Ready to build your own Founder-Led Growth engine? Book a Strategy Call

Frontlines.io | Where B2B Founders Talk GTM.

Strategic Communications Advisory For Visionary Founders

Actionable

Takeaways

Target ICP based on liability exposure, not just industry fit:

Heka narrowed beyond "financial institutions" to lenders who bear immediate losses from fraud—companies like LendingPoint, Avant, and Upstart. These buyers feel the pain acutely versus institutions with reimbursement terms who can deflect liability. Idan's insight: "We need the client to feel the pain just as much as we see it. That means we want them to see the liability." Map your ICP not just by vertical or size, but by who internalizes the economic impact of the problem you solve.

Frame your product as a new stack layer, not a competitive replacement:

Heka positioned web intelligence as the fourth distinct layer after credit bureaus, biometrics, and transaction analytics. This became their second pitch deck slide, showing logos of each category. The result: buyers stopped comparing Heka to existing vendors and started evaluating complementary value. When entering mature markets, resist the urge to claim you're "better than X"—instead, define where you fit in the existing architecture and why that layer didn't exist before.

Abandon spray-and-pray for sub-1,000 TAM markets:

Heka tested Lemlist flows with targeted LLM personalization and saw zero pipeline from it. Idan's take: "When you're selling to maybe a thousand financial institutions, that's it. You can be super specific when you target them." For enterprise plays with small addressable markets, allocate zero budget to automated outbound. Focus entirely on warm introductions, relationship nurturing, and becoming known to every relevant buyer through content and community.

Leverage investor networks to break data product cold-starts:

Data products face a critical barrier—you need customer data to prove value, but need proven value to get customers. Heka solved this by bringing on Barclays and Cornerback as investors who vouched for the team's capability to "do magic and create a new layer." Their backing convinced risk-averse financial institutions to pilot. If building a product requiring customer data for training or validation, prioritize strategic investors who can credibly de-risk early adoption for target buyers.

Build trust through teaching, not pitching:

Heka hosts dinners and fraud incident simulations with ~10 heads of fraud per session. Critical detail: they never pitch Heka in these forums. Idan explained the approach focuses on "building a community around Heka and how people engage with your product and you being a thought leader while listening." In high-trust categories, educational forums where you facilitate peer learning without selling create stronger pipeline than direct pitching.

Structure partnerships with active enablement and incentive alignment: Idan's key lesson:

"Partnerships are not synonymous to distribution channels." Heka requires partner sales teams to join early customer conversations to learn the pitch, provides detailed API and output training, and ensures partners get extra compensation for selling non-core products. Without this, partners lack motivation to prioritize your solution. Structure partnerships as true collaborations requiring ongoing enablement investment, not passive referral channels.

A/B test credibility signals versus technical specificity:

Idan assumed messaging around Barclays backing would crush, while specific fraud prevention content (account takeover, synthetic identity detection) was an afterthought. The data showed 10x better response to technical specificity. The lesson: sophisticated buyers in technical categories respond to precise problem-solving over brand credibility. Test whether your audience values "who backs us" or "exactly what we do" before defaulting to investor logos and validation.

Conversation

Highlights

How Heka Global Killed Automated Outbound to Build a New Anti-Fraud Category

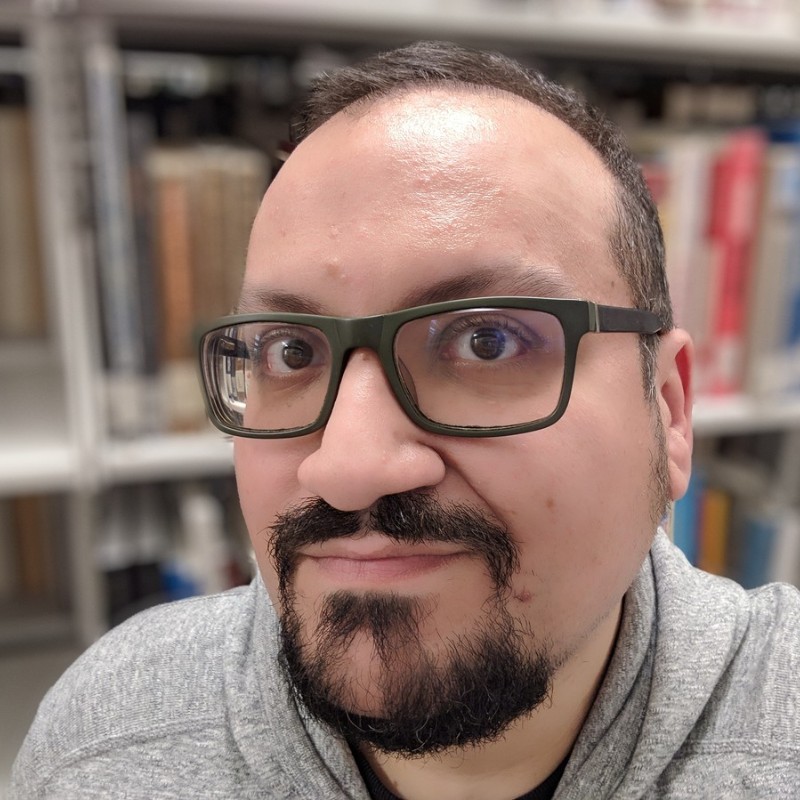

AI impersonation fraud exploded 148% in 2025. For Idan Bar-Dov , Co-Founder and CEO of Heka Global, this wasn’t just a statistic—it was validation that the entire fraud detection industry needed a fundamental reset.

In a recent episode of BUILDERS, Idan shared how Heka Global is building web intelligence as a fourth layer in the anti-fraud stack, and why their go-to-market strategy required abandoning nearly every conventional B2B playbook tactic.

The Identity Verification Crisis

The problem Heka addresses is existential for financial institutions. “Security is gonna boil down to a single question,” Idan explains. “Are you interacting with a real human being?”

This wasn’t always the central question. But the emergence of “fraud as a service” changed everything. “Every single person all of a sudden got access to nuclear arms and you could fabricate an identity kind of very easily,” Idan notes. Tools like Banana let anyone create convincing fake identities with a few clicks—the same accessibility as ChatGPT.

Traditional fraud detection relies on three established layers: credit bureaus like Experian and TransUnion, biometric solutions like Lexis Nexus and BioCatch, and transaction analytics from companies like Ekata. But these systems were built for a pre-AI world, where identity verification meant checking if someone had a Social Security number or cash flow history.

Heka introduced something different: web intelligence. Instead of traditional identity signals, they analyze digital footprints. “A normal human being is going to maintain 15 to 30 accounts between their Amazon prime and their duolingo,” Idan explains. “If you started a fake Persona yesterday, maybe you’re going to have like a G suite connected.”

This distinction became Heka’s positioning wedge.

Defining ICP by Pain Intensity, Not Industry

Before spending a dollar on marketing, Heka invested heavily in defining their ideal customer profile—but not in the traditional way. Instead of segmenting by company size or vertical, they mapped customers by liability exposure.

“We need the client to feel the pain just as much as we see it,” Idan emphasizes. “That means we want them to see the liability.”

This led them to target consumer lenders like LendingPoint, Avant, and Upstart—companies that absorb immediate financial losses when fraud occurs. “If you’re issuing a loan, if somebody defrauds you feel an immediate loss. It’s very painful,” Idan explains. “Compare that to institutions that if somebody stole your money, they say, well, let’s look at the terms of use. Maybe we’re going to reimburse you.”

This ICP precision created a clear qualification framework: if a company could deflect fraud liability through reimbursement policies, they weren’t the right customer—regardless of size or prestige.

Why Automated Outbound Failed Spectacularly

Armed with a precise ICP, Heka tested what most B2B startups try first: automated outbound. They ran Lemlist flows with LLM-powered personalization, targeting the right personas with thoughtful messaging.

The result? “It was just putting a pile of cash on fire. It didn’t generate anything,” Idan admits.

The realization was tactical: “When you’re selling to maybe a thousand financial institutions, that’s it. You can be super specific when you target them.”

With a total addressable market of roughly 1,000 companies, volume tactics made no sense. Every interaction needed to be surgical, relationship-based, and earned through warm introductions.

“The real thing that kind of like broke the seal for us was warm introductions into these specific icps,” Idan shares. The quality of these introductions mattered enormously. “We literally had one of the calls going on and the guy on the other side started the call saying, fuck, I just got defrauded. $50,000. What are we doing?”

That desperation signaled perfect timing and pain alignment—something no cold email could replicate.

Positioning as a Fourth Layer, Not a Competitor

Heka’s positioning strategy avoided competitive comparison entirely. Their pitch deck’s second slide showed the anti-fraud stack as four distinct layers, each with competitor logos: credit bureaus, biometrics, transaction analytics, and web intelligence.

This framing immediately differentiated them. “This is materially different. I can’t even compare you to these guys,” Idan explains prospects would say. “I’ll compare in terms of outcome but I can’t compare in terms of tools. This is not another hammer, this is another thing.”

By defining web intelligence as a complementary layer rather than a replacement, Heka sidestepped the exhausting vendor shootouts that plague mature categories. They weren’t competing for budget—they were creating a new line item.

Building Trust Through Dinners, Not Demos

For a category as trust-sensitive as fraud prevention, Heka invested heavily in community building. They host intimate dinners and fraud simulations with roughly 10 heads of fraud at a time.

The critical rule: never pitch.

“We never pitch our product in these sessions. We just want to listen,” Idan explains. “Every single person in this industry is just like starving for knowledge.”

These forums create peer learning environments where fraud leaders share emerging attack patterns, discuss vendor evaluations, and troubleshoot challenges. Heka facilitates but doesn’t sell.

This approach builds something more valuable than pipeline—it establishes Heka as the convener of the fraud prevention community and positions Idan as a thought leader who understands the space deeply.

Solving the Chicken-and-Egg Problem with Strategic Investors

Data products face a brutal reality: you need customer data to prove your product works, but you need proof to get customers willing to share data.

Heka solved this through strategic investor selection. By bringing on Barclays and Cornerback as backers, they gained credibility with risk-averse financial institutions. “They were able in the network to say this is a good company of people,” Idan explains. “If somebody can do magic and create a new layer, it’s them.”

This third-party validation convinced early customers to take the bet, providing Heka the data necessary to train models and demonstrate efficacy.

The Messaging Surprise: Specificity Beat Credibility 10x

Idan assumed showcasing Barclays backing would dominate their marketing performance. He was certain investor credibility would resonate most with conservative financial institutions.

He was wrong.

“I was certain that the biggest thing that’s going to sell is say that the company is backed by Barclays,” Idan admits. “That resonated tenfold just talking about being specific and exactly what you’re doing.”

Educational content explaining how Heka prevents specific fraud types—account takeover, synthetic identity detection—outperformed investor credibility messaging by 10x.

The lesson: sophisticated buyers in technical categories want precision over validation. They care more about exactly what you do differently than who vouches for you.

Partnerships Require Active Enablement, Not Passive Distribution

As Heka scaled, partnerships became a critical channel for navigating the vendor management complexity at financial institutions. But Idan learned partnerships aren’t plug-and-play revenue.

“Partnerships are not synonymous to distribution channels,” he emphasizes.

Success required active investment: training partner sales teams on API details and product outputs, joining early customer conversations to demonstrate the pitch, and ensuring partners received extra compensation for selling products outside their core offering.

Without ongoing enablement and proper incentive alignment, partnerships stalled regardless of strategic fit.

Building the New Gold Standard

Looking ahead, Idan sees traditional identity verification systems becoming liabilities rather than assets. Credit bureaus miss entire populations like new immigrants and thin-file consumers. Gen Z hates hard pulls on credit history.

“What we’ll see is that companies like Hacka, including Hacka is going to be the new gold standard of data,” Idan predicts. “Basically we’re in a process here of replacing yellow taxi with Ubers.”

For Heka Global, the vision is clear: become the primary open-source intelligence layer for any financial institution authorizing transactions, opening accounts, or issuing loans to consumers.

Their go-to-market journey offers a blueprint for building in mature, crowded categories: define ICP by pain intensity, position as a new architectural layer, kill automated tactics for small TAMs, build community before pipeline, and test messaging assumptions with data rather than intuition.

In an industry where fraud detection vendors all claim to be different, Heka proved they actually are—by building something the market didn’t have and going to market in a way no one else would.