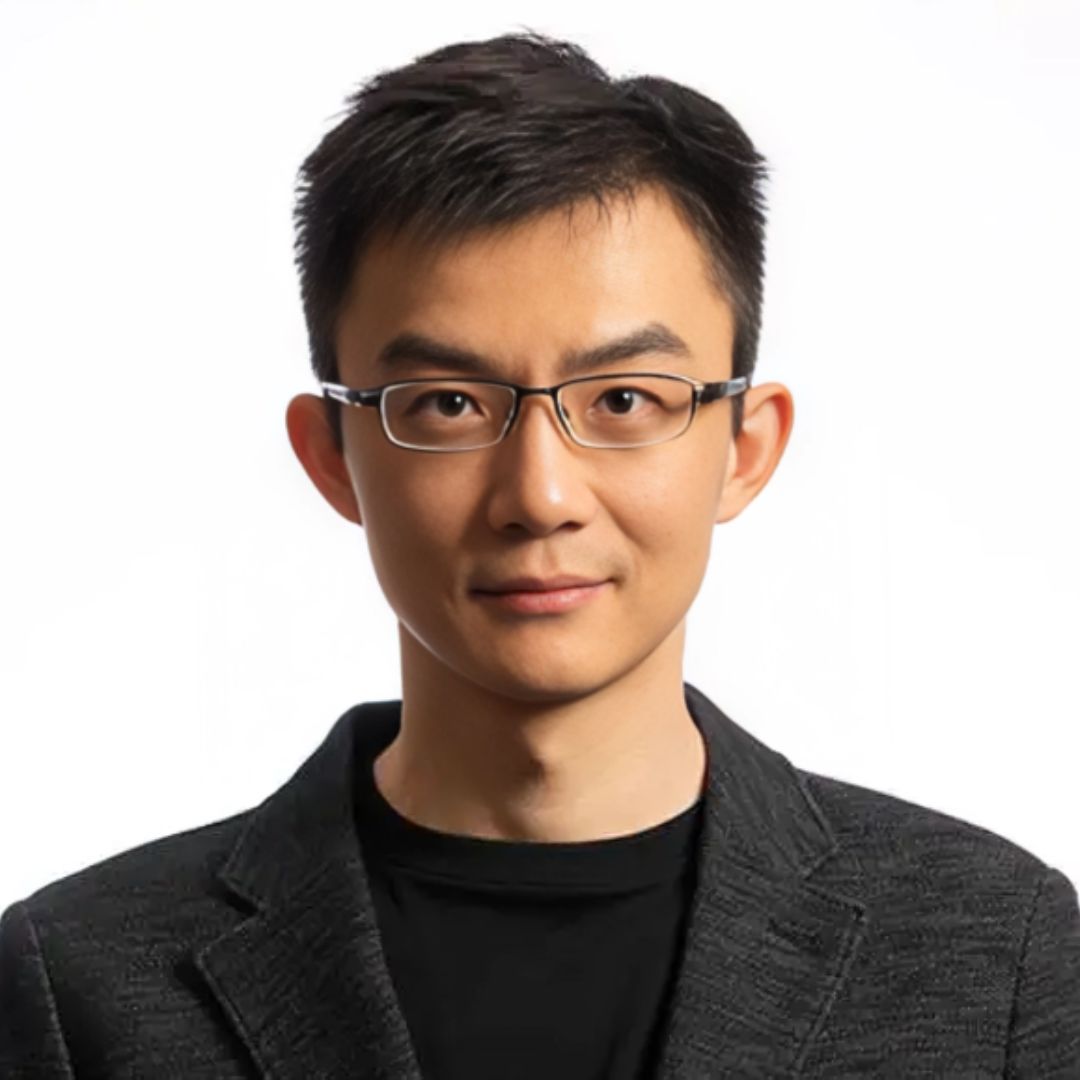

Early 2024 presented the critical test: could anyone besides Trey and his co-founder Taha close deals?

“Early on it was a brand new activity for me to be able to actually be the sole AE for the organization,” Trey admits. His background was commercial operations and relationship management, not quota-carrying sales. Taha came from AI, machine learning, and product management.

They brought on BDRs at the end of 2023, their first AE in early 2024. The validation: “Now they’re closing deals where I don’t even have to be involved and engaged.”

The transition required separating what worked because of founder-specific advantages—”the co-founder and CEO title that I’m able to get in front of folks”—from what could be systematized.

Trey prioritized hiring people “willing to experiment, try new things, and are not only motivated by earning commission, but also motivated to solving the problem of creating that initial playbook.”

The first AE hires in founder-led sales transitions need to be playbook builders, not playbook executors. They’re joining to discover repeatability, not follow established process.

Building the World’s Largest Industrial Distributor on Surplus

Amplio’s vision: “The world’s largest industrial distributor built on the backs of surplus inventory decommission equipment.”

The thesis: “The majority of disruptions and shortages that happened during COVID could have been resolved by surplus sitting on the balance sheets, collecting dust in warehouses for the various manufacturers. But there just wasn’t a means for creating that liquidity.”

Amplio creates virtual warehouses globally where manufacturers can procure inventory at 20-50% below new prices while diverting resources from landfills and monetizing previously written-off assets.

For B2B founders, Amplio’s journey crystallizes several counterintuitive principles: manual execution validates economics faster than automated systems, true PMF requires winning customers with zero founder relationship, enterprise can close faster than SMB when payment direction and urgency profiles align, and deal structure fundamentally determines sales velocity more than customer size.

The broader lesson: conventional GTM wisdom reflects aggregated patterns across many companies. Your specific market structure—who pays whom, urgency drivers, relationship dynamics—may invert standard assumptions entirely. The founders who win are the ones willing to test whether conventional wisdom actually applies to their context.