We only take on 4 clients per month. Join our June cohort. 1 spot left.

Conversation

Highlights

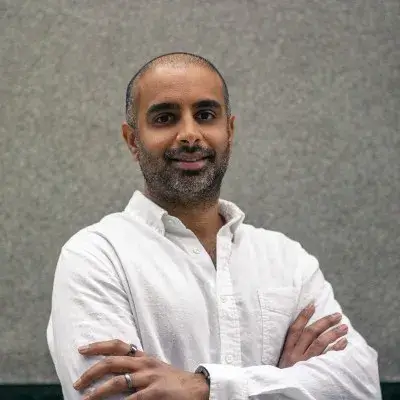

Welcome to another episode of Category Visionaries — the show that explores GTM stories from tech’s most innovative B2B founders. In today’s episode, we’re speaking with Ankit Ratan, co-founder and CEO of Signzy, a digital onboarding infrastructure platform that has raised over $38 million in funding.

- Ankit’s early career experiences at Accenture and his first startup, Crosslink, which provided data analytics for enterprises, and how the learnings from those ventures shaped his vision for Signzy.

- The once-in-a-lifetime transformation of the banking industry from branch-led to digital-first, and the challenges banks face in automating processes and distributing products through non-traditional channels.

- How Signzy provides a single-stack solution for banks to access fintech APIs and no-code workflows, enabling faster, cheaper, and more customizable onboarding journeys compared to legacy vendors.

- The evolution of Signzy’s positioning from risk and compliance to AI-led customer journeys, and the company’s ambition to establish this as a new category akin to CRM or core banking.

- Signzy’s traction in key geographies like the US, Middle East, and India, with 15-20 million customer journeys per month translating to a $15 million ARR and 100% year-over-year growth.

- Ankit’s lessons learned in selling to banks, the importance of demonstrating clear differentiation through rapid POCs, and the shift in mindset from “if” to “how” when it comes to digital transformation.

Actionable

Takeaways

Demonstrate "Magical" Differentiation Through POCs:

Ankit highlights the power of making a bold promise to prospects - like turning a 6-month workflow implementation into a 3-day POC - and then delivering on it. By rapidly standing up a functional (if not fully integrated) solution, Signzy proves its capabilities are vastly superior to legacy vendors. Technical founders should design POCs that create these "magical moments" showcasing an order-of-magnitude improvement.

Adapt Your Pitch to Investors' Priorities:

A key fundraising lesson Ankit shares is the importance of focusing not just on what your product is, but what it can do for customers. Founders, especially those with engineering backgrounds, often geek out about their technology - but investors care more about the business outcomes it enables. Crafting a narrative anchored in quantifiable value creation for a specific customer segment is critical.

Capitalize on Industry Inflection Points:

Signzy's growth has been propelled by the once-in-a-generation digitization wave sweeping the banking industry. Ankit notes that conversations with banks have shifted from "should we do this?" to "how should we do this?" - creating a massive opportunity for enablement solutions. Founders should closely monitor their target industries for these inflection points that create urgency and accelerate adoption.

Leverage Events for Category Evangelism:

To build mindshare around the emerging category of AI-led customer journeys, Signzy is doubling down on events as a key thought leadership channel. Ankit observes that banking decision-makers, especially from smaller institutions, are more engaged at conferences than with digital content. Founders should optimize their event strategy to deliver high-impact education on the strategic shifts reshaping their industry.

Pursue Expansion Vectors Within Anchor Accounts:

Signzy's land-and-expand model has been key to its 100% year-over-year growth. By going deep with anchor clients like the top 4 banks in India, the company has steadily increased its ARR while minimizing acquisition costs. Enterprise founders should seek out champions within lighthouse accounts and continuously add value through new use cases to drive efficient scaling.