Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Use mid-market to build onboarding velocity as moat:

Rubrik deliberately targeted mid-market accounts despite being an enterprise product that closed eight-figure deals. This served two strategic purposes: compressed sales cycles enabled faster learning loops, and the necessity of quick onboarding forced the team to build exceptional admin experiences that became their primary differentiation. For B2B founders, mid-market isn't just easier logos—it's a forcing function for product refinement that creates competitive advantages when moving upmarket.

Find problems through operational scar tissue, not market research:

Wisdom AI originated when Soham tried moonlighting as engineering's data analyst during Rubrik's scaling phase and discovered he couldn't do it effectively. This wasn't a customer interview insight—it was firsthand recognition that even sophisticated technical leaders with dedicated focus couldn't wrangle data for operational decisions. The problem proved ubiquitous across every business leader optimizing top line, bottom line, and operations. B2B founders building for enterprises should prioritize pain points they've personally hit in operational contexts where existing solutions demonstrably failed them.

Engineer time-to-value in minutes for PLG overlay on enterprise sales:

Wisdom AI's experiential quality—users get excited when they try it, not when they see slides—creates PLG opportunity despite enterprise positioning. The critical difference: sales-led motions tolerate weeks to first value and build confidence through process, but self-serve requires hook-to-value in minutes with zero support. Soham's insight is using PLG not for credit card swipes but to maintain champion enthusiasm during lengthy procurement processes. B2B founders should architect trial experiences that deliver standalone value pre-data connection, creating internal advocates who sustain momentum through AI committee reviews.

Treat ecosystem navigation as first-class GTM workstream:

Wisdom AI's success depends on partnership execution with Snowflake, Databricks, and cloud providers—all potential competitors with their own AI initiatives. The FiveTran-DBT merger created immediate dynamic shifts requiring repositioning. Rather than viewing partnerships as business development, Soham frames ecosystem navigation as core GTM infrastructure requiring dedicated strategy and repeatable playbooks. B2B founders in platform-adjacent spaces should staff for partnership complexity early, recognizing that integration points and co-selling motions often determine market access more than direct sales capacity.

Architect for AI committee gatekeepers with departmental executive sponsorship:

The market fundamentally shifted from mid-2024's "experimental AI budgets, try everything" to 2025's centralized AI committees focused on security, tool consolidation, and preventing organizational wild west scenarios. Soham's tactical response: secure champions owning specific important departments who can navigate approval hierarchies while trial experiences maintain grassroots excitement. The implication for B2B AI founders—assumption of longer cycles, security scrutiny as table stakes, and explicit strategies for climbing from individual enthusiast to organizational deployment become non-negotiable enterprise sales requirements.

Conversation

Highlights

How Wisdom AI Discovered Mid-Market Velocity Builds Enterprise Moats

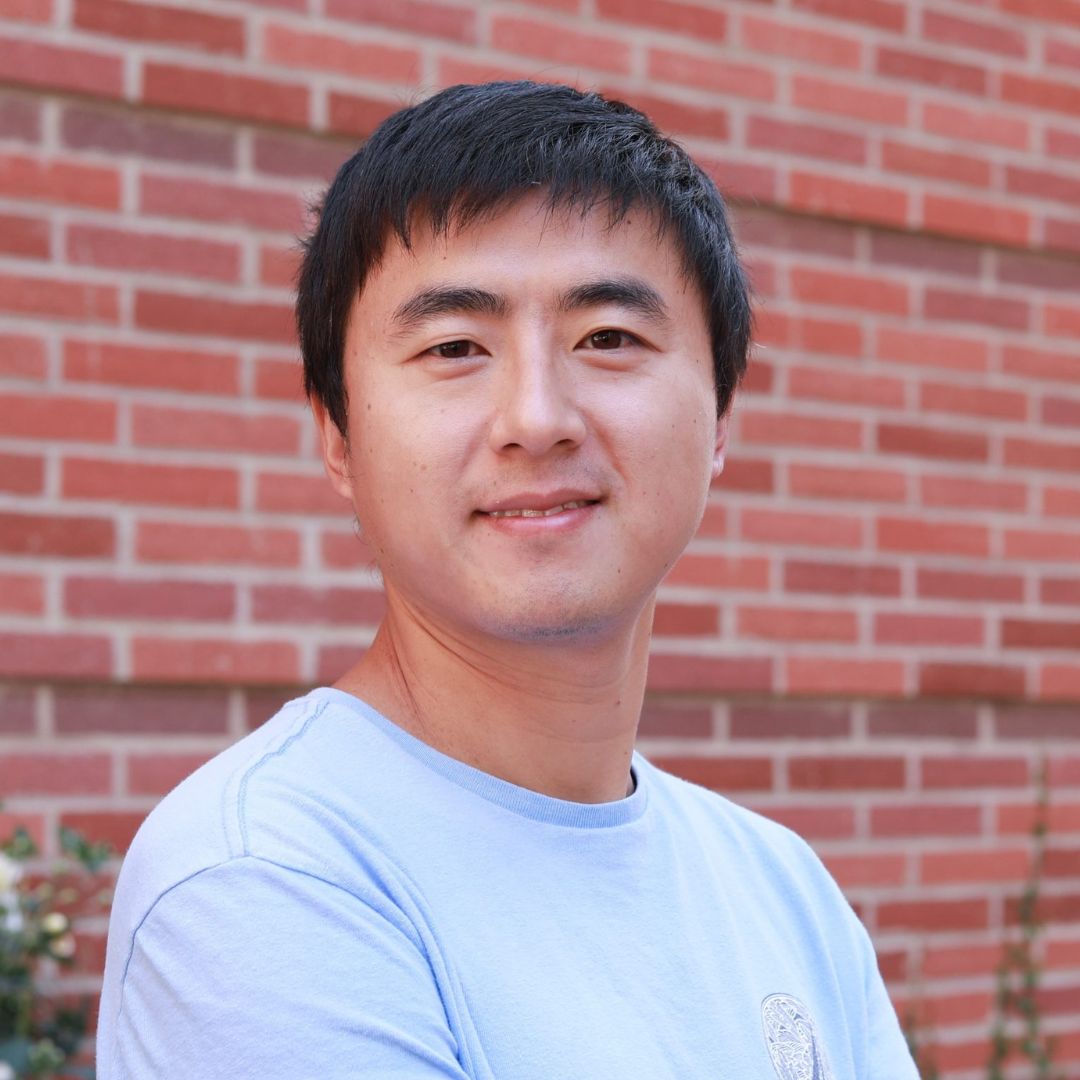

Soham spent years on Google’s search ranking team before co-founding Rubrik. When the company needed to shift from gut-driven to data-driven operations during hypergrowth, he tried moonlighting as engineering’s data analyst.

He couldn’t do it. “I tried to do a little bit of it myself. I realized it is very hard. We ended up building up a large data team.”

That operational failure became the founding insight for Wisdom AI.

In a recent episode of Category Visionaries, Soham, CEO and Co-Founder of Wisdom AI, revealed how four Rubrik alumni are building an AI data analyst for enterprise data teams—and how they’re navigating a market where AI buying committees transformed from experimental budgets to procurement gatekeepers in less than a year.

Finding Problems Worth Solving Through Operational Failure

When Rubrik was scaling, leadership recognized the limitations of intuition-based decisions. “We used to make decisions largely on gut and we realized that, you know, there are some whole bunch of inefficiencies. How do you kind of run the organization well? How do you do things predictably? How do you be efficient? And realized that we really needed to wrangle a bunch of data.”

Soham’s attempt at solving this revealed something critical. “I kind of realized that this is hard, it requires dedicated focus. You absolutely can’t moonlight on it.”

More importantly, the problem wasn’t unique. “This is a problem that literally every business leader thinks about. They’re thinking about how to make their operations better, how to make revenue better, and so on. So it’s a pretty ubiquitous problem.”

When GPT-3 emerged in late 2022, Soham recognized the technology could finally solve what traditional analytics couldn’t. “We felt that there was an opportunity to do something far better.” He assembled three other Rubrik co-founders and started building Wisdom AI—selling to enterprise data teams to deploy AI data analysts that automate analytics functions.

Why Mid-Market Targeting Creates Enterprise Product Differentiation

Soham brought a non-obvious strategy from Rubrik that most enterprise founders overlook: deliberately pursuing mid-market accounts despite building for enterprises.

Rubrik became a data protection product that closed eight-figure deals with major organizations. But “the early emphasis was very much on trying to go after the mid-market accounts. This served two purposes.”

First purpose: compressed sales cycles as learning infrastructure. “The first one was deal velocity. You could sign them much faster than you would be able to sign the bigger ones.”

Second purpose: onboarding constraints as competitive moat. Mid-market customers who couldn’t dedicate months to implementation forced Rubrik into “the ability to hone the product towards super sharp and super quick onboarding experience. That is something that is absolutely critical for any product to succeed.”

The result? “That is probably the single biggest differentiation that Rubrik really had. It was an incredible experience for all the admins that you had. All technical details aside.”

This wasn’t about easier logos or faster revenue—mid-market created a forcing function that built product advantages competitors couldn’t replicate when Rubrik moved upmarket.

Engineering Minutes-to-Value for PLG Overlay on Enterprise Sales

Wisdom AI runs traditional enterprise sales—high-touch customer engagement with sales teams driving implementation. But Soham is experimenting with product-led growth overlaid on top, serving a specific non-obvious purpose.

The driver isn’t self-serve revenue. “Ultimately our product has an experiential aspect to it. You know, I can create slides and talk about it, but ultimately there is a feel aspect to it. So when people try it, they get excited.”

But enterprise and PLG require fundamentally different time-to-value engineering.

Enterprise sales tolerate extended onboarding. “When you’re doing a sales led motion, let’s say it takes a few weeks from the time that you start the process to when the customer starts seeing some value. And it’s entirely fine, it’s not a big deal at all. In fact, people get a little leery when you say that oh it’s going to work immediately. That process kind of helps them building confidence in it.”

Self-serve demands immediate hooks. “On the other hand, if you give out a product to somebody to say that hey, go try it out yourself, you need to hook them on an experience from the get go, which means they need to be able to drive it themselves. They need to be able to be successful in a very bounded amount of time. And that bounded amount of time is a matter of minutes.”

Soham isn’t pursuing PLG for typical reasons. “I am selling to enterprises. So even if I’m getting like one person starting to use the product with an enterprise, I don’t really care that person swipes their credit card and gets us something that tends to be fairly unreliable from a perspective of genuinely landing in an enterprise.”

The actual use case: maintaining champion momentum during procurement. “Finding ways to keep the momentum and keep the excitement while you navigating the process, I think that’s an important one to kind of think about for most people.”

The strategic challenge becomes climbing from individual enthusiast to organizational deployment. “This motion of how do you start with one person, one enthusiast and then scaling it to a larger organization, that is the muscle that we have to kind of develop in the organization.”

The 2024-2025 AI Committee Shift: From Experimentation to Consolidation

Between mid-2024 and 2025, enterprise AI procurement fundamentally transformed.

The 2024 approach: distributed experimentation. “The first view of AI, I would say let’s say middle of 2024, that was about, let’s do a lot of experimental AI, each one for themselves, try things out. We don’t even know what value it’s going to generate. Let’s go for it.”

The 2025 reality: centralized governance. “Now it’s like, look, we believe there is going to be a tremendous value to be had. On the other hand, we are really worried about the wild west that is creeping up within every organization. Gazillions of new AI tools randomly in an unregulated.”

Organizations responded with formal committees. “Organizations are now kind of creating these AI committees to try to say, okay, which of these use cases make sense? Instead of like having hundred little tools, shall we consolidate around like you know, five that, you know, like let’s not have like these overlapping tools.”

Security became non-negotiable table stakes. “So there is, you know, thinking about security with much more intent. I think that’s a good thing because AI can absolutely create ridiculous problems on the security side.”

For sellers, committees function as mandatory gatekeepers. “On the other hand, as a seller there is a, you know, they also are a gatekeeper for you. So that’s not fun.”

Soham’s tactical adaptation: departmental executive sponsorship becomes required, not optional. “Few things that can help in moving things faster is having like a champion who is, you know, potentially with some specific important department that they own that can kind of help you speed up the process. I think that’s going to be very important because otherwise, you know, the moment the process is long, it becomes a little bit daunting for folks in who are lower down in the organization to be able to push a new product. So I think having that exact backing is going to be more important now than it was before.”

The implication: founders building AI products must architect for longer cycles, security scrutiny, and explicit champion cultivation strategies from day one.

Treating Ecosystem Navigation as Primary GTM Workstream

Wisdom AI operates in the data ecosystem where Snowflake, Databricks, and cloud providers function as simultaneous partners and potential competitors with their own AI initiatives.

“There are a lot of, I would say large organizations which play here who all end up being our partners. But finding ways to work with them effectively, I think that’s a big part of our go to market success.”

The ecosystem constantly shifts, requiring continuous repositioning. The FiveTran-DBT merger exemplifies this dynamic. “There’s this very cool recent announcement about FiveTran and DBT getting merged. These are like, you know, two very important companies in our ecosystem that has kind of like created an interesting dynamic shift. So again like I think navigating the ecosystem is like a big part of I think having success here.”

Soham frames ecosystem work not as business development but as core GTM infrastructure requiring repeatable execution. “So that’s another I would say, you know, we have some early successes with all of these partners, but at the same time, how to kind of build something very repeatable and robust is a—that’s the challenge.”

Positioning for 10X Transformation Versus Incremental Competition

The most critical positioning decision: refusing to compete as “better analytics tool.”

“The opportunity is not just to build like a better version of a DBT as an example. It’s truly to kind of like change how organizations consume data. So I think it’s a little bit of like this, you know, yes, there are similarities of like you’re replacing something, but on the other hand, you’re also trying to create a category.”

This works because AI shifted buyer evaluation criteria. “With AI, what folks are kind of looking for is this 10x improvement in terms of their processes and productivity.”

The category creation opportunity emerged specifically because of AI’s tailwind. “I think with AI, that opportunity is just like abundantly present” compared to a decade ago when similar openings were scarce.

Building Toward Real-Time, Proactive, Autonomous Analytics

Soham’s vision progresses through three distinct stages of AI capability for business operations.

Stage one: real-time insights. “When an exec comes in and he wants to know how am I going to run my business, he wants to know how am I going to increase my top line, bottom line, make my operations better. So the AI is there to help you make this decision because it is connected to all your data. So number one, if you want answer about how to make your business better, you get the answer immediately.”

Stage two: proactive intelligence. “Number two, why ask? Even the AI should already be—if the AI understands how your business is running, it should already know when something is not right and should tell you that, hey, there is a moment to intervene. So that’s a proactive piece.”

Stage three: autonomous action. “And lastly, if the AI understands your business and can be proactive, it can also make corrections on its own. That’s kind of the autonomy piece.”

The opportunity exists because despite decades of analytics solutions, these capabilities remain unbuilt. “All the things that I’m describing, none of this have been done even though there is no dearth of analytics solutions out there. So that’s what excites me.”

Soham discovered this gap firsthand at Rubrik—experienced technical leaders with operational responsibility still couldn’t execute effective analytics while moonlighting. Wisdom AI is building the solution that finally makes it work.