Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Exercise disciplined due diligence in your own ventures:

Before leaving his VC position, Tal created a comprehensive due diligence list and spent six months validating Atlas's potential during nights and weekends. B2B founders should apply the same rigorous validation processes to their own ideas that VCs would use, testing assumptions methodically before fully committing resources.

Leverage market disruptions as entry points:

Atlas launched during a period of rising interest rates when banks were pulling back from lending, creating an opportunity for new entrants. As Tal explained, "When we started Atlas, it was a crazy market environment... that actually enabled us to step into the market when each side was okay with us not having a lot of the other side." B2B founders should identify and exploit market dislocations that weaken incumbent advantages.

Build marketplaces by continuously balancing both sides:

Rather than solving the chicken-and-egg problem once, Atlas constantly rebalances supply and demand. Tal noted, "We're continuously balancing... Sometimes the challenging part is the deal flow, sometimes it's the investors. If it was always only one, maybe it's not the best product-market fit." The shifting nature of the challenge is actually a positive signal for marketplace businesses.

Use white-glove service to win initial customers:

For Atlas's first deals, personal relationships and exceptional service were critical. "It was a lot of white glove service... we're selling basically enterprise in a way," Tal shared. The team did "whatever it takes to win it, to make it successful." B2B founders should be prepared to deliver extraordinary service to early customers, especially in high-value transactions where trust is paramount.

Test marketing channels empirically, not based on assumptions:

Atlas discovered that LinkedIn performed poorly for their paid campaigns while Meta worked well, contrary to expectations for a B2B financial service. "I'm a big believer of not relying on our assumptions... always using data to make the decision," Tal emphasized. B2B founders should start with small tests across multiple channels, measure results objectively, and periodically retest channels that previously underperformed.

Conversation

Highlights

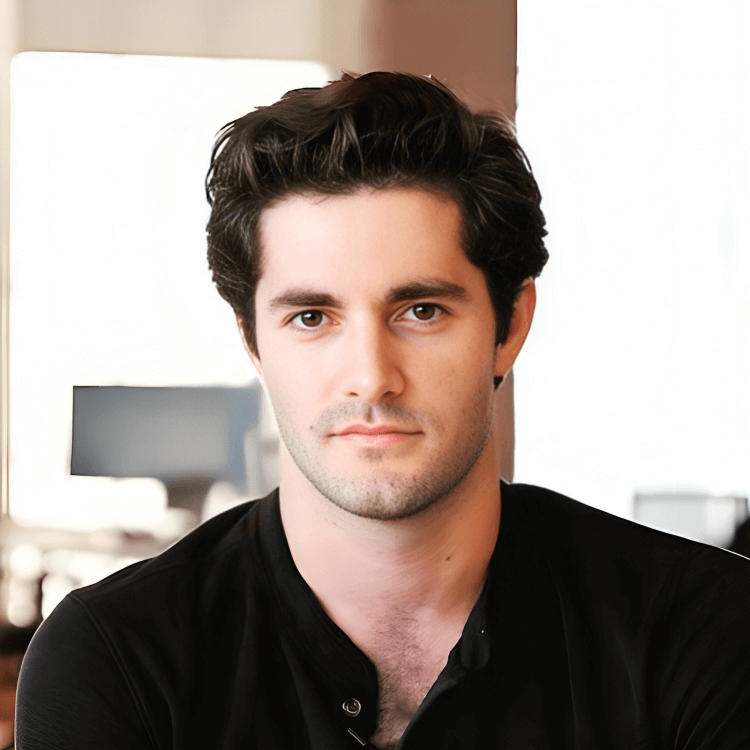

From Special Forces to Fintech Revolution: How Atlas Invest is Transforming Real Estate Financing

In a market where traditional lending institutions are increasingly risk-averse, innovative fintech platforms are stepping in to fill crucial financing gaps. In a recent episode of Category Visionaries, Tal Shahar, CEO and Co-Founder of Atlas Invest, shared how his company is revolutionizing real estate financing through a unique marketplace model that has attracted $13 million in funding.

Military Discipline Applied to Entrepreneurship

Before becoming a fintech entrepreneur, Tal honed his leadership skills in the Israeli special forces, where he was responsible for dozens of soldiers in high-stakes situations. This experience profoundly shaped his approach to business challenges.

“I think what I took the most out of it is just facing challenges and overcoming them,” Tal explains. “To face problems but solve them. There is no like backing out, it’s not an option.”

This no-retreat mindset proved invaluable when Tal later found himself simultaneously managing Atlas’s fundraising efforts while serving in military reserve duty during recent conflicts. “It was like three straight months that during the nights, I mean complicated situations we can say. And during the day after sleepless nights, you need to work on the fundraising or managing product remotely.”

The VC-to-Founder Journey

Unlike many founders who dive headfirst into entrepreneurship, Tal took a methodical approach. After leaving the military, he joined Deep Insight, a venture firm focused on what he calls “science fiction startups” — companies developing cutting-edge technologies in areas like cancer treatment and neuroscience.

When approached by his future co-founders with the Atlas concept, Tal didn’t immediately jump ship from his VC position. Instead, he created a comprehensive due diligence checklist and spent six months evaluating the opportunity.

“I took a day or two to create my diligence list like I learned by being a venture capital,” Tal recalls. “And I told them, listen, this is my list. It will not take us not a week and not a month to check it off. You’re willing to wait for me. We’re going to do it during nights and weekends.”

This methodical evaluation process — evaluating a potential startup with the same rigor he’d apply as a VC — exemplifies how Tal’s background informs his entrepreneurial approach.

Finding the “Holy Grail” Asset Class

Atlas Invest’s core innovation is bringing efficiency to what Tal describes as “the holy grail of asset class” — real estate-backed bridge loans. These short-term loans secured by real estate assets combine impressive returns with relatively low risk, creating an attractive opportunity for investors.

“The reason I call this the Holy Grail is because one hand, these are loans backed by real estate. So statistically nothing to do with our technology. They are very safe, especially when the loan ratio to asset is like about 65%,” Tal explains.

The returns are exceptional as well. “The return at the end of the day, even though it’s so safe and so costly, convenient, it’s actually about 11%. Actually 2024, 2023, Atlas generated to its investors a net IRR of 12%.”

This significantly outperforms traditional investment funds in the space, which typically generate around 8% — and often charge higher fees than Atlas’s model.

Perfect Timing: Launching in Market Disruption

Atlas’s market entry coincided with a period of significant disruption in traditional lending, as rising interest rates caused many banks to pull back from the market. This created the perfect opening for a new entrant.

“When we started Atlas, it was a crazy market environment. About three years ago we had interest rates going higher, which banks were closing and it took the market into some sort of a spiral,” Tal says. “That actually enable us to step into the market that each side was okay, us not having a lot of the other side.”

This timing advantage helped Atlas overcome the classic chicken-and-egg problem that plagues many marketplace businesses. The company could tell borrowers, “We have money to give you,” at a time when financing was scarce, which allowed them to build initial deal flow even without a large investor base.

Marketplace Balancing Act

Building a two-sided marketplace requires constant balancing between supply and demand. For Atlas, this means maintaining equilibrium between borrowers seeking financing and investors looking to deploy capital.

Rather than seeing this as a challenge to be solved once, Tal views the ongoing balance as a positive sign: “Sometimes this is the challenging part, the deal flow, sometimes the investors. And if it was always only one, maybe it’s not the best product market fit, but the fact that it’s always increasing on both sides and the challenges shifting between one to another, it’s a challenge, but it’s also a good sign.”

This perspective — that a marketplace should continually experience different bottlenecks rather than consistent constraints on one side — offers a valuable framework for other marketplace founders to evaluate their own business dynamics.

The Critical First Deal

For any B2B startup, especially in financial services, securing the first customer is extraordinarily challenging. Atlas’s first deal required building trust with both sides of their marketplace simultaneously, despite having no track record.

“For us it first of all started from a very funny story,” Tal recounts. Through a chain of connections starting with one of their shareholders, they eventually reached a broker with a potential deal. “The deal also had another offer on the table. So it wasn’t like we’re the only chance and it was very relationship driven.”

To win the deal, Atlas emphasized transparency about their status as a new company while promising exceptional service: “We talked to the board directly, tell them, listen, it’s our first deal, but you can trust us. This is who we are, this is what we’re willing to do. We have the money, we’re waiting.”

Simultaneously, they had to convince investors to fund this inaugural loan. “We ended up needing to mix a few investors together to do this deal which is not something we usually do on the platform, but it was a lot of white glove service.”

Counterintuitive Marketing Discoveries

As Atlas grew, they tested various marketing channels and discovered that assumptions about what would work for their B2B financial service were often wrong. Perhaps most surprisingly, LinkedIn campaigns — which should theoretically be ideal for targeting real estate professionals and investors — generated zero conversions.

“I’m a big believer of not relying on our assumptions, trying to choose where to start, but always using data to make the decision,” Tal emphasizes. This data-driven approach saved Atlas from wasting resources: “We would have started with a $10,000 budget, get zero and waste all that money. But we started slowly.”

Conversely, Meta campaigns delivered strong results, challenging the conventional wisdom about B2B marketing channels in financial services.

Event-Driven Strategy

For Atlas, in-person events proved to be the most effective channel for building brand awareness in the real estate financing community — but not in the traditional way many companies approach events.

“I personally don’t believe a lot in sponsorship of events. I feel like we don’t even need the booth,” Tal explains. “You need a sales rep you can trust that if there are 300 people in the event, they will talk at least 200 of them and everybody will hear the name Atlas the day event.”

This high-touch, relationship-focused approach to events allowed Atlas to build awareness cost-effectively, without spending on expensive sponsorships or elaborate booth setups.

The Amazon of Real Estate Financing

Looking to the future, Tal envisions Atlas becoming the comprehensive platform for all real estate financing needs — what he describes as “the Amazon of real estate financing.”

“The way I look at it is same idea, people borrowing money, we want them to go on to one place called Atlas no matter what their real estate financing need,” he explains. “And on the other side every investor in the world… know, if they want to deploy their capital in real estate financing, it must be first of all part of their portfolio based on data. And the only place to do it is through Atlas.”

With this ambitious vision and a strategic partnership with one of the world’s largest financial institutions on the horizon, Atlas is positioning itself to transform how real estate financing works — creating a more efficient, technology-driven marketplace that benefits both borrowers and investors.

For B2B founders navigating their own GTM journeys, Atlas Invest’s story offers valuable lessons in methodical validation, market timing, relationship-building, and data-driven marketing that challenge conventional wisdom about how to build a successful financial services platform.