Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Make CFOs your best friend, not IT departments:

Amir explicitly targets CFOs rather than IT as primary buyers because "it doesn't matter how small or big you are, you still have to do more with less." While IT serves as facilitators, CFOs control budgets focused on operational efficiency and ROI. B2B founders should identify which executive truly owns the pain point and budget authority, even if IT will implement the solution.

Deploy capital strategically to remove obstacles before they emerge:

aiOla convinced their airline investor to provide working capital specifically to fund POCs for prospects without existing budgets. This eliminated the "we don't have pilot budget" objection before it arose. B2B founders should proactively identify and neutralize common barriers in their sales process, whether through creative deal structures, proof-of-concept funding, or implementation support.

Prioritize instant ROI over long-term transformation promises:

Amir explicitly avoids "digital transformation" conversations, instead selecting use cases delivering "biggest impact within shortest period of time with minimum obstacle possible." The airline baggage tracking example saved 110,000 hours immediately, creating momentum for expansion. B2B founders should resist selling comprehensive transformation and instead identify narrow use cases with quantifiable, rapid returns that create internal champions.

Replicate proven use cases across customers rather than customizing:

Once aiOla achieved success with specific applications like CRM data entry or pre-op inspections, they "stop, print, replicate" rather than reinventing for each customer. This approach reduced a two-hour inspection process to 34 minutes in food manufacturing, then replicated across industries. B2B founders should document successful implementations as repeatable playbooks and resist the urge to over-customize for each prospect.

Channel success requires speaking the partner's economic language:

When working with telcos, Amir demonstrated that his solution increased ARPU by 34% and reduced churn by 17%—the only two metrics telcos prioritize. He built predictable models showing exactly how many units each channel rep would sell by geography. B2B founders pursuing channel strategies must translate their value proposition into the specific KPIs that drive partner economics and compensation.

Conversation

Highlights

How aiOla Turned Airport Encounters Into Enterprise Deals: A Speech-to-Data GTM Story

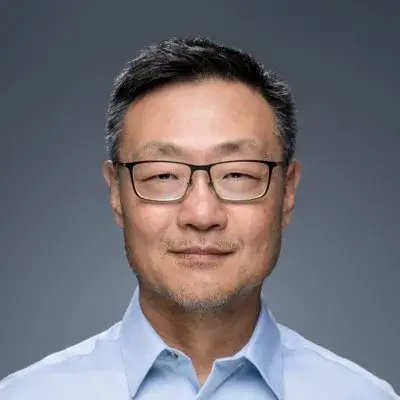

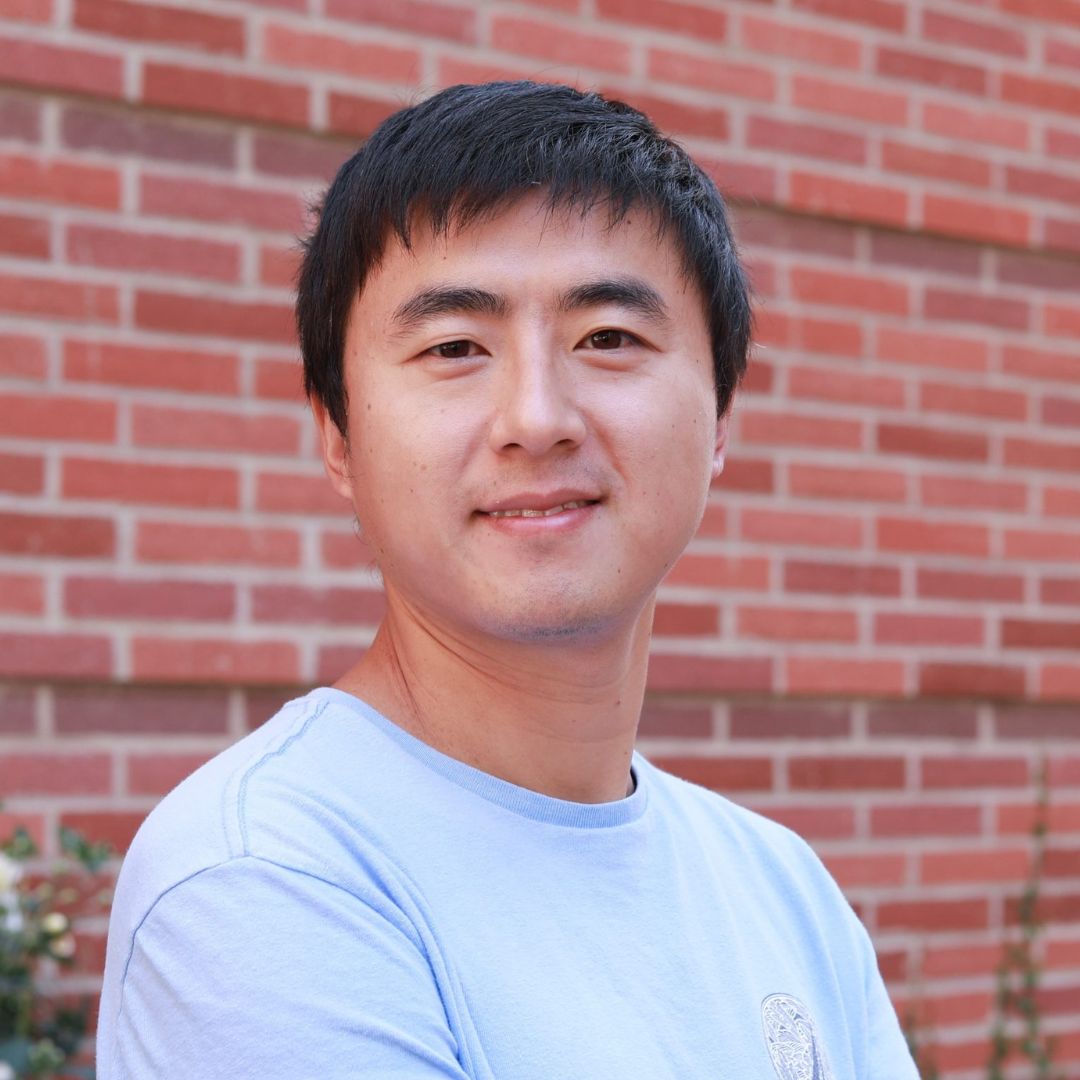

Most enterprise AI projects fail. When MIT published research showing that 95% of enterprise AI pilots don’t deliver ROI, Amir Haramaty wasn’t surprised. As co-founder of aiOla on his sixth startup, he’d spent years at a major management consulting firm watching this exact problem unfold across client engagements.

The issue wasn’t the AI technology. The problem was data—or more specifically, the 50% of enterprise vocabulary that exists only in domain-specific jargon, never captured in any structured system.

In a recent episode of BUILDERS, Amir shared how aiOla solved this fundamental problem by converting speech into structured workflow data—and built a go-to-market strategy that delivers quantifiable returns before asking for budget.

The Real Enterprise Data Gap

Before founding aiOla in 2021, Amir identified three interconnected failures in enterprise AI adoption. First, most operational data remains uncaptured because it lives in speech—walkthroughs, inspections, verbal handoffs. Second, manual data entry fails on quality, completeness, and timing because “there are very few things people hate more than entering data.” Third, existing speech recognition couldn’t handle real conditions: “Sometimes up to 50% of the vocabulary used is actually very specific jargon of a specific industry, in a specific company, in a specific location.”

Generic speech-to-text tools fail in these environments. A maintenance technician doesn’t say “water damage, $10,000.” They say “burst pipe, exterior wall, during 100-year cold snap”—context that drives underwriting decisions but gets lost in translation.

Amir reframed the problem entirely: “It’s not speech to text or speech to transcription. It’s actually speech is highly unstructured data that we turn into highly structured data. So it’s speech to data, speech to schema, speech to workflow.”

Strategic Capital Deployment: Funding Customer POCs

In 2021, an airline executive approached Amir in an airport lounge. The conversation led to something more valuable than a customer contract—it led to a strategic investment that unlocked aiOla’s entire go-to-market motion.

“We did something super creative because they were an investor and beside the capital investment, we convinced them to put some working capital that will actually fund the POCs,” Amir explains.

This wasn’t generic marketing budget. It was dedicated capital for funding proof-of-concept projects with prospects who had no existing AI pilot budget—which was most of them.

The airline became both investor and reference customer. With 1,047 aircraft, they realized “the biggest asset they have is not the number of aircraft, but actually the tremendous amount of data that currently flies the system, which was uncaptured and unstructured.” Five months later, Amir co-presented with their executive team at a major travel conference on reshaping aviation through spoken data.

Selling to Budget Authority, Not Technical Gatekeepers

While most enterprise software companies optimize for IT buyers, Amir targets CFOs exclusively.

“My perfect audience is IT are great friends and I respect them and they’re always a great facilitator, but I’m dealing, you know, I’m trying to make the CFO my best friend, because it doesn’t matter how small or big you are, you still have to do more with less.”

This shapes every aspect of aiOla’s value proposition. Instead of discussing technical specifications or integration complexity, conversations focus on operational metrics: hours saved, percentage improvements in data completeness, direct EBITDA impact.

At a Canadian supermarket chain (25 billion CAD revenue), a pilot checking food temperature in refrigerators saved 110,000 hours—straight to EBITDA. The CEO later told Amir that for three years, every board meeting opened with “what are you doing with AI?” Previously, his answer was “flailing or talking about chatbots.” After aiOla, he had concrete operational and financial metrics.

The Three-Filter Use Case Selection Framework

With potential applications across every industry, aiOla needed systematic prioritization. Amir’s framework: “Biggest impact within shortest period of time with minimum obstacle possible.”

Every prospective use case gets evaluated against all three filters simultaneously.

At a Thai food manufacturer producing chicken for McDonald’s globally, the pre-op inspection presented a clear opportunity. The process required two hours every morning—production idle until a 20-page equipment checklist was completed. Thai is a tonal language; none of aiOla’s team spoke it. But the use case scored high on all three filters: massive daily impact, clear implementation path, repeatable process.

aiOla developed what Amir calls their “jargonic” approach—a patented method for creating “customizable, highly personalized language model form or process or workflow in a specific language, specific accent, specific acoustic, a specific jargon with accuracy that can be very close to 100% and it’s zero shot, no retraining is needed.”

Result: inspection time dropped from two hours to 34 minutes in a razor-thin margin industry.

Stop, Print, Replicate: Disciplined Scaling Over Customization

After proving a use case works, aiOla makes a deliberate choice that shapes their entire scaling motion.

“Once you hit a clear success, stop, print, replicate,” Amir explains. “Most organizations are facing the same challenges and I don’t want to reinvent the wheel every time over and over again.”

This discipline—actively resisting customization requests—allows faster deployment and more consistent outcomes. The CRM data capture application demonstrates this approach. After proving they could improve data completeness from 65% to 99%, increase accuracy to 99%, achieve 100% CRM compliance, and reduce documentation time from 7.5 minutes to 1.5 minutes per meeting, they replicated the exact implementation across sales organizations in different industries.

The approach extends beyond individual use cases. After the airline success, aiOla deliberately expanded across the entire travel and hospitality ecosystem—airports, rental car companies, hotels, service providers—replicating proven applications rather than discovering new ones.

At a rental car company, the “Gatekeeper” application addresses vehicle damage reporting. Previously, lot attendants used red chalk on windshields to note issues—information often smeared or lost before mechanics reviewed vehicles. Now attendants describe problems verbally in any language, creating real-time maintenance tickets. Vehicle downtime dropped from 10 hours to 3 hours. Data completeness jumped from 55% to 100%. The company was losing $30-50 million annually on unactivated warranties because mechanics replacing parts underneath vehicles were “too lazy to go back to the office and log in the information.” Now they can activate warranties by speaking from underneath the vehicle. Average savings: $2 million per site across 200 U.S. locations.

Channel Economics: Speaking ARPU and Churn Reduction

Amir brought channel expertise from a previous startup where he scaled from 16 to 16,000 enterprise clients—100% through partners.

The core insight: partners only care about their own unit economics. When working with telecommunications companies, Amir identified their two metrics: ARPU (average revenue per unit) and churn.

“I was able to show them that the solution we solved through them first is bumping the ARPU by 34% and created stickiness the prevention by 17%. So now you speak their language.”

But Amir went further, building predictive models that quantified channel productivity down to individual rep performance by geography. “I brought it to a science that I knew if I bring a new sales guy in my organization in upstate New York City within six months I know how many units is going to sell in Rochester, in Syracuse and Albany. And if it doesn’t meet the numbers, it’s not the model, it’s the wrong person.”

He even segmented by SIC code—targeting specific business types with tailored value propositions and quick sales cycles. This precision gave channel partners confidence in the model and gave aiOla repeatable expansion playbooks.

Today, aiOla has built channel partnerships with Accenture and USG (both major CRM integrators), creating distribution at scale.

Positioning for Infrastructure: The Intelligate Layer

As the speech recognition market matured and AI agents emerged, Amir recognized a positioning opportunity. “One thing people fail to remember is the fact that AI agents are always going to be as good as the data underneath,” he notes.

This led to aiOla’s latest product evolution: the Intelligate orchestration layer. Rather than locking customers into a single speech recognition model, Intelligate “in real time will choose the best ASR model for the specific codes for specific accent specific language.”

The strategic shift is significant. Instead of being one of many speech recognition providers, aiOla becomes infrastructure—the orchestration layer that dynamically routes to optimal models based on context. This positions them above the ASR vendors while creating stickiness through the structured data layer they generate.

“We believe, especially with the fact that everybody getting to speech and getting and playing this infrastructure role that becomes us,” Amir explains. “It’s increasing our world, it’s highly defensible and we bring in even greater value to our clients.”

The Accidental Insight: Problems Create Opportunities

Amir’s GTM approach defies conventional startup wisdom. He didn’t dominate a single vertical. He didn’t build a predictable enterprise sales playbook. He funded customer POCs with investor capital.

But each unconventional choice solved a specific market friction. Funding POCs removed budget obstacles. Targeting CFOs shortened sales cycles. Replicating proven use cases accelerated deployment. Speaking channel economics in ARPU and churn enabled partner distribution.

The through-line: “Everything we do is to bring value.” In a market where 95% of AI pilots fail to show ROI, aiOla’s focus on immediate, measurable outcomes—demonstrated before asking for budget—has become their defining advantage.

As Amir puts it, the key differentiator isn’t the technology: “It’s always about cost versus value.” By consistently delivering value that exceeds cost within weeks, not quarters, aiOla built a go-to-market motion that turns the typical enterprise AI sales process on its head.