Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Map structural exclusions in existing distribution systems:

New construction homes can't enter MLS because they often lack finished addresses, real images, or completed properties—requirements designed for resale homes. This structural incompatibility created a $400B+ blind spot. Dan didn't just find underserved customers; he identified a category systematically locked out of dominant distribution. B2B founders should analyze whether incumbent platforms have structural requirements that exclude segments of the market, not just underserve them.

Exploit paid search category mismatches between buyer intent and seller behavior:

Dan discovered Google maintains separate product categories for new construction versus resale homes. Zillow and Redfin competed intensely in resale, but new construction was dominated by individual builders (Lennar, DR Horton) who assumed brand-driven intent—similar to car manufacturers. The reality: buyers search "new construction homes in Austin," not "Lennar homes." This category/behavior mismatch created immediate arbitrage. B2B founders should audit whether buyers search by problem/outcome while incumbents bid on brand terms, creating white space for aggregators.

Time enterprise outreach to industry stress events, not product readiness:

Jome scaled from 500 to 1,500 builders in one year by capitalizing on three specific moments: (1) pandemic demand surge when builders needed millennial/Gen Z reach, (2) 2022 quantitative tightening when builders feared demand collapse, (3) Zillow's 2023 policy change excluding builders with under 10 communities. Dan didn't wait for product-market fit—he mapped when prospects would be most receptive to any solution. B2B founders should create a calendar of industry stress events (regulatory changes, market corrections, competitor policy shifts) and time outreach to these windows regardless of product maturity.

Instrument conversion funnels to detect emergent channels before consensus forms:

Jome discovered meaningful lead volume and closed transactions from ChatGPT and Perplexity through analytics, not strategy. Only after seeing the data did they experiment with what Dan calls "reinforcement learning with LLMs"—promoting positive results to train the models. This wasn't about SEO or prompt engineering; it was about measurement infrastructure that surfaced signal before the channel was obvious. B2B founders should track referral sources at the closed deal level, not just top-of-funnel, to catch emerging platforms while unit economics are still favorable.

Manually deliver value at zero margin before building product:

Before any integrations or platform, Jome ran Google Ads to a Typeform, manually created searches in their agent-facing tool, and texted results to buyers. Dan's framework: "Start with manually creating value...and then step by step, improve it, automate it, make it more efficient." He launched this on a personal credit card and got immediate signal. B2B founders should resist the urge to build scalable product until they've proven someone will pay for (or convert on) manual delivery of the outcome.

Optimize for the non-paying side when you're building a two-sided marketplace:

Despite 100% of revenue coming from builder commissions, every product decision optimizes for buyer experience. Dan's logic: "If we want to bring value to the builders...we need to start with the buyers. We need to create the best possible home buying journey." This isn't idealism—it's recognition that in transaction-based models, buyer liquidity determines builder participation. B2B founders in marketplace businesses must identify which side is supply-constrained and build obsessively for the other side.

Conversation

Highlights

How Jome Turned a Structural Market Exclusion Into 1,700+ Builder Partnerships

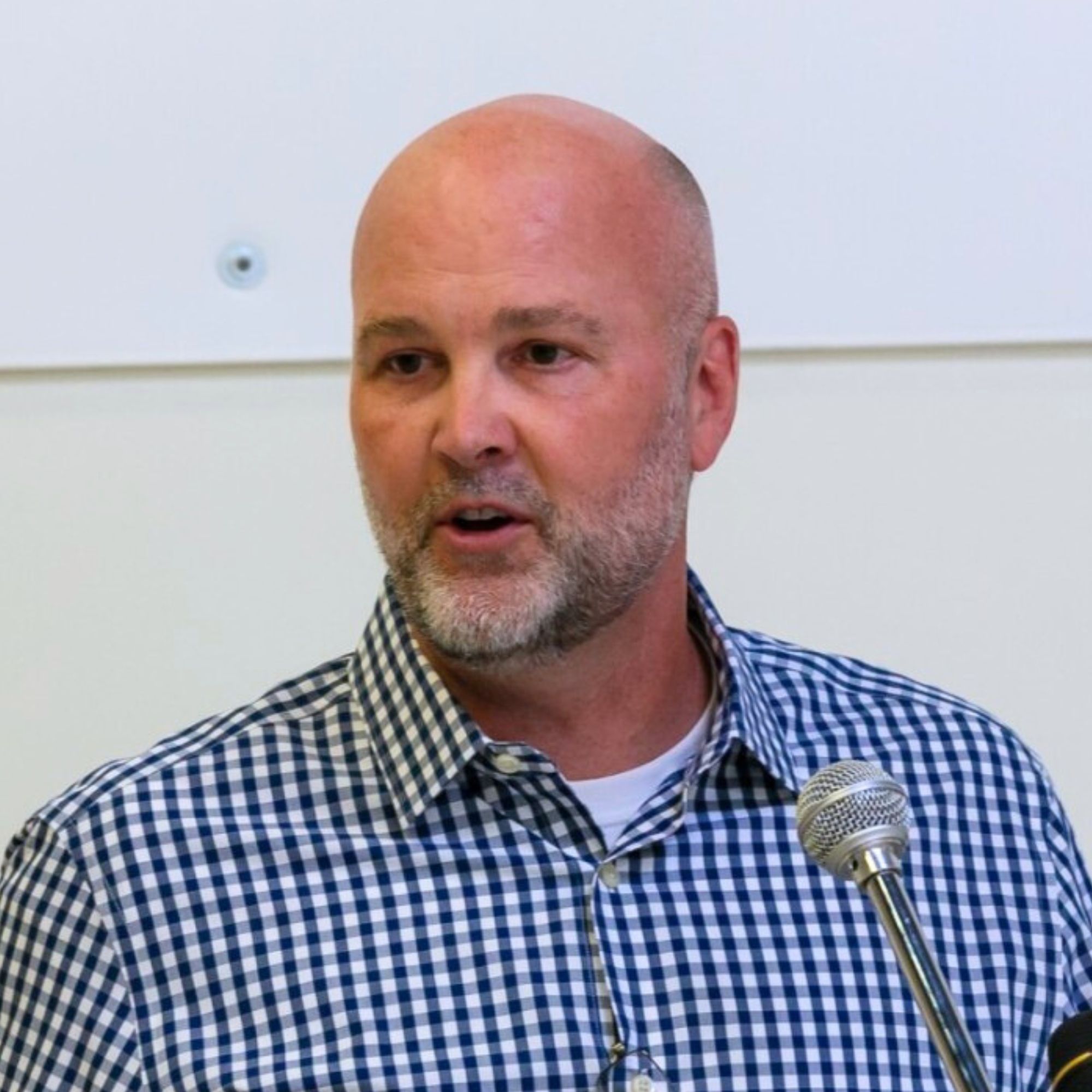

Most homebuyers don’t realize that searching on Zillow means missing an entire category of inventory. In a recent episode of BUILDERS, Dan Hnatkovskyy, CEO and co-founder of Jome, explained how he discovered that new construction homes are systematically excluded from MLS-based platforms—and built a transaction-based marketplace that now partners with 92 of the top 100 US home builders.

The insight emerged during Austin’s pandemic housing boom. Dan watched friends relocate from San Francisco and New York expecting affordable homes, only to face bidding wars hundreds of thousands over asking. While the resale market was chaotic, new construction operated differently. Builders were selling through normal channels with available inventory. Dan’s consistent advice: check builder websites directly.

The pattern in their responses revealed the gap. “They just can’t find any information, Zillow, realtor.com or other major portals,” Dan recalls. “And we figured that there may be an opportunity.”

Why MLS Architecture Excludes New Construction

What Dan uncovered wasn’t underserved buyers—it was architectural incompatibility. MLS systems require data fields that new construction inherently lacks. “Most of the builders, they are not able to put their homes on MLS because either the homes are not finished yet, they don’t have real images. Sometimes they don’t even have the real address,” Dan explains.

The exclusion compounds through the ecosystem. Zillow, Redfin, and Realtor.com pull inventory through IDX feeds generated by MLS systems. When new construction can’t meet MLS requirements, it becomes invisible on platforms where buyers actually search. This created a transparency crisis layered over the existing housing shortage. “There’s like lot of data and a lot of information on homes that are just not anywhere,” Dan notes.

At the time, Dan was building a different product—a search tool helping real estate agents find new construction inventory. But direct buyer demand kept surfacing. He tested with minimal infrastructure: a landing page with Typeform collecting buyer preferences. “We basically were manually creating them a search in our product for agents and sharing that over text messages,” Dan explains. He funded the experiment personally through Google Ads. “I did it on my personal credit card…We started getting some of the first buyers. And pretty instantly we realized that it works.”

Solving Cold Start Through Web Scraping

The marketplace liquidity problem was structural: builders won’t partner without proven buyer demand, buyers won’t come without inventory. Large builders had no reason to work with an unknown platform.

Dan’s approach was pragmatic. “I’m not sure that I should be saying this,” he admits, “but we basically started parsing websites, collecting all of the inventory from everywhere we can, and then also getting like all of the available data from MLS from some of the public and private feeds, basically generating all of the supply.”

This created functional marketplace liquidity before formal partnerships existed. As traffic scaled and Jome expanded geographically, builders began noticing referral volume. But converting awareness into direct partnerships required identifying when prospects would be most receptive to change.

Timing Enterprise Outreach to Three Crisis Moments

Jome scaled from 500 to 1,500 builder partnerships in one year by mapping industry stress events and timing outreach accordingly. The first moment was the pandemic demand surge when builders scrambled to reach millennial and Gen Z buyers flooding Sunbelt markets. “Everyone wanted to find a way to market to millennials and Gen Z,” Dan recalls. Jome positioned as the platform already delivering that demographic.

The second was 2022 quantitative tightening. As mortgage rates climbed sharply, “builders became really stressed about the prospective demand and what’s going to happen with all of the homes that they try to sell.” Jome’s zero-upfront-cost model became more compelling: “We don’t charge you for any exposure, we don’t charge you for tools, we don’t charge you for leads, but you pay us when you make a sale.”

The third catalyst was Zillow’s 2023 policy change excluding builders with fewer than 10 communities. “Zillow basically stepped back from mid size and small builders,” Dan explains. Hundreds of builders lost their primary distribution overnight. Jome was positioned to absorb them immediately.

Exploiting Google’s Product Category Separation

While scaling paid acquisition, Dan discovered structural arbitrage in how Google categorizes real estate searches. “Google has a different product and services category for new construction homes versus resale homes,” he explains. While Zillow, Redfin, and Realtor.com competed intensely in resale, the new construction category was dominated by individual builders bidding on their own brand terms.

“Most of the home builders, they operate under the assumption that people know about their brand,” Dan notes, comparing the approach to automotive manufacturers. Builders structured paid search assuming buyers would search “Lennar homes Austin” or “DR Horton homes Austin.”

Buyer behavior contradicted this assumption entirely. “People don’t think about how Lennar is better from Pulte or Pulte is better from Dr. Horton. And people are kind of like brand agnostic.” While builders bid defensively on brand terms with limited volume, Jome bid on high-intent category terms like “new construction homes Austin.” The channel scaled to hundreds of thousands in monthly spend before competitive dynamics shifted.

Finding LLM Traffic Through Conversion Analytics

Jome didn’t strategically target AI platforms as acquisition channels—they discovered them through closed transaction analysis. “We just were gathering a lot of analytics and we started seeing that we are getting leads from ChatGPT perplexity like Claude and other places,” Dan explains. More critically, “we started getting transactions from there.”

This visibility prompted experiments with what Dan calls “reinforcement learning with LLM”—amplifying positive results when models feature Jome in responses. The channel remains nascent with incremental improvements, but Dan identified it early by instrumenting conversion tracking at the closed deal level rather than just top-of-funnel metrics.

Optimizing for Non-Paying Users in Transaction Models

Jome’s most counterintuitive strategic decision was product focus. Builders provide 100% of revenue through transaction commissions, yet every product decision optimizes for buyer experience. “Our answer from the very beginning was the home buyers. Even though like buyers are not paying us anything directly,” Dan explains.

This wasn’t philosophy—it was marketplace mechanics. “We just understand that if we want to bring value to the builders, if you want to bring value to our financing partners, if we want to bring value to anyone…we need to start with the buyers. We need to create the best possible home buying journey.” Dan draws a parallel to Zillow, which generates revenue from agents and brokerages despite building exclusively for home searchers. In transaction-based marketplaces, optimizing for the demand side ultimately serves all participants.

The 100,000 Annual Transaction Target

By 2030, Dan aims to facilitate 100,000 home sales annually—representing approximately 10% of the total new construction market and exceeding the volume of America’s largest individual home builder.

His framework for reaching that scale returns to the principle that enabled initial traction: “Starting from the point of value creation is the best thing,” he advises. “Try to solve it, and then step by step, improve it, automate it, make it better, make it more efficient, make it more scalable, and then you have the product that suddenly everyone wants to use and everyone wants to buy.”

Jome’s trajectory demonstrates that the most defensible opportunities aren’t always in underserved segments. Sometimes they exist in categories systematically excluded from dominant infrastructure through architectural requirements—you just need to identify the structural incompatibility and build distribution around it rather than through it.