Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Design your architecture for product expansion:

Renaud built Upgrade's technology with a modular, componentized architecture of microservices that could be rearranged for different products. This allowed them to reuse 70% of their codebase when launching their second product, dramatically accelerating time-to-market for new offerings.

Create complementary product sequences:

Upgrade deliberately sequenced their product launches to create natural cross-selling opportunities. Their personal loans (which consolidate existing credit card debt) pair perfectly with their credit card (which handles future spending more responsibly). Think about how your initial products can lead customers to need your next offerings.

Leverage low-CAC entry points:

Upgrade acquires 75% of new users through their Buy Now, Pay Later partnerships at virtually no customer acquisition cost, then cross-sells higher-margin products. As Renaud explains, "BNPL is only 20% of our revenue, but 75% of our user acquisitions." Find your own low-friction entry points that can feed your higher-margin business lines.

Build resilience through diversification:

Upgrade created a balanced portfolio of products that perform differently across economic cycles. Their unsecured lending thrives when the economy is strong, while secured loans provide stability during downturns. This diversification allows them to "lean on different products depending on the environment."

Optimize the second time around:

When building Upgrade after Lending Club, Renaud focused on recurring revenue and customer relationships: "At Lending Club, we had mostly one product with revenue that was very front-loaded. Every quarter you had to go out and earn revenue. Upgrade is entirely different—it's a lot of recurring revenue." Design your business model to create predictable, sustainable growth rather than constantly chasing new customers.

Conversation

Highlights

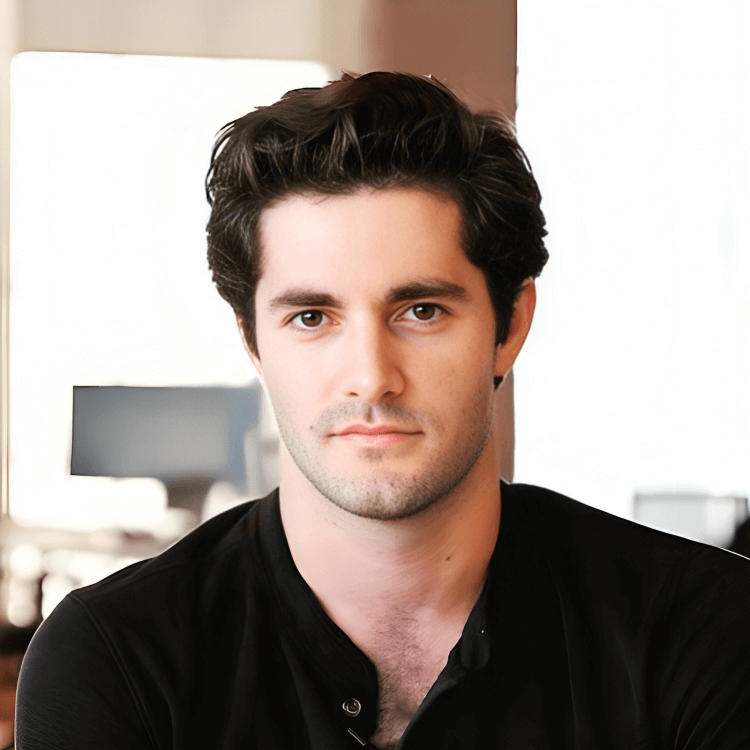

The Upgrade Playbook: How Renaud Laplanche Built His Second Fintech Unicorn in Record Time

From sailing world records to fintech disruption, Renaud Laplanche has never been one to take the conventional path. In a recent episode of Unicorn Builders, the Co-founder and CEO of Upgrade shared insights on how he built his second fintech unicorn after pioneering the industry with Lending Club.

What makes Laplanche’s story particularly compelling isn’t just the $8+ billion valuation Upgrade has achieved, but the speed and strategic precision with which he did it. For B2B founders looking to scale rapidly while building sustainable businesses, his journey offers valuable lessons in product architecture, go-to-market strategy, and creating resilient business models.

The Rebound: Weeks, Not Months

When Laplanche left Lending Club in 2016, he didn’t spend months regrouping. Instead, he moved with remarkable speed to launch Upgrade.

“It was a few weeks later,” Renaud explains about the timeline between ventures. “We got together pretty quickly. I was lucky enough that a lot of the top team at Lending Club and a lot of the shareholders were really unhappy from my side and really wanted to keep working with me.”

This support allowed him to gather resources quickly and apply a decade of learning to build something more sustainable. Within six months of starting, Upgrade had launched its first product. Even more impressively, they reached $1 billion in loan volume in less than a year.

“Between release of inception, getting first employees and launch was about six months. But then from launch to $1 billion in volume was less than a year,” Renaud recalls. “That had taken us almost five years at Lending Club.”

Building for Expansion: The Architecture of Growth

Unlike many startups that focus on getting a single product to market, Laplanche designed Upgrade with multi-product expansion in mind from day one.

“The architecture is very modular, very componentized,” Renaud explains. “It’s a bunch of microservices that are all self-contained and can be deployed and rearranged differently depending on the product.”

This approach has paid significant dividends when launching new products. “Between the personal loan product, the first product we launched, and credit card was the second… the code base is 70% identical,” he notes. “So we were able to reuse a lot of these components to create that new product.”

This architectural decision embodies a key lesson for B2B founders: design your technical foundation not just for your first product, but for the multi-product company you aspire to become.

The Strategic Product Sequence

Perhaps most fascinating is how deliberately Upgrade has sequenced its product launches. Rather than creating disconnected offerings, Laplanche thought carefully about how products would complement each other and create natural upsell opportunities.

“The personal loan is often used to refinance an existing set of credit cards, consolidate cards together and lower the payments,” Renaud explains. “So that takes care of like everything you spent on your credit cards until that point, but it doesn’t take care of the future.”

This insight led to their second product: “We said, okay, if you’ve just refinanced all your credit cards with one loan, then what if we had a new credit card that’s built in a way that it’s already low cost, no fees, and built in a way that you never have to refinance it again, but that takes care of future expenses.”

This complementary approach drives multi-product adoption and strengthens customer relationships, which Laplanche notes improves not just retention but also credit performance: “When you have a choice between making the payments to that company where you also have your bank account or you have two credit cards and auto loan or making rent payments to a company where you’re only getting a personal loan from them… you’re more likely to make the payment with a company that you have a broader relationship with.”

The Low-CAC Acquisition Engine

Upgrade’s customer acquisition strategy demonstrates similar strategic thinking. Rather than competing in expensive direct-to-consumer channels for their main products, they’ve created an ingenious low-cost acquisition funnel.

“We acquire 2.5 million customers every year through BNPL [Buy Now, Pay Later] with virtually no acquisition cost,” Renaud reveals. “We don’t pay the partner for that customer. So we use that as our primary acquisition channel. Then we cross sell higher margin, higher LTV products.”

The numbers are striking: “BNPL is only 20% of our revenue, but 75% of our user acquisitions.” This approach creates exceptional unit economics by sidestepping the high CAC that plagues many fintech companies.

Building for Economic Resilience

Upgrade’s multi-product strategy serves another crucial purpose: creating resilience through economic cycles. This stands in stark contrast to the more vulnerable mono-product approach of Lending Club.

“We have products like credit cards and personal loans, but also unsecured lending that are very profitable when the economy is booming and interest rates are lower,” Renaud explains. “So we can lean on these products during good times, but then sort of lean more on sort of secured prime auto loans or home improvement financing, a lot less sensitive to economic conditions.”

This balanced portfolio approach allows Upgrade to “have these multiple products, multiple channels, different ways to grow depending on the environment.”

The Brand Mission: Beyond Financial Products

Underpinning Upgrade’s growth is a clear brand mission focused on customer improvement rather than just financial products.

“It’s about helping our customers get to the next level, like really sort of upgrade their credit and their finances, sort of make good decisions, good financial decisions that would have a sort of immediate impact, immediate benefit, but also sets them up well for the long run,” Renaud says.

This approach manifests in product designs that incorporate “forced discipline” like their credit card that amortizes down each month rather than allowing customers to make minimum payments perpetually.

Looking Forward: The IPO Question

Having already taken Lending Club public, Laplanche is approaching the potential for an Upgrade IPO with a more measured perspective. “Upgrade is now twice as big as Lending Club was when I took it public and we’re still private,” he notes. “So I’m really taking our time to get there. We’re in no rush.”

He compares the IPO process to a wedding: “The IPO day is amazing obviously, but I like to compare it to a marriage. The wedding day is kind of like the thing you plan for and that generally feels pretty good. But then the day after is beginning of the marriage.”

His advice to founders? “A lot of founders probably spend too much time, like I did, too much time on the wedding day and not enough time on planning the marriage… because operating as a public company is an entirely different ballgame than as a private company.”

The Takeaway: Lessons for B2B Founders

Laplanche’s journey with Upgrade offers several powerful lessons for B2B founders:

- Design your architecture for expansion from day one

- Create complementary product sequences that solve related customer problems

- Find low-CAC entry points to feed your higher-margin products

- Build resilience through product diversification

- Optimize for recurring revenue rather than front-loaded models

- Be deliberate about when and how you go public

As Upgrade continues to grow with six billion-dollar products and counting, Laplanche’s approach demonstrates that second-time founders can leverage their experience to build more sustainable, resilient businesses that scale faster than their predecessors. His “unfinished business” has become a masterclass in strategic growth.