Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Start go-to-market activities during the design partner phase:

Kostas emphasized that go-to-market isn't something you switch on after product development. "It's okay to go out there and talk about something that it's not very well defined or it might change, but actually it doesn't matter... go to market like just like everything else, it's an interactive process." B2B founders should begin building awareness, creating content, and engaging with potential customers even while their product is still evolving.

Design partners must have real pain, not just time:

The biggest insight about design partnerships is treating them like real customer relationships. "A design partner is still someone who has a problem that needs to be solved... no one is just donating their time out there... There still has to be value there." Don't approach design partnerships as charity work - ensure there's genuine mutual value exchange where your solution addresses real business pain.

Product-market fit requires both product AND market innovation:

Kostas challenged the common engineering mindset about product-market fit: "Many times, especially engineers, think that when we say product, market fit is that we have market, which is a static thing and we just need to iterate over the product until we find the right thing that matches exactly the market. No, that's not right." B2B founders must innovate on both the product and go-to-market sides simultaneously, including defining their target vertical and building appropriate sales motions.

Infrastructure sales require dual-persona strategies:

When selling to developers and technical infrastructure, you need both bottom-up and top-down approaches. "Even if you go to the manager and they love what you are saying, you still have to convince the engineers to use this thing... And they have a lot of leverage and vice versa." The bottom-up motion involves open source adoption and education, while the top-down involves traditional outbound sales to decision makers.

Category creation doesn't guarantee category dominance:

Having witnessed category creation firsthand, Kostas shared that defining a category doesn't ensure winning it. "It doesn't necessarily mean that because you define the categories that you are going to win at the end... Vercel was not actually the company that invented the category there." Focus on solving real problems and building sustainable competitive advantages rather than just being first to market with category messaging.

Conversation

Highlights

Building AI Infrastructure: How Typedef Navigates the Challenges of Selling to Developers and Enterprises

Most founders launching AI companies today face a familiar challenge: convincing customers to adopt new technology. But what happens when you’re building the infrastructure that powers AI itself, and the entire category is still undefined?

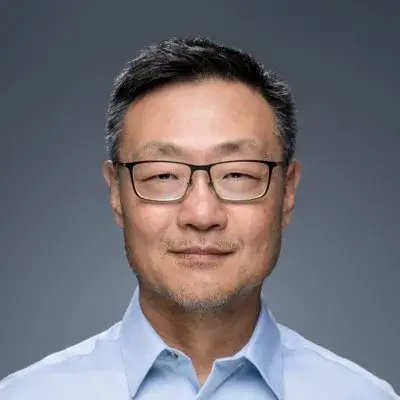

In a recent episode of Category Visionaries, Kostas Pardalis, Co-Founder and CEO of Typedef, shared insights from building an inference-first data engine that has raised $5.5 million in funding. His journey reveals counterintuitive lessons about go-to-market strategy, design partnerships, and the unique challenges of selling infrastructure in a rapidly evolving AI landscape.

The Data Infrastructure Thesis That Preceded AI

Typedef’s story begins with a thesis that many founders might recognize: the next wave of value creation would come from extracting insights from data, not just collecting it. As Kostas explains, “With the sassification of the industry in the past 10, 12 years, what we’ve done is that any activity that we have out there, we kind of manage to bring technology to do it on a platform.”

The result? Companies drowning in data with limited ways to extract meaningful value from it. “We can’t keep growing the same rates unless we figure out the next way of creating value,” Kostas notes. “The next decade is going to be about how we extract value out of the data that we have.”

But timing proved crucial. While Kostas and his co-founder Yoni identified this trend early, the pace of adoption was slower than expected. Then AI happened, accelerating everything they had predicted about data infrastructure needs.

“The amazing thing that happened is that the pace that this was actually happening was not that great until AI happened. And that accelerated things tremendously,” Kostas recalls. “AI at the end of the day is all about data.”

The Infrastructure Company Reality Check

Eight months after founding in June 2023, Typedef made a critical realization about their positioning in the AI revolution. But unlike SaaS companies that can iterate quickly with wireframes and demos, infrastructure companies face a different reality.

“The thing with when you build infrastructure and when you build things that are used by developers, the idea that you can fake it until you make it doesn’t really work,” Kostas explains. “That’s one of the reasons that companies that they are building this space usually take more time for them to get into revenue and it’s more money.”

This infrastructure reality means Typedef, 18 months post-founding, remains pre-revenue with design partners – and Kostas is refreshingly honest about it. “It’s not unheard. Actually, it’s common for companies in our space to actually even raise their Series A and still be pre revenue.”

Redefining Design Partnerships

Most founders approach design partnerships as charity work – finding friendly companies willing to test their product. Kostas discovered this approach fundamentally misses the point.

“A design partner is still someone who has a problem that needs to be solved,” he emphasizes. “No one is just donating their time out there. There still has to be value there. It’s an exchange of value.”

This insight transformed how Typedef approaches potential partners. Instead of seeking companies with available time, they focus on organizations experiencing genuine pain that their infrastructure could solve. Even when money isn’t changing hands initially, both parties must derive clear value from the relationship.

“I might not get money from you, but I’ll get knowledge that will make me get closer to my goal either by understanding that some assumptions that I have are wrong or you will end up paying me because something what we did there was right,” Kostas explains.

The Parallel Innovation of Product and Market

Many technical founders, particularly engineers, approach product-market fit with a specific mindset: there’s a static market, and they need to iterate their product until it matches perfectly. Kostas challenges this assumption based on his infrastructure experience.

“Product and marketing are two things that work in parallel and you have to innovate in both of them and you have to figure out things in both of them to find the fit,” he argues.

This parallel innovation becomes especially critical for infrastructure companies targeting multiple personas. Even with a technically sound product, success requires defining the right market segments, building appropriate go-to-market motions, and understanding different stakeholder needs.

“You can have a CRM that can be used in every vertical out there. But there is no way when you start a company, even probably post series A, that you can have a go-to-market motion that can sell to every vertical,” Kostas notes.

The Dual-Persona Challenge of Infrastructure Sales

Selling infrastructure requires convincing both technical implementers and business decision-makers – a challenge that requires fundamentally different approaches for each audience.

“Even if you go to the manager and they love what you are saying, you still have to convince the engineers to use this thing. And they have a lot of leverage and vice versa,” Kostas explains.

For engineers, Typedef employs a bottom-up strategy combining open source access with educational content. “Engineers are people who love to learn and they want to understand before they use something,” Kostas observes. “The open source, where the engineer can go and play around and understand deeply what the technology is and build trust into this thing.”

For business stakeholders, they use traditional outbound sales approaches. But both tracks must work in parallel – neither alone is sufficient for infrastructure adoption.

Starting Go-to-Market During Product Development

Conventional wisdom suggests perfecting your product before beginning marketing activities. Kostas advocates the opposite approach, especially for infrastructure companies.

“It’s okay to go out there and talk about something that it’s not very well defined or it might change, but actually it doesn’t matter,” he says. “Go to market just like everything else, it’s an interactive process.”

This early go-to-market activity serves multiple purposes: building awareness, engaging potential customers, and gathering market feedback that informs product development. The key is treating marketing as an iterative process that evolves alongside the product.

Category Creation Without Obsession

Having witnessed category creation battles in his previous company, Kostas takes a pragmatic approach to defining Typedef’s market position. The AI infrastructure space remains largely undefined, creating both opportunity and uncertainty.

“The market category is still not defined and I think that’s a very unique situation that has to do with how disruptive AI is,” he notes. A CEO in the inference space told him, “You might have product market fit today and in six months from now you might need to start another company.”

Rather than obsessing over category definition, Typedef focuses on solving real customer problems. Kostas points to companies like Vercel, which didn’t invent their category but eventually became perceived market leaders through execution.

“It doesn’t necessarily mean that because you define the categories that you are going to win at the end,” Kostas explains. “There are many things that need to happen, especially with go to market that you have to get right in order to maintain your dominance.”

The Long Game of Infrastructure

Infrastructure companies operate on different timelines than typical SaaS businesses, requiring founders to think differently about milestones and investor expectations. For Typedef, this means focusing on design partner success and product validation rather than traditional revenue metrics.

“When you are selling infrastructure, people takes much longer to put it into production because it’s really sticky. They know that and it’s something that literally runs part of their own business and their product,” Kostas explains.

This extended timeline isn’t a weakness – it’s a feature. Infrastructure decisions carry higher stakes, but successful implementations create deeper, more defensible customer relationships.

Lessons for AI Infrastructure Founders

Typedef’s journey offers several key insights for founders building in the AI infrastructure space:

Start go-to-market activities early, even with an evolving product. Treat design partnerships as genuine value exchanges, not charity work. Plan for dual-persona sales strategies targeting both technical and business stakeholders. Focus on solving real problems rather than defining categories. Embrace the longer timelines inherent in infrastructure sales.

As the AI landscape continues evolving at breakneck speed, companies like Typedef are building the foundational infrastructure that will power the next generation of AI applications. Their approach to balancing technical depth with sophisticated go-to-market strategies offers a playbook for other infrastructure founders navigating similar challenges.

The category may still be undefined, but the problems Typedef solves are real. In a world where both humans and machines need seamless data access, that focus on genuine customer pain points may prove more valuable than any category definition.