Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Demand generation unlocks engineering potential:

Yogi learned from his Rubrik mentors: "focus on demand and if you have great engineers then they will solve the problems." Maxima built products in 2-3 months they didn't initially know were technically feasible—because customer demand pulled the engineering team forward. For founders with strong technical teams, customer demand should drive the roadmap, not engineering's comfort zone. Trust your engineers to solve hard problems when customers are waiting.

$3K-$5K is the pre-product validation threshold:

Before writing any code, Yogi secured POC commitments at this price point based solely on Figma mockups. This isn't about revenue—it's about proving urgency. Verbal interest means nothing. Small pilot commitments mean "we'll try it someday." But $3K-$5K pre-product means "this problem is urgent enough to pay before seeing a working solution." Use this threshold to separate real pain from polite interest.

Sophisticated buyers will reject your narrow MVP: Scale AI and Rippling told Maxima explicitly:

"If you will only build this one thing, we will not buy. You have to commit to building three, four modules." Conventional wisdom says start narrow, but enterprise buyers with complex workflows won't adopt point solutions that create new integration headaches. When sophisticated buyers articulate their real buying criteria, ignore the startup playbook. Yogi built a "compound startup" with 4-5 modules from day one because that's what the market demanded.

Target acute pain over easy access:

Early-stage companies (10-30 people) were easier to reach but finance wasn't urgent enough. At that scale, it's "build product, ship product"—finance operations aren't broken enough to warrant urgent attention. Companies at 500-1,000+ employees have finance teams drowning in manual work that prevents strategic contribution. Target where pain justifies urgent action and budget exists, not where calendar access is easiest.

Hire intensity and first-principles thinking over domain knowledge:

Maxima deliberately hired zero engineers from legacy finance software companies. Their frontend engineer came from YouTube Studios. Others came from Apple, Robinhood, Netflix—none with financial product experience. Yogi's three hiring criteria: "incredible intensity, huge confidence in themselves, and fast thinking mode." Domain expertise creates pattern-matching to old solutions. First-principles thinking creates breakthrough products. One team member didn't finish high school but is "one of the best out there."

Make AI explainable or finance teams won't adopt:

Finance teams adopted faster than expected because Maxima showed every calculation step. "If they can prove by looking at the Math, you know, 18 plus 88 plus 36 is X. And I can see the step of the work, they are willing to give it to them." This isn't about fancy UX—it's about auditor-grade proof of work. Finance professionals won't trust black box outputs. Build transparency into the product architecture, not as an afterthought. This explainability became Maxima's competitive moat.

Conference booth sizes reveal infrastructure gaps:

At NetSuite World, the largest booths weren't ERP vendors or payment processors—they were data integration companies. This single observation validated that enterprises are desperately solving data fragmentation problems. Companies manually download from Stripe, Snowflake, Salesforce weekly to build Excel pivots. Maxima invested in upstream integrations as core infrastructure from day one. Use industry conferences to validate where companies are spending money on workarounds—that's where infrastructure gaps exist.

Conversation

Highlights

Maxima: Building AI Agents Finance Teams Actually Trust

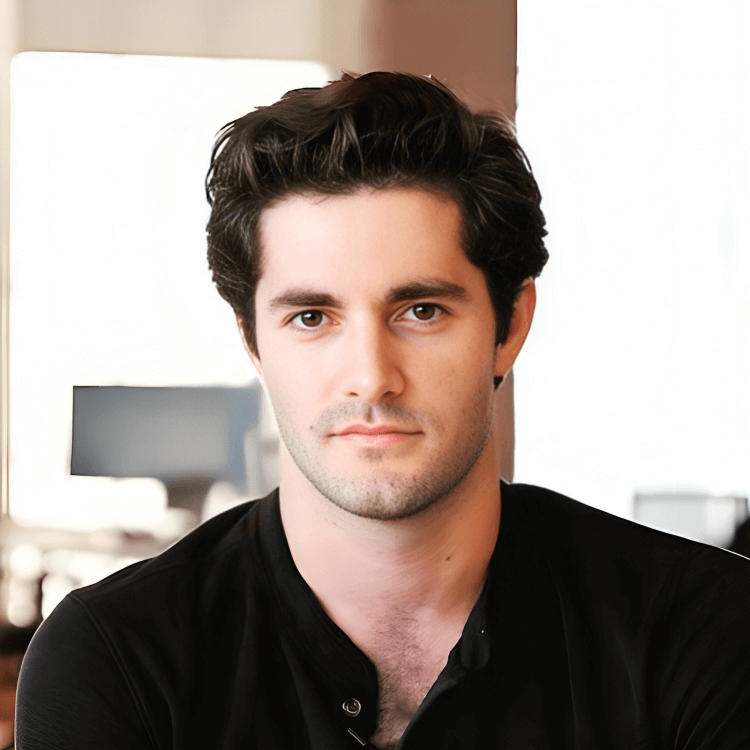

Finance teams spend 70-80% of their time on manual work instead of strategic analysis. In a recent episode of BUILDERS, Yogi Goel, CEO and Co-Founder of Maxima, explained how his company is changing that—and why the path to product-market fit required rejecting nearly every piece of conventional startup advice.

The Rubrik Lesson: Think for Yourself

Before founding Maxima, Yogi spent eight years at Rubrik, joining at Series C and staying through IPO. His mentor was CEO Bipul Sinha, who came from a village in Bihar, India just 20-30 miles from Yogi’s hometown—a connection that would prove formative.

The most valuable lesson? “To be comfortable to think for yourself,” Yogi explains. “There are almost no experts in the world. They don’t know your situation, they don’t know your industry. And there are almost no universal truths in the world. There are thumb rules, there are best practices which all have exceptions. So you cannot outsource the thinking, the rigor, the action.”

This wasn’t abstract philosophy. Yogi would soon face decisions where following conventional wisdom meant losing customers.

$3K-$5K: The Pre-Product Validation Threshold

Yogi’s approach to validation started in a Stanford entrepreneurship class he attended after work. His professor’s advice was simple: make cold calls.

“I did a lot of that,” Yogi says. “And we started asking for people very early on. It was pre product, just based on concept, just based on figmas.”

But Maxima didn’t just collect verbal interest. “We started seeing a lot of customers expressing this as a problem and they were willing to sign up for POCs, give us 3k 5k in sign up, which was a strong enough validation for us to go and build something.”

This wasn’t about revenue. It was about proving urgency. For finance leaders reading this: verbal enthusiasm means nothing. Small pilots mean “we’ll try it eventually.” But $3K-$5K commitments before seeing working code means the pain is urgent enough to justify immediate action.

When Customers Reject Your Strategy

Then came the fork in the road. Conventional startup wisdom is clear: start narrow, nail one use case, expand later. Scale AI and Rippling had different expectations.

“One of our early customers for scale AI, the other was rippling,” Yogi recalls. “They were very clearly told us that if you will only build this one thing, we will not buy. You have to commit to building three, four modules.”

Most founders would push back, cite the lean startup playbook, explain that focus beats breadth. Yogi made a different calculation: “In a way we are building a massive compound startup type of thing where from very early days we are building four or five modules.”

The reasoning was sound. Sophisticated buyers understand their own workflows. They won’t adopt point solutions that create new integration problems. For Maxima’s target customers—companies with complex, fragmented finance operations—a single-module solution would just add another tool to the frankenstack.

This decision reflects Bipul’s lesson about thinking for yourself. The standard advice didn’t account for Maxima’s specific situation: selling to enterprise finance teams who’ve lived through decades of point solutions that created more problems than they solved.

The 500+ Employee Inflection Point

Another assumption collapsed during customer discovery. Yogi initially targeted 10-30 person startups, reasoning they’d be more open to new technology.

“But my skepticism was correct that even though they are easier to access because they’re more early adopters, the finance problem is just not as acute or as important there,” he explains. “So we quickly got pulled towards companies which are sort of 500 to 1000 to beyond.”

At smaller companies, the urgent work is building product and acquiring customers. Finance operations aren’t broken enough to warrant immediate attention. “So you are more kind of interested in fixing your product development and sales than anything else,” Yogi notes.

But at 500+ employees, finance teams are drowning. Manual reconciliations, fragmented data sources, multi-day closes that eat into weekends. The pain isn’t theoretical—it’s acute enough to justify urgent change.

The lesson: target where pain meets budget, not where access is easy.

Conference Intelligence: Following the Money

Before starting Maxima, Yogi attended NetSuite World. What he observed changed his product roadmap.

“One thing I observed there is that the biggest booths were not of other credit card companies or other sort of NetSuite consulting companies. The biggest booths were of companies which are providing data integration,” he recalls.

The implication was immediate: enterprises are spending significant money solving data fragmentation. “If you go into most mid market companies, a lot of people are still and enterprise companies, a lot of companies are still going to these systems, downloading, hitting pivots and they do this on a weekly or daily basis, which is nuts.”

Finance professionals manually download data from Stripe, Snowflake, Salesforce, and other systems, then build Excel pivots to consolidate. This happens weekly or even daily at companies with hundreds or thousands of employees.

Maxima made upstream data integration a core product investment from day one. Not a nice-to-have add-on, but fundamental infrastructure that would determine whether AI agents could actually work in production.

Making AI Explainable

Finance teams have a reputation for being conservative, slow to adopt new technology. Yogi found the opposite—if you solve one critical problem.

“I think it’s actually faster adoption than I expected it to be,” Yogi says about AI in finance. But there’s a caveat: finance professionals won’t adopt black boxes.

The breakthrough was radical transparency. “If they feel that the agent is able to not just make errors and have them redo the work, they’re willing to give it more and more, provided they can prove by looking at the Math, you know, 18 plus 88 plus 36 is X. And I can see the step of the work, they are willing to give it to them.”

This came from Yogi’s auditing background: “We used to say that if you can’t prove your work with the auditors then it didn’t happen.”

Finance teams started viewing AI agents as “digital college freshmen”—reasonable IQ, no judgment yet, but capable of executing clear instructions repeatedly without getting tired. But only if they could verify every step of the work, just like they’d verify a junior analyst’s spreadsheet.

This explainability became Maxima’s competitive advantage. While other AI products operate as black boxes, Maxima shows every calculation. The result? Adoption rates faster than expected, because the product architecture was designed for auditor-grade verification.

Hiring for Intensity Over Experience

Maxima’s hiring strategy defied another convention: don’t hire people who know the space.

“We deliberately didn’t go for any engineer in our team from legacy companies, not a single one,” Yogi explains. “We wanted people to come from non traditional industries. We have our front end person who was building YouTube Studios which has nothing to do with financial apps. We have one of the leading first female engineer, she was building Apple products, the other person who’s building Robinhood and Netflix products.”

The hiring criteria came down to three traits: “Incredible intensity, huge amount of confidence in themselves, and third, this fast thinking mode is way more important than domain.”

This extended beyond engineering. One sales team member represented the United States in wrestling and fights MMA. Another holds world records for solving Rubik’s cubes while doing hula hoops. One engineer started coding in high school and never finished: “He didn’t even finish his high school and we decided to hire him and he’s one of the best out there,” Yogi says.

The reasoning: domain expertise creates pattern-matching to old solutions. People from YouTube, Apple, and Netflix aren’t constrained by assumptions about how finance software “should” work. They think from first principles.

The Bigger Problem

The stakes extend beyond efficiency. Last year, 140 public US companies had material financial errors requiring restatements. Symbotic had a 40% stock price correction. Macy’s discovered a $130 million error.

“Clearly the current state with human bodies is not working because people are overworked,” Yogi observes.

But the vision isn’t just error prevention. As mundane work moves to AI agents, finance professionals can focus on decisions that actually drive business value: evaluating pricing models that could open new markets, greenlighting expansion into new geographies, identifying which product lines generate real profit versus which ones don’t even cover their infrastructure costs.

At Rubrik, Yogi saw this firsthand. The finance team “were able to make a real difference to companies growth” by developing new pricing packages that opened the managed service provider market. They greenlighted expansion into new countries. They analyzed product line profitability at the level required to make strategic decisions.

None of that happens when 70-80% of time goes to downloading, uploading, and reconciling data.

“We are creating time and capacity for the humans to work on these value added things to not only help the companies but also to elevate themselves,” Yogi explains.

The Vision

Maxima’s mission is helping companies maximize long-term financial performance. For Yogi, the math is simple: “There are about 5 to 10 million finance professionals out there in the world. We hope that in the next few years at least a million of them, call it 10 to 20% of the whole population, is able to reach their personal, their career maxima, which is the highest point of their career that they want to be.”

For some, that’s becoming CFO. For others, it’s taking their company through IPO. For all of them, it means spending time on work that actually matters—not on downloading CSVs and building pivot tables.

Getting there required rejecting conventional wisdom at every turn: building multiple modules instead of one, targeting enterprise instead of SMB, hiring intensity over experience, making AI transparent instead of magical.

The common thread? Thinking for yourself about your specific situation—exactly what Yogi learned during his years at Rubrik.