Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Leverage trusted relationships for early validation:

Plon's industry experience and network provided crucial early adopters who could bridge the credibility gap for a novel AI solution. When launching innovative technology, founders should identify and activate relationships where trust can overcome initial skepticism about new approaches.

Focus on jobs-to-be-done over features:

Portrait succeeded by deeply understanding specific research workflows and tasks investors need to accomplish, rather than leading with AI capabilities. Plon explains, "AI is a how, not a what." B2B founders should focus messaging on the concrete progress users want to make rather than the underlying technology.

Identify natural product-qualified leads:

Portrait targets users who have already attempted DIY solutions with tools like ChatGPT, indicating both pain awareness and willingness to adopt AI solutions. B2B founders should look for similar revealed preferences that suggest prospect readiness for their solution.

Position AI products as team members:

Rather than creating a new budget category, Portrait positions its solution as an alternative to hiring junior analysts - connecting to existing buying patterns. B2B founders should align their value proposition with familiar purchasing decisions their target buyers already make.

Build content marketing flywheels:

Portrait leverages the research insights their platform generates as marketing content, creating a natural loop between product value and audience building. B2B founders should identify similar opportunities where their product's output can fuel marketing efforts.

Conversation

Highlights

How Portrait Analytics Went from GPT-3 Fine-Tuning to Serving Institutional Investors

Most founders building AI products for institutional investors face a brutal chicken-and-egg problem: you need credibility to get customers, but you need customers to build credibility. David Plon solved this by treating his first product demos like job interviews.

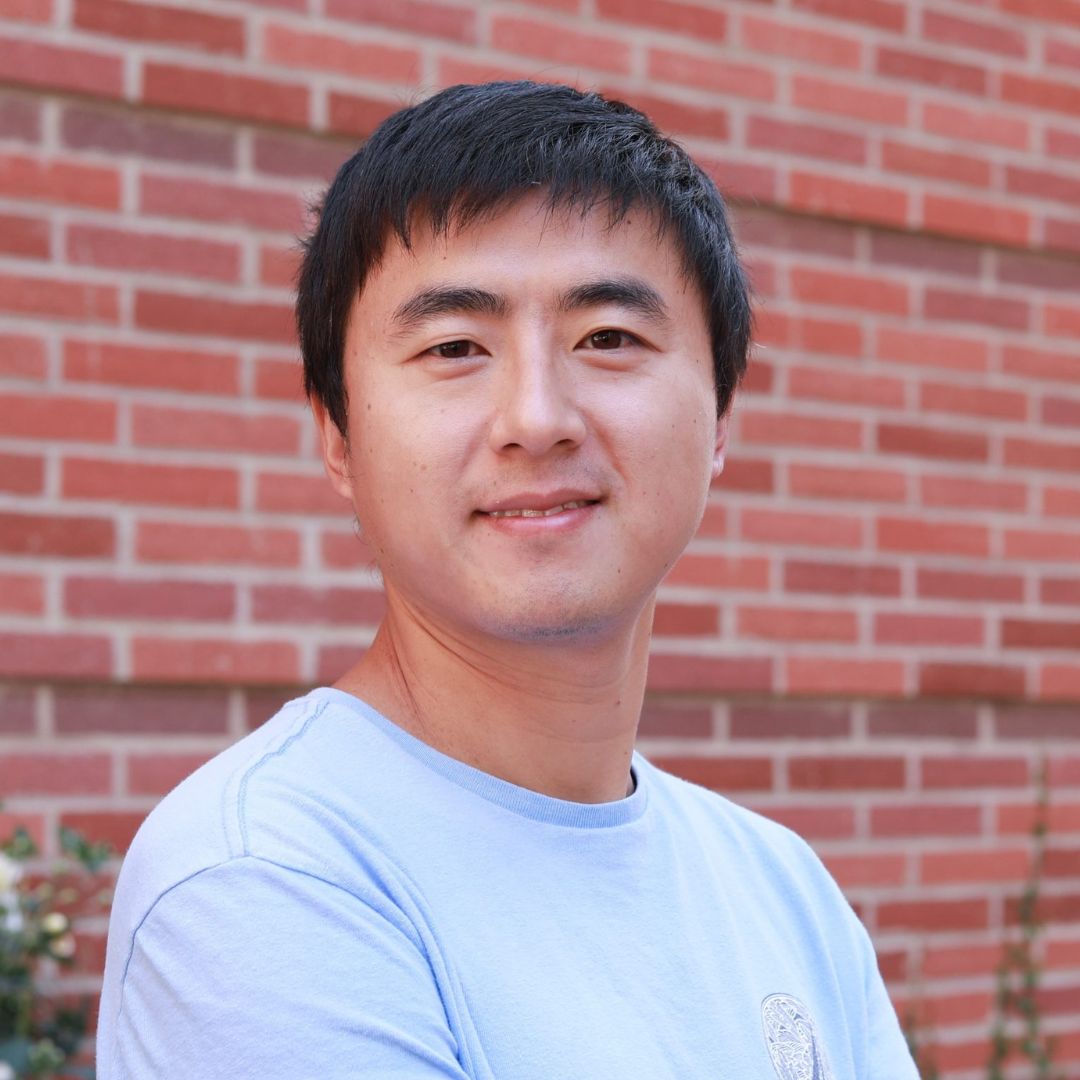

In a recent episode of Category Visionaries, David Plon, CEO and Co-Founder of Portrait Analytics, an investment research platform that’s raised $10 million in funding, shared how he navigated the journey from Stanford experiments to serving some of the most skeptical users in finance.

The Moment Everything Changed

David’s aha moment came during his time at Stanford Business School between 2015 and 2017. “Deep learning is kind of getting into the Zeitgeist and the Transformer paper which underlies a lot of the foundation behind language models today had just come out,” he explains. But it wasn’t just academic curiosity that drove him—it was pattern recognition.

“I was just very curious about the idea of large scale pattern matching that machines were doing being similar to the large scale pattern matching that great human investors do,” David shares. The real validation came when he started fine-tuning early versions of GPT-3 on earnings calls analysis. “Once I got to a point where I was fine tuning very early versions of GPT3 to recreate, analyzing or summarizing earnings calls to the point where I couldn’t tell the difference between something the model was writing and what I was writing, it became really clear to me that this technology would be wildly impactful to any knowledge based domain.”

Leveraging Relationships Without Burning Them

When it came time to land those first customers, David had an advantage—but he was strategic about how he used it. “I had been in the industry for a bit, working at a few different funds. So I had some relationships with people that trusted me and I certainly leveraged those relationships early on,” he says.

But here’s the critical insight: this was pre-ChatGPT. “AI as a thought partner on an investment team was something that felt very far fetched,” David notes. His industry credibility became the bridge between skepticism and willingness to experiment. The approach was methodical: early prototype demonstrations, specific examples of impact on idea generation and context building, then converting those into letters of intent before delivering an actual product.

The Formula for Finding Early Adopters

When asked about identifying early adopters—something every novel technology company struggles with—David shared a practical framework that goes beyond demographics. “The biggest tell is actually just the revealed preferences of what someone’s doing,” he explains.

His favorite customers to meet? “Those who have hacked together their own basic implementation of using something like anthropic projects or GPTs on OpenAI with prompts they’ve created to try to recreate some of the very basic aspects of what we’re doing.” This revealed preference signals both pain and initiative. “There’s no better telling someone that cares enough that they’ve invested time and money into actually trying to do some of this themselves.”

But there’s also an earlier signal in qualification conversations. “You can tell quite quickly based on their tone and the nature of their questions that they’re asking and the reactions as they go through the demo, whether this is someone who’s leaning into this and is seeing the positive side of, or maybe the possibility and the potential of what the product’s going to do versus someone who is, you know, going to be quite skeptical.”

Selling Beyond Your Network: The ICP Precision Play

The transition from selling to friends to selling to strangers is where most startups stumble. David’s strategy centered on extreme precision. “The most important aspect of it, especially as an early stage company with a novel technology that is rapidly changing, is to have a fairly prescriptive definition of who the ICP and early adopter is.”

Rather than expanding broadly, Portrait Analytics deliberately constrained who they let in off their waitlist. “A lot of the people we’ve been letting in off our wait list and connecting with have been folks who look a lot like our, the friends or net connections that we have,” David explains. This allowed them to refine their understanding of burning problems and ensure their solutions were “10xing, whatever else is out there.”

The Anti-AI Marketing Strategy

In a market saturated with AI buzzwords, David took a contrarian approach to positioning. “I think the biggest thing you can do is focus on the user to the point where the fact that your product is AI isn’t actually part of the messaging,” he says.

His reasoning cuts through the noise: “What the user really cares about is does this product meaningfully improve upon solving a job to be done that I have. Like our user shouldn’t care whether Portrait is being powered by an AI or powered by a hundred analysts who are like constantly slamming on their keyboard to respond to our users.”

The conclusion is direct: “AI is a how, not a what. And I think focusing on the what and the why is how you really stand out.”

Jobs to Be Done in Practice

David operationalized the Jobs to Be Done framework by deconstructing the investment research process. “We really did was take a look at the investment research process as I understood it and people similar to me and broke down each step. What is analyst trying to do here? Like what are they essentially trying to learn or what questions are they trying to answer?”

One concrete example: “A classic job to be done is, you know, finding what the key tension points or debates are around a stock. So something we spend a lot of time on is how do you discover what those key debates are?”

Positioning as a Team Member, Not a Tool

When it comes to category positioning, David rejects the binary of copilot versus agent. “I try to think about like what Portrait is doing is a bit of it’s a different category and more of a synthesis engine that both is doing a lot of challenging research tasks at a very broad scale, but it’s doing so in a way that deeply integrates within existing research workflows.”

The positioning that resonates most? A thought partner. “If someone was on your team as an investor, you are not going to sit next to them and talk to them every single day about every piece of work that they’re doing. But they’re also not going to be like in a silo just doing work all by themselves with no interaction with the team.”

This reframes the budget conversation entirely. Investment firms aren’t evaluating a software purchase—they’re evaluating a hiring decision. “When we position this as someone you would hire onto your investment team, that tends to really resonate because like especially in a field like this where ultimately for an investment firm, their main asset is the people.”

The Content Flywheel

Portrait’s marketing leverages a natural advantage: “The nice thing about Portrait, it ultimately is, you know, generating content. Right. And research insights. And so we share those on our LinkedIn page and just get a ton of engagement.”

But David’s most effective tactic is hyper-personalization at scale. When reaching out to potential customers, “one of my favorite things to do is to kind of look at like maybe some of their holdings and send them an insight or some sort of output that’s going to be highly relevant for them.”

For founders building in AI-saturated markets, David’s journey offers a clear playbook: leverage credibility strategically, find users with revealed preferences, stay laser-focused on ICP, position around outcomes rather than technology, and let your product generate your marketing content. The future belongs to those who can make AI feel less like magic and more like the teammate you’ve been trying to hire.