Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Solve distribution economics before product-market fit:

ZayZoon spent 2014-2016 building product and signing payroll partners before generating first revenue in 2016. The insight: "Why would we go and try to sign up business by business...Let's sign up the payroll company because they're this umbrella organization." For B2B2C models, solve the distribution layer first—even if it delays revenue. Your bottleneck is partner adoption curves, not product readiness.

Structure three-way economics where everyone wins big:

ZayZoon discovered payroll companies had "this gold mine of employees that they hadn't yet monetized" and built a model where they pay payroll partners "a really hefty revenue share" while keeping enough margin for ZayZoon and keeping the service low-cost for employees. In platform businesses, the unit economics must be compelling enough that each party actively sells for you, not just tolerates you.

Map your value prop to your buyer's actual job metrics:

ZayZoon's breakthrough came from reframing earned wage access as solving recruitment, retention, and productivity—the metrics small business owners are measured on. Tate explained the unlock: "It's free for me, and it's deployed seamlessly through the HCM provider that I already use. Yeah, turn it on." Your features matter less than your impact on the specific KPIs in your buyer's quarterly review.

Kill underperforming markets immediately, even after years of investment:

After building in Canada from 2014-2017, one US trade show in November 2017 generated "more signed business than we had done in the previous couple of years in Canada." They put Canada "on life support" by January 2018. Resource reallocation speed matters more than sunk cost. When signal clarity emerges, move capital and team within weeks, not quarters.

High-touch relationship GTM beats automation until you hit scale:

Tate's core partnership advice: "Pick up the phone...be gritty as hell. Those first hundred customers that you do, be gritty." He emphasized personal outreach builds "pattern recognition and learnings that you receive from being ultra curious." For partnerships specifically, bring "humility, transparency and the expectation that you're building a ten year plus relationship, not being transactional." Automation scales what works—but relationship GTM discovers what works.

Conversation

Highlights

How ZayZoon Built 300+ Payroll Partnerships by Solving Distribution Before Product-Market Fit

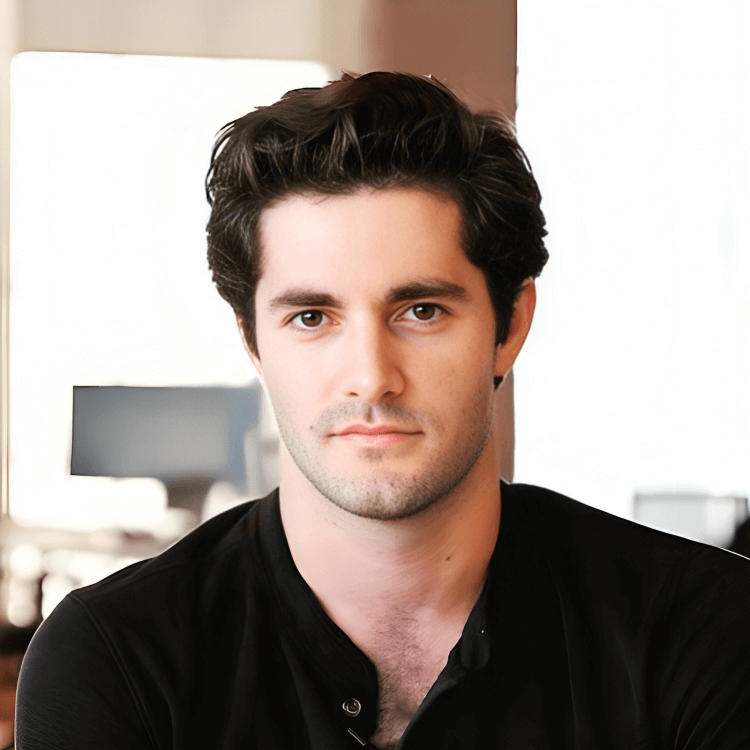

At 16, Tate Hackert posted “money available” on Craigslist. Hundreds of emails arrived within hours—people desperate for short-term liquidity with nowhere else to turn. Over seven years of commercial fishing on Canada’s west coast, he’d lend out $250,000 of his own capital through this channel, systematically evaluating creditworthiness and collecting repayments.

The pattern was undeniable: massive demand existed for small-dollar loans, but the only available products were payday loans charging effective APRs in the triple digits. The market failure was obvious. The question was structural: how do you eliminate loss rates while passing savings to consumers?

In a recent episode of Category Visionaries, Tate Hackert, Co-Founder and Chief Strategy Officer of ZayZoon, unpacked how that insight evolved into a company that’s raised over $50 million, established 300+ payroll partnerships, and now serves 15,000+ businesses.

The Unit Economics Breakthrough

The unlock came from a casual conversation. A friend’s father owned a company and was frustrated about managing employee cash advances. For someone who’d spent years in consumer lending, this complaint revealed the architecture of a solution.

“Could you reduce your loss rates to zero by issuing this through an employer and getting repaid back through payroll?” Tate recalls thinking. “And in the process, could you pass all of those savings on to the consumer and therefore have a really similar in utility type product but for, you know, effectively zero dollars?”

Payroll-integrated repayment eliminated default risk entirely. If you advance wages that employees have already earned and capture repayment through the next paycheck before funds hit their account, your loss rate approaches zero. The entire cost structure of payday lending collapses.

This became earned wage access—the category ZayZoon would pioneer a decade ago.

Counterintuitive Distribution Strategy: Two Years Without Revenue

When Tate and co-founder Darcy started building in 2014, they made a decision that defied conventional startup metrics: prioritize distribution infrastructure over revenue velocity.

The reasoning was architectural. “Why would we go and try to sign up business by business and create like it sounds like a lot of work,” Tate explains. “Let’s sign up the payroll company because they’re this umbrella organization that pays everyone else.”

B2B2C models have an embedded constraint: your bottleneck isn’t product readiness or customer demand—it’s distribution partner adoption curves. Payroll companies move slowly. Integration cycles are measured in quarters. Sales cycles involve committee decisions and compliance reviews.

From 2014 through 2016, ZayZoon generated zero revenue. “Between 2014 and 2016, we didn’t actually make a dollar of revenue,” Tate confirms. “We were still building this product, signing up some payroll companies, which we use as a distribution channel and a partner to us.”

They spent two full years building payroll partnerships before launching revenue in 2016. For founders conditioned to celebrate first revenue milestones, this approach seems reckless. But for ZayZoon’s model, it was rational: solve the distribution constraint first, then optimize conversion.

Market Selection Through Rapid Signal Processing

By 2017, ZayZoon had built their business in Canada with modest results. Then in November 2017, three Canadians attended a US payroll industry trade show.

“We came back with more signed business than we had done in the previous couple of years in Canada,” Tate says.

The signal was unambiguous. Within two months—by January 2018—they’d made the call: “Put the entire Canadian company on life support and eventually drop it entirely…Since January of 2018 until now, it’s been a complete tear.”

This execution speed reveals a critical principle for resource allocation: when signal clarity emerges, decision latency is measured in weeks, not quarters. The question isn’t whether to pivot—it’s whether you can move capital and team fast enough to capture the window.

ZayZoon’s insight: the US had “thousands of gustos that exist in the US that no one’s ever heard of before”—a fragmented payroll landscape that created distribution arbitrage opportunities unavailable in Canada’s consolidated market.

Engineering Three-Sided Marketplace Economics

ZayZoon’s embedded strategy required solving a multivariable optimization problem: create unit economics that work simultaneously for payroll companies, employers, and employees. The breakthrough came from recognizing monetizable data that partners were leaving on the table.

“The payroll company was sitting on this gold mine of employees that they hadn’t yet monetized, right?” Tate explains. Payroll providers focused exclusively on employer acquisition, treating employees as pass-through entities rather than monetizable users.

ZayZoon’s offer: “We could pay them a really hefty fat, you know, revenue share back for offering our services.” But the economics had to clear a high bar across all stakeholders.

“There’s enough economics for Zayzun to continue to build a beautiful business,” Tate explains. “There’s enough where that payroll partner is happy to continually bake us further and further into their technology and into their, call it like success and sales stack. And there’s enough where you know, at the end of the day, that employee still gets like what they need out of it all as well.”

The architecture: if each party’s marginal revenue exceeds their adoption cost by enough to justify active selling, you’ve created a self-reinforcing growth mechanism. Partners don’t just tolerate you—they actively drive penetration.

Value Prop Mapping to Buyer Job Metrics

Finding product-market fit with employees was trivial—people needed money. The hard problem was payroll companies and employers.

“Although we very quickly found product market fit with the employee, you needed the buy in from the payroll company and the employer to make that employee, you know, a customer,” Tate explains. “And the product market fit in those other two Personas was much more difficult to achieve.”

The messaging breakthrough: stop selling product features and start selling buyer KPIs. ZayZoon abandoned “financial wellness” language and reframed around recruitment, retention, and productivity—the metrics that determine whether a small business owner keeps their job.

“How do you translate that into really concise, good marketing speak and sales speak more so to the employer?” Tate says. “So that when you go and talk with a McDonald’s franchisor with 25 locations in rural Kentucky, it just clicks for them.”

The script became: “Oh, yeah, I’m having difficulty recruiting. I’m definitely having difficulty retaining my staff. And you’re saying that this can help with that, and it’s free for me, and it’s deployed seamlessly through the HCM provider that I already use. Yeah, turn it on.”

This wasn’t repositioning—it was translating product impact into the language of buyer performance reviews.

Partnership GTM: Grit Over Systems

ZayZoon’s approach to signing 300+ payroll partnerships defies current GTM orthodoxy. No automated sequences. No product-led growth motions. Just high-touch, relationship-driven sales.

“Pick up the phone. Either metaphorically or literally,” Tate advises. “My advice to any founder starting anything, whether it’s B2B, whether it’s partnerships, whether it’s going direct, consumer, whatever, like be gritty.”

The reasoning: automation scales what works, but personal outreach discovers what works. “If you’re not picking up the phone, like you’re missing out on so many little learnings that you don’t get otherwise,” Tate emphasizes. “There’s so much just intuitive nuance that exists that you can sense as an individual that helps you set the tone of your company culture, it helps you build the next product, it helps you understand the needs of your customer.”

For partnerships specifically, ZayZoon optimized for relationship duration over transaction velocity: “Go into a partnership with a little bit of humility, go in with, going with the confidence that you know you can deliver and you have what they need, but also going with humility, going with transparency and going with the expectation that you’re building a ten year plus relationship, not that you’re being transactional.”

This ten-year framing changes negotiation dynamics entirely. When partners believe you’re optimizing for decade-long value creation, they invest differently in integration depth, GTM alignment, and product roadmap collaboration.

Product Expansion Timing: When to Break Focus

After nearly a decade of single-product focus, ZayZoon launched five new products this year. The timing reveals lessons about when to expand beyond core offerings.

“This year is the first year that we’ve gone away from our core business for the last, again, better part of a decade,” Tate notes. For nine years, the answer to every product question was: make earned wage access better.

The expansion thesis draws from gig economy dynamics. “I think there’s this narrative where people have convinced themselves that people don’t want to work,” Tate observes. “And I would counter that by saying, no, people absolutely want to work. They just want a better deal in the work that they’re doing.”

Gig platforms like Uber give workers control over pay timing, schedule, and performance visibility through star ratings. ZayZoon’s vision: bring that engagement infrastructure to traditional small businesses through payroll-embedded tools—rewards, recognition, communications, surveys.

The strategic logic: “What are the other products that we have a competitive advantage in serving up because of our payroll partnerships, because of the data that we receive, because of the interaction we have with the customer?” Products that leverage existing distribution and data moats, not arbitrary adjacencies.

The Embedded Playbook

ZayZoon’s journey from Craigslist lending to 300+ enterprise partnerships reveals core principles for embedded B2B2C distribution:

Solve the distribution layer before optimizing conversion. Two years without revenue bought ZayZoon the partnership infrastructure that enabled scale.

Structure three-way economics where all parties actively sell. Revenue share models that merely work aren’t sufficient—they must be compelling enough to drive partner GTM investment.

Move fast when market signals clarify. ZayZoon killed Canada within 60 days of their trade show insight. Resource velocity beats sunk cost attachment.

Map value props to buyer performance metrics, not product capabilities. Small business owners don’t buy “financial wellness”—they buy solutions to recruiting and retention problems that affect their quarterly reviews.

Use high-touch GTM to discover patterns, then scale what works. Automation is for optimization, not discovery.

Today, ZayZoon serves 15,000+ businesses through 300+ payroll partnerships with a team of 200. Their expansion into workplace engagement tools suggests the earned wage access wedge was always just the entry point for a broader vision: becoming infrastructure for how small businesses engage hourly workers in an economy where 20% of people maintain multiple jobs and expect gig-economy-style flexibility.