Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Let customer requirements redefine your product scope:

Land Life initially sold discrete technology—cocoon hardware and software tools—to corporations. Buyers consistently responded: "great tech, but we sell shoes online for a living. I need a full project, A to Z." Rather than insisting on their original product definition, Rebekah agreed to plant trees and hire contractors despite "knowing very little at the time what it actually took." The company evolved from a technology vendor to a full-service restoration provider because that's what buyers would actually purchase. B2B founders should recognize when customer feedback reveals a larger market opportunity than their initial product scope, even if delivery capabilities don't yet exist.

Target buyers whose operational experience mirrors your delivery complexity:

Land Life struggled with tech companies despite strong initial traction because these customers operated on "much shorter term economic cycles" incompatible with 40-year projects. The company found stronger fit with financial institutions, insurance companies, and energy providers—buyers Rebekah described as "familiar with asset management, familiar with physical operations" who could "identify with some of the cycles that we have to manage in terms of planting windows." She told her team: "you know you have a business when an insurance company starts buying your product. These are conservative buyers." B2B founders with long implementation cycles, physical operations, or asset-intensive models should prioritize buyers with analogous operational complexity rather than chasing early adopters who lack relevant mental models.

Build transparency infrastructure as core product, not marketing:

For customers committing to 40-year relationships, Land Life addressed the fundamental trust problem through systematic monitoring and data sharing. Rebekah identified the specific perception barrier: "people have this image that people are just going out and planting trees and there's no accountability." The company's response wasn't better sales materials but "a data focused and transparent process" that continuously validates project performance. B2B founders selling long-term commitments should invest in measurement and reporting systems as primary credibility drivers, recognizing that transparency infrastructure is product, not overhead.

Adapt positioning to buyer priority shifts without abandoning core value:

When climate investments "came to a standstill for six months" in 2024, Land Life didn't pivot its business model—it reframed its language. Climate "just dropped on the priority list" as corporations focused on "AI, defense and tariffs." The company shifted to "resilience" positioning that "doesn't use the word climate in it" but connects to infrastructure, defense, and supply chain concerns. Critically, this wasn't invented messaging—Land Life had internally called their engineers "resilience engineers" for years because "you can't bet one climate scenario." B2B founders facing external market shifts should mine existing internal frameworks for language that naturally aligns with new buyer priorities rather than forcing artificial repositions.

Expand value proposition beyond primary category benefit to operational impact:

Land Life evolved from pure carbon sequestration sales to showing customers how restoration addresses their core operational risks. For biogenic customers—"people who work in timber, food and agriculture"—the pitch became: "if you're surrounded by a degraded ecosystem, it will eventually encroach" on your supply chain. Rebekah explained: "it's not just enough to have a robust supply chain like your field for example. Great that things are healthy there, but if you're surrounded by a degraded ecosystem, you know it will eventually encroach." This connected restoration directly to supply shed stability and de-risking rather than relying solely on carbon credit value. B2B founders should identify how their solution protects or enhances customers' existing operations, not just deliver category-specific benefits.

Pursue partnerships to reach scale thresholds faster than organic growth allows:

Rebekah emphasized that achieving buyer-required scale through partnerships is now essential: "buyers are looking for scale and it is hard for us, who are in nature based solutions and physical assets, to achieve that overnight." She advocated for "constructive and innovative partnerships where you can bring that scale to buyers, whether it's organic or just through partnering" as the path to "play at a different level." The sector signal is clear: "they want bigger volumes, they want stronger suppliers, and that path goes a lot more quickly when you partner, as opposed to trying to do it alone." B2B founders in capital-intensive or operationally complex businesses should view partnerships as strategic accelerators to reach minimum viable scale, not just growth tactics.

Conversation

Highlights

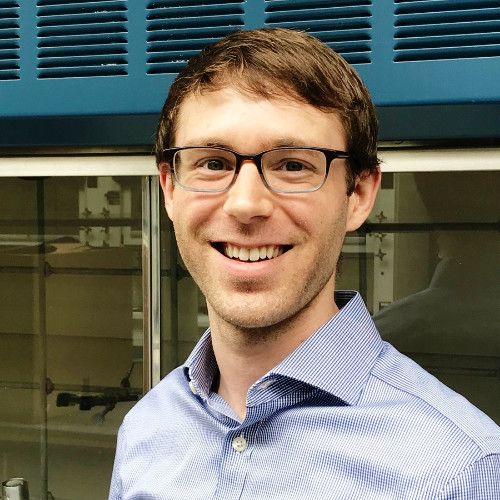

How Land Life Built Credibility for 40-Year Customer Commitments in Nature Restoration

Most B2B founders optimize for shorter sales cycles. Land Life needed customers willing to bet on their survival for four decades.

In a recent episode of BUILDERS, Rebekah Braswell, CEO of Land Life, explained how the company navigated this fundamental trust barrier. Their restoration projects—seven validated on Verra—commit customers to 40-year timelines. No amount of venture funding or growth metrics solves that credibility problem.

The breakthrough came from targeting the right buyer profile, repositioning when their category disappeared from corporate agendas, and treating transparency infrastructure as product, not marketing.

When Customer Feedback Contradicts Your Product Strategy

Land Life launched with a clear value proposition: sell technology to corporations with degraded landscapes. They built cocoon hardware and remote sensing software, classic SaaS plays for climate tech.

Every qualified prospect rejected the product scope.

“We would try to sell our technology to corporates who had degraded landscapes or were invested in certain landscapes,” Rebekah explained. The response became predictable: “Rebecca, great tech, but we sell shoes online for a living. I need a full project, A to Z.”

The founders faced a decision point. Push customers toward their existing product, or expand scope dramatically into unfamiliar territory.

“Being the entrepreneurs that we were, we just said, sure, absolutely. We can also plant the trees and hire the contractors for you, knowing very little at the time what it actually took.”

This wasn’t feature expansion—it was business model transformation. Land Life became responsible for securing land agreements with local owners (who retain ownership while Land Life secures environmental attributes), designing restoration blueprints using machine learning algorithms, coordinating contractors and nurseries during narrow planting windows, and managing monitoring systems across decades.

The tactical lesson: when multiple qualified prospects request the same expanded scope, the market is revealing what it will actually purchase. The question isn’t whether you can deliver—it’s whether the expanded opportunity justifies building those capabilities.

Buyer Sophistication Determines Deal Viability

Land Life’s initial customer base seemed ideal for an early-stage climate tech company. In 2020, tech companies and e-commerce platforms “were really leading the charge on climate,” eager to invest in nature-based solutions.

These deals closed quickly. Then they didn’t renew predictably.

“The challenge we found there is that it was difficult to tie our business to businesses that had much shorter term economic cycles,” Rebekah said. Tech companies optimized for quarterly performance. Their climate commitments fluctuated with revenue cycles and shifting priorities.

Land Life needed buyers with fundamentally different time horizons and operational mental models.

The shift to insurance companies and asset managers wasn’t obvious. “I always used to tell the team when we started to work with financial institutions or insurance companies, well, that may not sound as sexy and exciting,” Rebekah admitted. But these buyers brought crucial advantages: “You know you have a business when an insurance company starts buying your product. These are conservative buyers.”

More importantly, they were “familiar with asset management, familiar with physical operations” who could “identify with some of the cycles that we have to manage in terms of planting windows.”

This wasn’t about finding bigger logos—it was matching operational complexity. Insurance companies and asset managers understand decades-long asset lifecycles, physical operations with seasonal constraints, and risk management across extended time horizons. They have internal frameworks for evaluating 40-year commitments because they make them regularly.

The targeting principle: for complex, long-cycle products, prioritize buyers with analogous operational experience over buyers with faster decision cycles or stronger innovation mandates.

Transparency Infrastructure as Trust Mechanism

For 40-year commitments, traditional enterprise sales credibility signals—case studies, reference calls, ROI calculators—provide insufficient proof.

Land Life identified the specific objection pattern: “People have this image that people are just going out and planting trees and there’s no accountability.”

The response required product investment, not sales enablement. Land Life built extensive monitoring systems, continuous data collection, and transparent reporting that validates project performance year over year.

“We really try to bring a data focused and transparent process which definitely helps build our credibility,” Rebekah said.

This approach treats transparency as core product infrastructure. The monitoring systems aren’t cost centers supporting sales—they’re the mechanism that makes the business model viable. Without continuous proof of project health, customer renewal rates would crater as projects age and memory of the initial sale fades.

The implementation insight: for long-term commitments, invest in measurement and reporting systems before scaling sales. These systems compound credibility over time, but only if they’re operational from the first customer.

Repositioning When Your Category Loses Market Priority

In 2024, Land Life confronted a market shift that invalidated their positioning overnight.

“Climate investments almost came to a standstill for six months this year,” Rebekah said. The catalyst wasn’t just U.S. election results—it was the corporate response. “Financial institutions and other corporations started to pull back from their commitments. They didn’t do that in the first administration.”

The deeper issue was attention economics, not political stance. “It was actually the tariffs that through just the corporations that we work with, you just dropped on the priority list. They’re trying to figure out what tariffs mean for their business.”

Climate didn’t become controversial—it became irrelevant to immediate corporate priorities as “everything just kind of pivoted from climate to AI, defense and tariffs.”

Land Life’s reposition leveraged existing internal language: “We’ve focused a lot on resilience and that language which connects both to oddly even defense language, it connects to technology about resilience against multiple future climate scenarios. And it doesn’t use the word climate in it. This is about resilience, infrastructure.”

Critically, this wasn’t new positioning invented for the crisis. “We’ve actually always called them resilience engineers because we’ve always had this theory that you can’t bet one climate scenario. We need to create climate resilient landscapes.”

Years earlier, a regional director told Rebekah he “can’t hire anyone under the title resilience engineer because no one knows what this means.” That internal terminology became their external market position when buyer priorities shifted.

The repositioning framework: maintain existing internal language that describes your core value differently than your market positioning. When external priorities shift, you have pre-tested alternatives rather than inventing positioning under pressure.

Connecting Product Value to Operational Risk

The resilience reposition enabled deeper value articulation beyond carbon credits.

Land Life began targeting biogenic customers—timber, food, and agriculture companies experiencing supply chain impacts from ecosystem degradation.

The value proposition shifted from carbon sequestration to operational protection: “If you’re surrounded by a degraded ecosystem, it will eventually encroach” on core operations, Rebekah explained.

This addressed a specific planning horizon problem: “It’s not just enough to have a robust supply chain like your field for example. Great that things are healthy there, but if you’re surrounded by a degraded ecosystem, you know it will eventually encroach.”

The tactical shift: “We’ve gotten a lot more tailored with who we reach out to show how nature restoration in that supply shed area can also stabilize and de-risk the investments in their goods and services.”

This connects restoration directly to supply chain stability and operational continuity rather than treating it as a separate sustainability initiative. For biogenic customers, degraded ecosystems aren’t environmental concerns—they’re business continuity risks.

The go-to-market principle: identify how your solution protects customers’ existing operational investments rather than relying solely on category-level value propositions. This works particularly well when category enthusiasm cools but underlying operational needs persist.

Strategic Partnerships as Scale Mechanism

Land Life operates in a business where organic scale happens slowly. Physical operations, geographic constraints, and capital intensity create natural growth limits.

Buyers don’t accept those constraints as their problem.

“Buyers are looking for scale and it is hard for us, who are in nature based solutions and physical assets, to achieve that overnight,” Rebekah acknowledged.

The strategic response: “Constructive and innovative partnerships where you can bring that scale to buyers, whether it’s organic or just through partnering is actually one way to start to be able to play at a different level.”

The buyer expectation is clear: “They want bigger volumes, they want stronger suppliers, and that path goes a lot more quickly when you partner, as opposed to trying to do it alone.”

For founders in capital-intensive or operationally complex businesses, partnerships aren’t optional growth tactics—they’re the mechanism for reaching minimum viable scale before buyers eliminate you from consideration.

Building for Generational Impact

Land Life’s ambition frames their 40-year customer commitments as the minimum viable timeline.

“The big picture is that we can restore the world’s 2 billion degraded hectares within our lifetime,” Rebekah said. The team validated feasibility early: “That was the first thing we did with the Excel spreadsheet back in the day. Is this possible within our lifetime?”

The scale is meaningful: degraded land totaling “the size of the US and China put together.”

Progress feels uneven. “Sometimes I feel like it’s one step forward, two steps back in terms of land degradation that’s continuing to happen.” But the fundamentals support the vision: “It is possible. There’s the funding for it to be, there’s the science and technology for it. We just need to create the momentum for it.”

That momentum starts with solving the trust problem that blocks 40-year commitments. By matching customer sophistication to operational complexity, building transparency infrastructure as core product, and connecting restoration to operational risks rather than sustainability goals, Land Life created a repeatable model for the longest of long-term B2B businesses.