Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Build lead-gen infrastructure before you have a product to sell:

Four months before launching Open Frame, Michael shipped OpenMSP—a free tool that analyzes MSP tech stacks and suggests open source replacements. It wasn't a waitlist landing page; it delivered standalone value while capturing intent data. This generated 1,000 qualified signups and 200 Slack community members while simultaneously validating paid acquisition channels. By launch, he knew Facebook cost $6-8 per lead while outbound failed completely. Most founders build product first, then scramble for distribution. Michael inverted the sequence.

Fire fast on sales hires in early stage, or don't hire them at all:

Michael fired three VP Sales at Vicarious before learning the lesson: "The moment to bring salespeople is not when you are able to sell your product, is when someone else is able to sell your product." The critical test isn't whether the founder can close deals—founders sell vision and relationship. The test is whether a marketing person, SDR, or non-sales hire can generate revenue. Only then do salespeople accelerate an already-working motion. Hiring VP Sales at $50K ARR because the board wants "someone to own revenue" burns 12+ months and $200K+ learning this.

Spend 6-12 months researching before building in unfamiliar markets:

Michael conducted 15+ MSP interviews, mapped all 19 tool categories they use with pricing, evaluated open source alternatives by analyzing GitHub commit frequency and pull requests, identified which projects had VC backing for long-term viability, and tested multiple marketing channels before alpha deployment. This allowed him to launch with product-market fit indicators already validated and 70% of his $2.2M still in the bank. The alternative—build fast, iterate with customers—works when you deeply understand the market. When you don't, research is cheaper than pivots.

Target categories where lack of innovation creates adoption momentum:

MSPs represent 30-40K companies in the US alone, part of a $380B global market growing 12% annually. Yet VCs historically avoided the space assuming low ACV and high churn. The dominant platforms—ConnectWise, Datto, Asea—have existed 20+ years with minimal AI adoption or architectural modernization. Michael specifically chose MSPs because "in cyber security you would never get traction that we're getting right now unless you're spending millions of dollars." In crowded categories, distribution cost kills you. In starved categories, any credible innovation gets attention.

Architect your product so adoption mechanically improves customer unit economics:

Open Frame attacks both sides of MSP margin compression simultaneously. The open source tool suite eliminates the 30% of revenue paid to commercial vendors. The dual AI agent system (end-user self-service + technician orchestration) reduces the 25-30% spent on labor. Michael didn't find a problem and then figure out monetization—he reverse-engineered a solution where product adoption directly expands customer margins. When your product makes customers structurally more profitable, adoption isn't a marketing problem.

Conversation

Highlights

How Flamingo Built a 1,000-Person Waitlist Four Months Before Product Launch

Most founders validate product-market fit by shipping quickly and iterating with customers. Michael Assraf spent seven months researching before writing code—then built distribution infrastructure four months before his product existed.

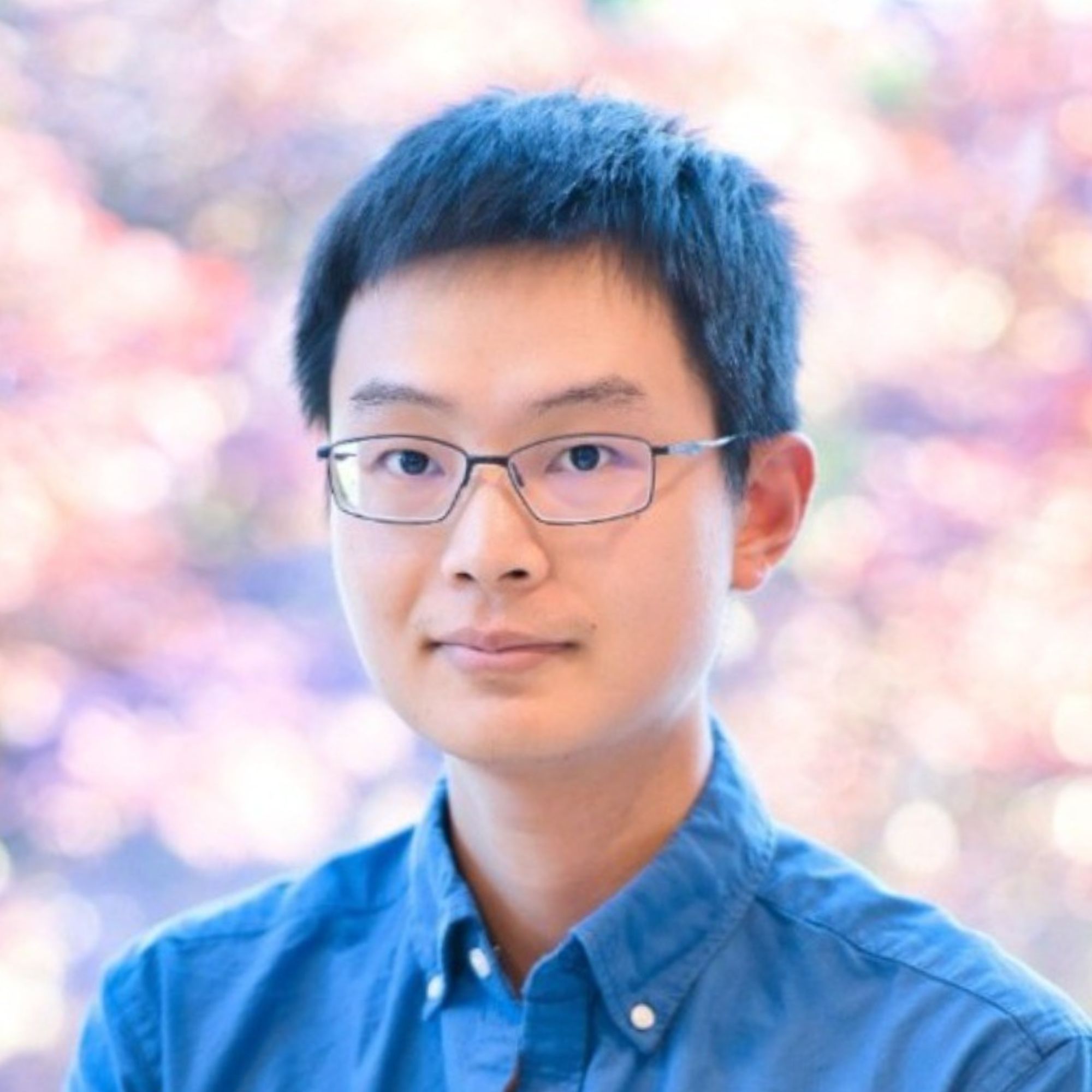

In a recent episode of Category Visionaries, Michael, founder of Flamingo, explained how this inverted sequence allowed him to launch with 1,000 qualified prospects, proven acquisition channels at $6-8 per lead, and 70% of his $2.2 million pre-seed still in the bank.

Why Seven Months of Research Beats Fast Iteration

Michael’s previous company, Vicarious, started with technology and searched for business applications afterward. “That’s why it took us much more time to find product market fit,” he explains. “This time, I took like I left Vicarious back in May 24th. I took seven months just to conduct extensive research.”

The research methodology was systematic: 15+ interviews with MSPs, complete mapping of their 19-category tool stack with pricing data, and evaluation of open source project maturity using commit frequency and VC backing as proxies for long-term viability.

What he discovered was margin compression from both directions. MSPs operate on 10-15% net margins. Approximately 30% of revenue goes to vendor payouts for commercial software. Another 25-30% covers technician labor—either 9-to-5 support or more expensive 24/7 coverage. Meanwhile, private equity consolidation drives customer pricing down while legacy vendors raise prices.

“So prices goes down and on the other hand vendors increasing their prices so the margins are just becoming smaller and smaller,” Michael observed.

This wasn’t academic research. Michael was reverse-engineering the product architecture from customer unit economics. If open source could eliminate vendor payouts and AI could reduce labor costs, adoption would mechanically improve MSP profitability—making the product nearly inevitable rather than optional.

Building OpenMSP: The Lead-Gen Product

In July 2025, four months before launching Open Frame commercially, Michael’s team shipped OpenMSP—a free tool that analyzes MSP technology stacks and recommends open source replacements.

OpenMSP wasn’t a waitlist disguised as a product. It delivered standalone value with no required next step. “It’s a free tool, they can use it without any relation to being a commercial or paying customer etc.,” Michael explains.

But it served a dual purpose. While providing genuine utility to MSPs, OpenMSP also validated distribution channels and captured qualified intent data. “We also started to advertise it. Okay, so we started to advertise on Reddit, Facebook and we figured out the cost per lead, etc. So that gave us ahead like that got put us kind of ahead of our launch so we know what works and what not in terms of marketing.”

The results: around 200 MSPs joined their Slack community, over 1,000 validated signups on the waitlist, and concrete data on which paid channels worked.

Why Facebook Beat LinkedIn 5:1

The acquisition channel testing revealed a counterintuitive winner. Facebook—not LinkedIn—generated more than 40% of qualified leads at $6-8 cost per lead. The target demographic: MSPs aged 25-50 in central US markets.

“People at my age, yeah, they still use Facebook,” Michael notes when asked about the surprising results.

LinkedIn, despite being the default B2B channel, underperformed significantly. And outbound completely failed. “My marketing guy came to me and told me, let’s do outbound. And I told him, outbound is not going to work, but prove me wrong. And we tried outbound and it didn’t work. I told him, those people are busy. If you’re not going to put something that interests them, they just see it as spam.”

The lesson: test channels early with real budget, set clear KPIs, and kill what doesn’t work quickly. “This is another lesson, fail fast. Like put the KPIs fail and then move on. And it’s okay to fail. Right? That’s what, that’s why we started the marketing operation so early.”

The Sales Hiring Framework: When Someone Else Can Close

Michael fired three VP Sales at Vicarious before crystallizing the hiring timing framework. The conventional wisdom—hire sales leadership once you have early traction—burns capital and time.

“The first thing you would do once you have even small traction like you have 50k of ARR or something very low, the first thing that the board will tell you is let’s hire salespeople. And that’s the worst thing you can do. Why? Because the product’s not ready,” Michael explains.

The product might be sellable to customers when the founder is in the room. Founders sell vision, relationships, and future potential. But that’s not a repeatable motion.

Michael’s framework: “The moment to bring the salespeople is not when you are able to sell your product, is when someone else is able to sell your product. And this someone else doesn’t necessarily have to be a salesperson. It can be your marketing person, it can be your SDR.”

The signal to watch for isn’t founder-led revenue. It’s whether non-sales team members can independently generate deals. Only then do salespeople accelerate an already-working motion rather than trying to create one from scratch.

“Most salespeople if you have really fantastic salespeople, they either work for top companies and you cannot afford them or they will come, they will see you’re not ready and then leave,” he notes.

Targeting Markets Starved for Innovation

Michael’s decision to build for MSPs was deliberate market selection. The managed services provider space represents 30-40,000 companies in the US alone, part of a $380 billion global market growing 12% annually.

Yet venture capital has historically avoided MSPs. “Traditionally, VCs didn’t really invest money in companies targeting MSPs. The reason for that is that ACV considered to be low, there is considered to be high churn, et cetera, which I believe it’s not correct,” Michael explains.

The lack of VC funding meant minimal innovation. Dominant platforms like ConnectWise, Datto, and Asea have existed for at least 20 years. “We talk about companies like Asea, ConnectWise, Dado, those companies that’s been around at least 20 years, the product, they kind of like lag behind innovation, in AI adoption and things like that.”

This creates asymmetric opportunity. “In cyber security you would never get traction that we’re getting right now unless you’re spending millions of dollars,” Michael notes. In crowded categories like cybersecurity, breaking through requires massive marketing spend just to get attention. In underserved categories, credible innovation generates organic interest.

Michael knew this from experience: “When I left my previous company, knowing the MSP space, I knew I’m going to build something in the MSP space just because of this. I think there is not a lot of innovation and anyone that will do something interesting in the MSP space is going to have less hard time on getting the traction he wants.”

Launching With 70% Capital Remaining

By October 11th, when Flamingo deployed alpha versions, the company had retained approximately 70% of its $2.2 million pre-seed. This capital efficiency stemmed directly from the research-first approach.

“I think we managed to utilize the funds that we raised in a very efficient manner. Because of the experience I had with Vicarious, I knew exactly where to spend and where not,” Michael reflects.

The spending priorities were clear: solve for product-market fit signals and distribution validation before scaling headcount. “I also learned like and that goes back to what I told you about acting as a CMO. I think I didn’t do a great job in the beginning of Vicarious in order to build this mid management layer. So I’m trying to do that now in a much better fashion.”

Rather than immediately opening access to all 1,000 waitlist signups, Flamingo is rolling out in waves of 100 companies. “We’re taking this 1,000 waitlist and we give in access every time to 100, make sure that products work, we fix the bugs and then another hundred, another hundred.”

The product remains completely free until January 2026, allowing Flamingo to build customer relationships and validate pricing before activating billing.

The Dual-Agent Architecture

Open Frame’s product architecture directly attacks both sides of MSP margin compression. It functions as a unified control plane over open source tools spanning remote monitoring and management, single sign-on, identity management, and zero trust security—eventually expanding to all 19 categories Michael mapped during research.

The AI layer consists of two distinct agents. “We built an AI layer on top of it that can orchestrate it with two AI agents, one AI agent that sits on the end user,” Michael explains.

When an end user encounters an issue—slow internet, application problems—they interact with the first agent, which already has orchestration access to all integrated tools. It can run diagnostic commands, check zero trust gateway configurations, and often resolve issues without human technician involvement.

“And when needed, he will contact a technician that has another AI agent that also have access to all the tools but on a bigger scope,” Michael continues. The technician agent operates at infrastructure level, able to approve escalated actions and deploy changes across entire MSP customer environments.

This architecture directly improves unit economics: open source eliminates the 30% vendor payout, while AI agents reduce the 25-30% labor cost. When product adoption mechanically expands customer margins, sales becomes an education problem rather than a persuasion problem.

Importantly, Flamingo offers both self-hosted (free, available on GitHub) and commercial SaaS deployment options. The self-hosted option builds trust in a market unaccustomed to VC-backed innovation and skeptical of vendor lock-in.

The Category Vision

Michael’s vision extends beyond individual MSP tools. “The product vision is to have single product, single operating system for MSPs that cover all of their IT security needs and also helps them with the collateral things,” he explains.

Those collateral needs include marketing operations—website development, LinkedIn management, and other business functions where technical MSPs often lack expertise. “What we identify is that MSPs, they’re great tech people, but they need help with their marketing operation.”

The broader play: “At the end what we’re building is a vertical SaaS software for MSPs with AI agents. So we want to be there wherever those MSPs needs us.”

By launch day, Flamingo had validated its core assumptions through systematic research and pre-product distribution building. MSPs would adopt open source if security and trust concerns were addressed. Facebook dramatically outperformed LinkedIn for paid acquisition. The product architecture that directly improved customer unit economics created natural adoption momentum.

“We want to be the tech leader that change it and take it to the AI era,” Michael says of the MSP market.

For founders building in unfamiliar markets, Michael’s approach demonstrates that research isn’t a delay tactic—it’s the foundation for capital-efficient execution. Seven months of research, four months of distribution building, and systematic channel validation created more momentum than most companies achieve in their first year of rapid iteration.