Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Transparent post-mortem communication converts crises into trust:

When AODocs hit unexpected Google Cloud platform limitations in 2014-15—breaking deployments for customers running mission-critical workflows—they published detailed explanations of root causes outside their control and remediation plans. Stéphan explained: "We've always been extremely transparent...Yes, we screwed up here. Here is the thing we put in place so that it doesn't happen again." This approach consistently strengthened customer relationships during their worst incidents. For founders in business-critical infrastructure: your crisis response protocols matter more than preventing every outage.

Bootstrap via complementary services revenue until product-market fit:

AODocs funded development by merging with a Google Cloud consulting firm that deployed early Gmail enterprise implementations. Services profits subsidized product R&D while providing direct customer access. Stéphan described the deal structure: "I have a software company that has no revenue, but I can suck the profit of the service company until I make revenue." The model worked until 2022 when AODocs became independently profitable. For technical founders: identify services businesses with your target customer base as bootstrap partners, not just revenue sources.

Partner technical capability trumps partner pipeline size:

AODocs initially partnered with Google Cloud resellers (SATA, Onix) who had enterprise access but couldn't scope or deploy document management implementations. The inflection point came shifting to system integrators with actual DMS practices. Stéphan noted: "These guys don't really understand document management...they could not really help us deploy our product because they don't understand what we're doing." For complex B2B products: vet partners on technical delivery capacity, not just lead generation promises.

Platform products require 12-month marketing onboarding:

AODocs learned marketing hires need equivalent ramp time as engineering roles—not two one-pagers and go-to-market. Stéphan's realization: "It takes a year before someone is able to write the right things and to sense the essence of the product." This applies specifically to platforms with multiple use cases, not point solutions. For founders with horizontal platforms: budget full-year onboarding before expecting marketing productivity, or hire people who've sold similar complexity before.

Founder must own category positioning until $10M ARR:

Stéphan argues technical founders can't delegate core messaging early: "My personal take is that in the tech company the CMO cannot be anybody else than the founder itself at least for the first $10 million." This comes from watching marketing experts produce "beautiful words and lots of fluff but still not get the essence of what we're doing." For technical founders uncomfortable with marketing: you're avoiding your most important job in the early years.

Regional 2K-5K conferences deliver better unit economics than flagship 30K events:

While AODocs attends Google Next (30,000) and Gartner conferences, smaller regional IT decision-maker events generated superior cost-per-qualified-lead. Stéphan's finding: "If you look at the number of dollars you spend per lead that you get, the small events are surprisingly effective." This contradicts conventional wisdom about flagship event ROI. For enterprise B2B: test regional and vertical conferences before scaling spend on mega-events.

Technology paradigm shifts create replacement urgency:

AODocs positioned as "modern cloud-based document management" for years without forcing function to rip out legacy systems. AI agents changed the calculus entirely. Stéphan's repositioning: "If you don't upgrade your document foundation, you won't be able to benefit from the AI productivity acceleration." The urgency comes from AI agents requiring clean, validated document repositories—impossible with SharePoint chaos. For founders in infrastructure categories: look for adjacent technology waves that make your solution prerequisite, not optional upgrade.

Conversation

Highlights

How AODocs Bootstrapped to Profitability Over 14 Years Without Venture Capital

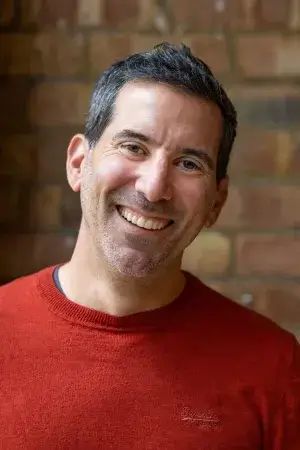

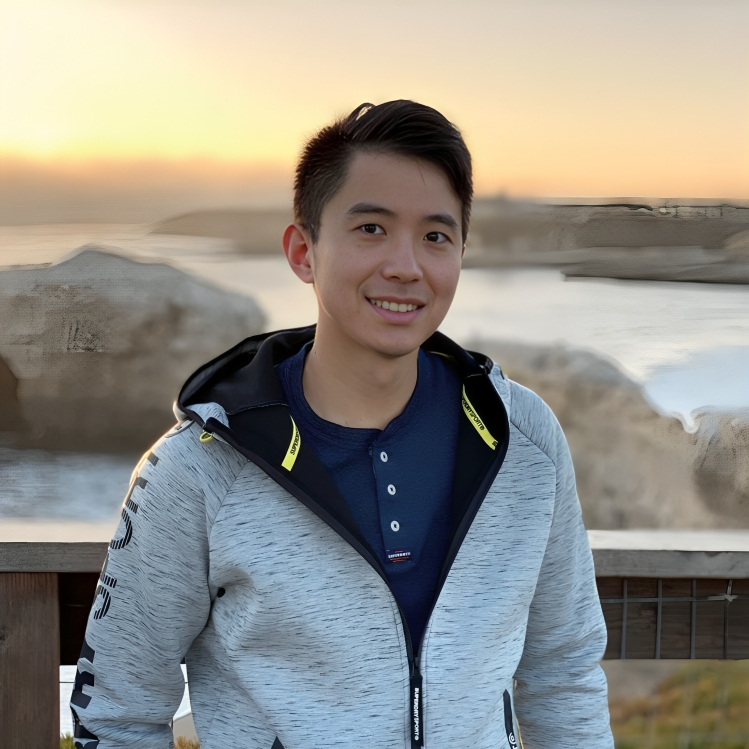

Most technical founders assume they need venture capital to build enterprise software. Stéphan Donzé proved otherwise. After founding AODocs in 2012, he spent fourteen years bootstrapping through services company profits, surviving platform-breaking crises, and eventually reaching profitability in 2022—all while managing mission-critical documents for Google’s data center builds, aerospace manufacturers’ FAA certifications, and global industrial operations.

In a recent episode of Category Visionaries, Stéphan shared the tactical lessons from building a document management platform where downtime means production lines stop and construction projects delay—without ever raising venture capital.

Engineering Background Meets Document Management Gap

Stéphan’s path to AODocs began at Exalead, a French search engine company that became what he calls “a mini PayPal mafia in France.” Companies like Algolia and Dataiku emerged from that ecosystem. When Dassault Systems acquired Exalead in 2010, Stéphan gained exposure to product lifecycle management—how manufacturers control critical product information like 3D designs and simulation files.

This combination gave him a specific hypothesis: “I want to control critical information because that’s rewarding and extremely valuable. I don’t want to do it in the same way as the SAP and the big guys are doing because they kind of think that controlling information equals being not user friendly. Why can you not be user friendly and control information at the same time?”

By 2012, he had reconnected with an early Exalead investor funding a Google Cloud consulting firm deploying early enterprise Gmail. The deal they structured was unusual: merge a profitable services business with a zero-revenue product company. “I have a software company that has no revenue, but I can suck the profit of the service company until I make revenue,” Stéphan explains. “Maybe we can bootstrap all of that thing together without even raising money.”

The services firm provided two critical assets: recurring revenue and direct access to enterprises experimenting with cloud collaboration tools who were frustrated they could migrate email but not documents.

When Cloud Platform Limits Break Mission-Critical Workflows

AODocs’ hardest years came in 2014-15 after deploying their first large-scale enterprise customers. They discovered Google Cloud platform performance behaviors and limitations that weren’t documented—problems that only manifested at scale.

For a system managing business-critical workflows, the failures had real consequences. “When our software is down, not very often, but we have containers that don’t get loaded on ships, we have production lines that can stop, we have big construction projects that can be delayed,” Stéphan explains.

The technical challenge was compounded by a control problem: “It’s not so much in your own software, but the behavior of the cloud components on which you build, it’s hard to fix because it’s not in your hands. It’s not under your control.”

AODocs’ response created their differentiation in crisis management. Rather than hiding behind platform limitations or vague explanations, they published detailed post-mortems: “We’ve always been extremely transparent in our communication. Yes, we screwed up here. Here is the thing we put in place so that it doesn’t happen again. And this is the reason why this and that happened and this is how we’re going to fix it.”

The outcome surprised them: “Every crisis we had, we ended up positively in the eyes of our customers because they saw how we managed the crisis, how we communicate, how we handle the thing, how we are transparent.”

This period also marked their deepest cash burn. 2015 represented “the year where our need for funding was the biggest…it was the year where we absorbed the biggest part of the sister company’s revenue.” But from there, growth accelerated while burn decreased, validating the model.

The Fundraising Decision They Revisit Every Two Years

AODocs has systematically reconsidered venture capital roughly every two years. Each time, they’ve chosen independence for reasons beyond founder control.

“Our business managing documents that have a lifetime of 10, 20, 30 years for customers is by nature long term,” Stéphan explains. “So we’re very prudent about getting short term people control, you know, giving short term people control of the company, even minority control.”

The 2020-21 venture boom tested this conviction hardest. Stéphan admits: “In 2020, 21, we were kind of losers because, you know, when I was talking to my other founders like, you know, I didn’t do the TechCrunch press release with raising $80 million and whatnot.”

The subsequent crash validated their patience within months. “When you look at the crash in 2021, 22, the number of people we’ve seen, we’ve hired in 20, 22, 23 that were coming from VC funded companies that never had any chance of being profitable, it was quite daunting.”

By 2022, AODocs achieved standalone profitability, no longer dependent on services company subsidies.

Why Cloud Reseller Partnerships Failed

AODocs’ initial go-to-market assumed Google Cloud resellers—companies like SATA, Onix, and even Accenture’s cloud practice—would be natural distribution partners. They had enterprise relationships with cloud early adopters, AODocs’ exact target market.

The strategy failed because pipeline access doesn’t equal deployment capability. “These guys, except for Accenture who’s big enough company to have a DMS practice, these guys don’t really understand document management,” Stéphan explains. “Even if they had access to the kind of customers we wanted, they could not really help us deploy our product because they don’t understand what we’re doing.”

The inflection came when AODocs achieved Microsoft 365 compatibility and shifted to system integrators with actual document management practices. “We started seeking partners who can understand our product, who can deploy it, who can advise customers on making the right choices. And so we turn to more large system integrators like the Accenture or the Atos in Europe.”

The lesson: for complex B2B infrastructure, partner technical depth matters more than partner customer access.

Marketing Team Onboarding Takes 12 Months for Platform Products

Stéphan holds a controversial position on early-stage technical marketing: founders can’t delegate it before significant scale. “My personal take is that in the tech company the CMO cannot be anybody else than the founder itself at least for the first $10 million or something,” he argues. “That’s your main job as a tech founder is to explain your vision and your product to the world.”

This comes from hiring marketing experts who produced what he calls “beautiful words and lots of fluff but still not get the essence of what we’re doing.”

Even when hiring strong marketing talent, AODocs learned platform products require technical onboarding investment matching engineering roles. “It takes a year before someone is able to write the right things and to sense the essence of the product,” Stéphan notes. “If you have a simple product, a cookie cutter or something can be faster. But for us as a platform, it takes a lot of investment to get a marketing team to the point where they can really be effective.”

This recently changed AODocs’ investment strategy. After years prioritizing R&D—building Microsoft compatibility, developing AI features—they’re now shifting spend. “Now we get to a point where product is good, it works. And our biggest problem is we’re not known. So we are shifting the investment…started last year already to shift the spend more towards marketing and sales than towards R and D.”

On event strategy, AODocs found counterintuitive ROI patterns. While they attend flagship conferences like Google Next (30,000 attendees) and Gartner events, smaller regional conferences delivered better unit economics. “If you look at the number of dollars you spend per lead that you get, the small events are surprisingly effective,” Stéphan notes, specifically citing 2,000-5,000 person IT decision-maker events.

How AI Agents Created Category Urgency

For years, AODocs positioned as modern, cloud-based document management—technically accurate but lacking forcing function. Why rip out working FileNet implementations today?

AI agents fundamentally changed the positioning and urgency. “The biggest mistake we see people doing at the moment is they try to put AI chatbots, search AI agents on, okay, let’s connect them to SharePoint, let’s connect them to the company folder and they will magically find a way,” Stéphan explains.

The problem is information quality: “Your SharePoint, your company folders are made of 90%, let’s say, call it to be nice, unreliable information and 10% right information. As a human, you’re lost. Why do you think your AI agent is not lost in that sea of data?”

This insight drives AODocs’ current positioning: “If you want your AI agents to work just like people, they need access to reliable information.” Companies can’t deploy effective AI agents on top of chaotic document repositories. They need clean, validated, properly-structured document foundations first.

The repositioning creates immediate urgency: “If you don’t upgrade your document foundation, you won’t be able to benefit from the AI productivity acceleration.” AODocs is no longer competing on features against legacy systems—they’re positioning as prerequisite infrastructure for AI agent deployment.

Stéphan’s vision extends this logic: “We want to be the foundation, the document foundation on which companies build their AI agents.” And he believes the timeline is compressed: “I don’t think it’s a five year vision, it’s a next year vision because the AI agents are here.”

After fourteen years of transparent crisis management, patient capital allocation, and strategic independence, AODocs demonstrates that venture backing isn’t the only path to significant enterprise software companies. Sometimes the longer game wins—especially when your customers’ document lifecycles span decades, not quarters.